Mark Zuckerberg keeps his Facebook shares: Will it reassure investors?

The young tech whiz takes steps to renew confidence in his social network, as early investors bail and the company's share price takes a beating

Facebook's share price has been in free-fall ever since the social network debuted on the stock market in May. The market value of the company has been cut in half, with investors fretting that Facebook does not have a sustainable revenue model and has fallen behind as its users increasingly switch from desktop computers to smartphones. Early investors aren't helping matters by dumping their shares like rats fleeing a sinking ship. This week, CEO Mark Zuckerberg stepped in to stem the bleeding, vowing not to sell any of his Facebook shares for at least a year. Facebook's share price rose slightly in response, an indication that Zuckerberg's confidence-building move is having an effect. But will it reassure investors in the long term?

Yes. Clearly, Facebook is committed to protecting its stock: In addition to Zuckerberg, two Facebook directors committed to holding onto their shares, selling just enough to cover their tax bills, says Geoffrey A. Fowler at The Wall Street Journal. The company also said it would not sell stock to pay for a $2 billion tax bill, keeping 101 million shares off the market. "Together, the steps function like a kind of defensive wall around the Facebook share price," reducing the number of shares that are sold just as employees begin selling previously restricted stock. Without these measures, the stock likely would have plunged further.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But it makes Zuckerberg look desperate: It's nice to see that Facebook's stock "finally is getting some attention" from Zuckerberg, says Tom Taulli at InvestorPlace. But Facebook's move to keep 101 million shares off the market, which essentially functions as a stock buyback, "traditionally is the tool of older tech companies, especially when they're seeing slower growth, as a way to artificially boost earnings per share." For a company that was billed as the next great tech stock, it's a step backward.

"Zuckerberg gets serious about FB stock"

And the company's problems haven't disappeared: Zuckerberg's move is less a sign of confidence "than a clever bit of foolery," says Abram Brown at Forbes. Investors "should demand much more," including a long-term vision for how Facebook intends to compete with Google and Apple. Until that happens, you can expect Facebook's stock to "come under fresh — and fairly intense — selling pressure in the coming months."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 13, 2024

Today's political cartoons - April 13, 2024Cartoons Saturday's cartoons - moderate MAGA, automotive politics, and more

By The Week US Published

-

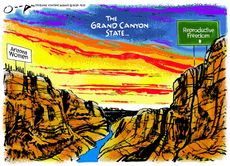

5 Grand Canyon-size cartoons on the Arizona abortion ruling

5 Grand Canyon-size cartoons on the Arizona abortion rulingCartoons Artists take on a chasm in reproductive freedom, the dangers of an abortion ban, and more

By The Week US Published

-

Crossword: April 13, 2024

Crossword: April 13, 2024The Week's daily crossword

By The Week Staff Published