Goldman Sachs' $428 million loss: What does it mean?

Amid market turmoil, the investment banking giant posts a rare loss for the third quarter — inspiring both ominous predictions and shrugs

On Tuesday, Goldman Sachs reported a $428 million loss for its third quarter, down from a $1.7 billion profit in the same three-month period a year ago. It marked only the second time the investment bank has reported a quarterly loss since it went public in 1999. Goldman did have "pockets of strength" last quarter, but those were more than offset by nearly $3 billion lost in the tumultuous stock and bond markets. The result? "The banking industry’s perpetual winner was this quarter's loser," says the Associated Press. What does it mean for Wall Street?

This signals a seismic shift: "Goldman Sachs, once Wall Street's highest flier, has been grounded, and it does not bode well for the rest of the financial industry or the New York City economy that depends on it," says Susanne Craig in The New York Times. And with new regulations that force banks to "discontinue high-profit businesses like proprietary trading, reduce borrowings, and hold more capital," plenty of other Wall Street firms "may no longer be able to produce the supercharged earnings that were common before the financial crisis."

"Goldman loss offers a bad omen for Wall Street"

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Other banks won't suffer Goldman's fate: "It's too early to tell if the loss at Goldman Sachs Group Inc. is a temporary blip driven by a wild period in the markets or a sign of cracks in the bank's long-held business strategies," says the Associated Press. But one thing's for sure: Bank of America and Citigroup each reported billions in earnings. And Morgan Stanley is also expected to be in the black — "reinforcing this season's reversal of fortunes." Perhaps Goldman's reliance on investment banking services makes it more susceptible to market volatility than its rivals, which have substantive borrowing-and-lending businesses.

"Goldman Sachs loses $428 million in third quarter"

Perversely, Goldman employees will still get giant bonuses: Despite "an awful three months," Goldman "continued to shovel billions into the bonus pool it will share with its employees at year's end," says Gary Rivlin at The Daily Beast. The company has set aside $10 billion for bonuses, which averages out to $333,000 per employee. "Is it any wonder the Occupy Wall Street crowd might think there's something rotten about the system?"

"Goldman execs stay fat and happy"

And investors aren't flinching: On Wednesday, Goldman Sachs shares were up 5.5 percent "as investors looked past a third-quarter loss and focused on gains in trading revenue and prospects for a rebound in underwriting and takeovers," says Christine Harper at Bloomberg Businessweek. Apparently, investors and analysts aren't panicking quite yet.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

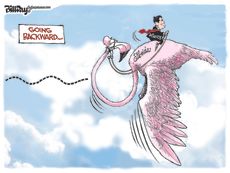

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published