Issue of the week: The bailout’s alarming details

Newly released documents reveal that the Federal Reserve's bailout of the economy from autumn 2008 through spring 2009 was much broader and much riskier than the public realized.

The financial crisis, it seems, was even scarier than it appeared at the time, said Sebastian Mallaby in the Financial Times. Last week’s “document dump” by the Federal Reserve, occasioned by the Dodd-Frank financial reform act and a lawsuit by Bloomberg L.P., revealed that Fed efforts to rescue the financial system from autumn 2008 through spring 2009 were broader “and far riskier to taxpayers” than the public knew. All told, the Fed lent $3.3 trillion to U.S. and foreign banks, hedge funds, and even motorcycle maker Harley-Davidson “without a congressional say-so.” In rushing loans out the door, the Fed violated the cardinal rule of central banking, which is to lend freely in emergencies—but only against top-notch collateral and at punitive interest rates. Instead, the Fed accepted toxic assets as collateral and charged “palliative” rates. That the Fed could take such massive risks with the public’s money—and bitterly resist disclosing those risks—underscores “the might of unelected central bankers.”

Those central bankers continue to withhold crucial information, said The Wall Street Journal in an editorial. The documents give “a fuller picture of how the Fed intervened in the panic,” but we still don’t know why. Above all, we don’t know why Fed Chairman Ben Bernanke insisted on bailing out insurer AIG, “despite apparent resistance within the Fed.” The central bank refuses to release a memo to Bernanke from staffers that reportedly argues “that an AIG bankruptcy was not a systemic risk.”

Sad to say, bankers don’t always tell the whole, unvarnished truth, said Aaron Elstein in CrainsNewYork.com. Last April, JPMorgan Chase CEO Jamie Dimon told shareholders that the bank hadn’t actually needed the Fed’s help—but “the program did save us money.” Last week we learned that JPMorgan Chase had hit up the Fed for secret loans on seven different occasions, utilizing a program created to spare banks from having to “embarrassingly make their needs known to the public.” Goldman Sachs President Gary Cohn told the “whopper” that his firm could have survived the crisis without the Fed’s help. In reality, the firm “turned to the Fed every single day during the darkest weeks of the crisis,” for a total of 84 loans. So what else don’t we know about the “murky, shadow banking world” of hedge funds and the like, where much of the globe’s financial business is conducted? asked Gillian Tett in the Financial Times. It’s not just the Fed that must come clean. In return for its $3.3 trillion rescue, the Fed has “every right” to demand that players in this hidden world reveal the risks they’re taking—because the rest of us might someday have to pay for them.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

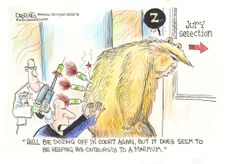

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Issue of the week: Raising the minimum wage

feature How will raising the federal minimum wage from $7.25 to $9 an hour affect the economy?

By The Week Staff Last updated

-

Issue of the week: Breaking up the big banks

feature There’s a growing realization that we need to end the taxpayer guarantees that Dodd-Frank left in place.

By The Week Staff Last updated

-

Issue of the week: The death of daily deals?

feature This is a “winter of discontent” for daily deal companies Groupon and LivingSocial.

By The Week Staff Last updated

-

Issue of the week: CEOs tackle the deficit

feature America’s top business leaders sent Congress an open letter urging immediate action on the $16 trillion national debt.

By The Week Staff Last updated

-

Issue of the week: Does Wall Street need speed limits?

feature High-frequency trading now accounts for as much as 70 percent of market volume.

By The Week Staff Last updated

-

Issue of the week: Victory for a bank watchdog

feature A New York state financial regulator accused a London-based bank of laundering $250 billion for Iran.

By The Week Staff Last updated

-

Issue of the week: A former megabanker’s conversion

feature Sanford Weill, the architect of the modern megabank, now favors the end of too-big-to-fail banks.

By The Week Staff Last updated

-

Issue of the week: Libor scandal rocks banking

feature The interest rate scandal is just beginning and may soon engulf at least a dozen other major banks.

By The Week Staff Last updated