Supreme Court avoids online tax dispute

The Supreme Court has declined to review the issue of whether states can force online retailers to collect sales taxes.

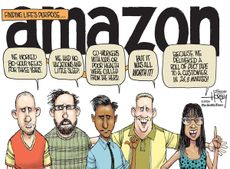

The Supreme Court this week declined to review the multibillion-dollar issue of whether states can force online retailers to collect sales taxes, leaving intact a patchwork of laws across the country and increasing the pressure on Congress to come up with a national solution to the dispute. All but five states now impose sales taxes on online purchases. This week’s decision leaves unchanged a New York law that forces Amazon.com to collect taxes on sales to New York residents. Amazon argued that because it had no physical presence in that state, the New York law violated the Constitution. Brick-and-mortar businesses say that failure to impose taxes on online purchases puts them at a disadvantage.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Create an account with the same email registered to your subscription to unlock access.

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published