Personal finance tips: Keeping car loans in check, and more

Three top pieces of financial advice — from how pay impacts credit to new rules for inherited IRAs

How pay impacts credit

A pay cut may hurt twice, says Christine DiGangi at Credit.com. While "income isn't reported to credit bureaus," the size of your paycheck "can still have an impact on your credit standing." For starters, your income will affect your ability to make loan payments and determine how much total debt you actually have. And while your salary isn't factored into your credit score, "it's often part of a credit application," with some lenders setting standards for debt-to-income ratios before taking on a customer. If your cash flow does change, the first thing you need to adjust is your budget. And be sure to pay "extra attention to your bank accounts," and limit your credit card purchases to correct your spending habits and protect your credit.

Keeping car loans in check

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Quit extending that car loan, says Kerri Anne Renzulli at Time. According to a new report by Experian, the average length of new car loans is at a record high of five and a half years. But longer loans are "costing us, big time." Car loans of five years or more may require lower monthly payments, but that only means you are paying more interest over time. And since cars are depreciating assets, longer loans work against you by limiting your equity in the car even as it loses value. The best way to save on monthly costs is to put more money down and reduce the amount you need to finance. When negotiating, try to be armed with rate quotes from outside lenders, which may encourage car dealers to improve their financing offers.

New rules for inherited IRAs

Beware of bequeathing your IRA, says Dan Caplinger at Daily Finance. The Supreme Court issued a new ruling last week that changes the game for inherited IRAs. The decision "drew distinctions between one's own retirement accounts and those inherited," making the latter fair game for creditors seeking to collect on the deceased's debts. Surviving spouses can still roll inherited IRAs into their own accounts, but for other heirs, the impact could be huge. Individuals who plan to bequeath "substantial amounts in IRAs" should consider making serious changes to their estate planning, "establishing trusts to receive inherited IRA money rather than leaving it outright to your heirs." But be careful here, too, since the wrong terms can "reduce or eliminate the ability to stretch out IRA distributions and preserve tax benefits."

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

The hunt for Planet Nine

The hunt for Planet NineUnder The Radar Researchers seeking the elusive Earth-like planet beyond Neptune are narrowing down their search

By Chas Newkey-Burden, The Week UK Published

-

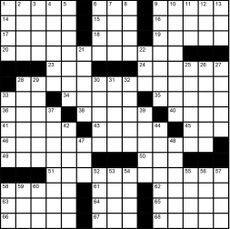

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published