Personal finance tips: Dealing with delayed tax refunds, and more

Three top pieces of financial advice — from taking advantage of falling mortgage rates to indulging in high-tech therapy

Tax refunds could be delayed

If you're expecting a tax refund next year, you may have to wait, said Laura Saunders at The Wall Street Journal. Internal Revenue Service Commissioner John Koskinen suggested last week that next year's tax season could be the most complicated ever for the IRS, thanks to dozens of expired tax provisions that Congress has yet to act upon. In years past, "late action by Congress on such provisions created problems" and sometimes delays. Among the expired provisions are "a deduction for state and local sales taxes; a tax exemption for the forgiveness of mortgage debt; a tuition deduction; [and] an enhanced break for transit commuters." New laws that took effect this year, including the Affordable Care Act, are also expected to make the IRS's job harder. Congress is not expected to address the expired provisions until after the midterms.

Mortgage rates keep falling

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Now may be the time to refinance your mortgage, said Marcy Gordon at The Associated Press. Mortgage rates have fallen for five straight weeks, with the nationwide average for a 30-year mortgage falling to 3.92 percent, the lowest level since June 2013. The average rate for a 15-year mortgage fell to just 3.08 percent. Many lenders and borrowers had assumed that mortgage rates "would soon start rising closer to a two-decade average of 6 percent," but volatility in the markets has compelled investors to move into bonds for safety. That has pushed up prices of U.S. Treasuries and suppressed their yields, which likewise keeps mortgage rates low. Consumers who refinance won't save much on the extra fees, known as points, that they have to pay to lock in the lower rate. Average fees for 30- and 15-year mortgages have stayed flat at 0.5 point.

Therapy goes high tech

A new startup is taking talk therapy to the Web, said Ann Carrns at The New York Times. Instead of "buying a self-help book and paying $100 or more for an hour of in-person therapy," a slew of new sites and mobile apps is offering "online therapy" to help clients get help. One new service, Lantern, charges users $49 a month or $300 a year to connect clients with licensed therapists, "initially by telephone and then via secure electronic messaging." For now, Lantern is aimed at helping subscribers with anxiety, but "programs for other concerns like sleeping and relationship problems are expected to be added later."

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

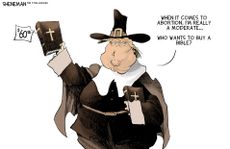

Today's political cartoons - April 13, 2024

Today's political cartoons - April 13, 2024Cartoons Saturday's cartoons - moderate MAGA, automotive politics, and more

By The Week US Published

-

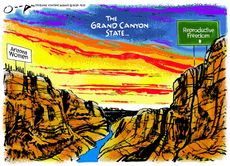

5 Grand Canyon-size cartoons on the Arizona abortion ruling

5 Grand Canyon-size cartoons on the Arizona abortion rulingCartoons Artists take on a chasm in reproductive freedom, the dangers of an abortion ban, and more

By The Week US Published

-

Crossword: April 13, 2024

Crossword: April 13, 2024The Week's daily crossword

By The Week Staff Published