'Bankageddon': 4 reasons Wall Street is struggling

The nation's biggest banks are unveiling their quarterly earnings, and some of the numbers are downright ugly

As earnings season ushers in a string of stronger-than-expected corporate profits, Tuesday was "bankageddon" for some of Wall Street's top financial institutions. Bank of America reported a record $8.8 billion quarterly loss, Goldman Sachs badly missed analysts' expectations, and even the day's banking bright spot, Wells Fargo, recorded a 5 percent drop in revenue. Three years after the Wall Street meltdown, why are banks still struggling? Here, four theories:

1. The debt-ceiling standoff is taking its toll

Blame Congress' intransigence for banks getting "hammered on concerns about the U.S. debt-ceiling," says Halah Touryalai at Forbes. If the nation's $14.3 trillion borrowing limit isn't raised by Aug. 2, the government will run out of cash to pay its bills. And as Washington remains mired in a standoff over a debt-ceiling solution, and uncertainty spreads, bank stocks are taking a beating.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. Banks are still paying for their housing binge

If you want to understand why banks are still struggling, imagine you drank too much at a party, says Matt Koppenheffer at DailyFinance. "You then proceed to kick over the punchbowl onto a white rug... and make a pass at your best friend's wife." Now "it's time to make apologies and, more importantly, settle up with the host." That's why Bank of America just now agreed to an $8.5 billion settlement with investors in its bad mortgages. "We have seen weakness in mortgage from everyone," not just BoA, says Joseph Hogue at Seeking Alpha. Expect more "write-downs and litigation."

3. The slow economic recovery is killing banks

The big banks are actually starting to "stanch their losses," says Eric Dash in The New York Times, but they're also "reckoning with an unfortunate reality: The anemic recovery is hurting their results." The recession is technically over, but consumers are still digging themselves out of debt and unwilling to take out new loans, notably new mortgages and credit card debt. And who can blame them? "Home prices are falling again, the unemployment rate is above 9 percent, and consumer confidence has been shattered by the disappearance of more than $1 trillion of stock market wealth" since 2007.

4. Actually, the banks are stronger than they look

The economy may be "stuck in neutral," but the banks have reason to be hopeful about businesses "accelerating their borrowing," says David Benoit in The Wall Street Journal. A rise in business loans is the latest hopeful sign "that old-fashioned banking could be crawling back to life." There has certainly been "a negative news cycle surrounding the financial sector," says Matt Nesto at Yahoo Finance. But the big banks are primed for a recovery. And when it hits, "watch out."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

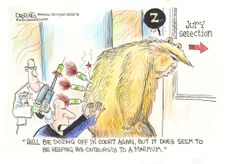

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published