Issue of the week: A regulatory revolution

The regulatory reform outlined by Treasury Secretary Timothy Geithner would be the biggest overhaul of market rules since the New Deal.

The Obama administration has mapped out a bold “new era of regulation,” said Damian Paletta and Jenny Strasburg in The Wall Street Journal. The regulatory reform, outlined last week by Treasury Secretary Timothy Geithner, would be the biggest overhaul of market rules since the New Deal. If approved by Congress, the rules would empower an independent super-regulator to monitor risks to the financial system and dramatically tighten oversight of hedge funds and private equity firms. The government would also oversee trading in credit default swaps and other risky derivatives. Most controversially, Geithner asked for the power to seize nonbank financial firms such as insurer AIG. Many Wall Street insiders “were quick to announce their opposition.” But facing popular outrage over bonus payments to AIG executives and other abuses, opponents of the muscular new approach will be lucky if they can even manage to limit a few provisions that they consider too intrusive, “such as making their trading records public.”

Obama is operating on the high ground here, said Clive Crook in TheAtlantic.com. House Minority Leader John Boehner was quick to call Geithner’s proposal for seizing financial firms “an unprecedented grab for power.” But there’s nothing unprecedented about it. The FDIC already has the power to take over failing banks and put them into a “pre-packaged bankruptcy.” It then restores the banks to financial health or merges them with more stable banks. Can anyone “intelligently oppose an FDIC-like resolution regime for AIG and other systemically important nonbanks?” The firm is the beneficiary of $173 billion in federal loans and guarantees. With that kind of money at stake, the feds have the right and the obligation to protect the taxpayers’ interest.

Unfortunately, there’s little reason to believe that government bureaucrats are up to this task, said Francis Diebold and David Skeel in The Wall Street Journal. Consider the saga of IndyMac, the troubled California mortgage lender. “It was not taken over by the FDIC until long after it was obvious it should be closed.” The delay cost taxpayers some $10 billion. Shortly after the IndyMac takeover last year, the FDIC brokered the sale of Wachovia Bancorp to Citigroup “at a lowball price.” When Wells Fargo snatched Wachovia away from Citi with “a vastly superior offer,” the FDIC “wound up with egg on its face.” The point is, the government is just not equipped to micromanage the financial world.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Ultimately, the tools we give regulators matter less than their willingness to use them, said The New York Times in an editorial. The financial crisis, “including what went wrong at AIG,” came about not because of some missing rule or regulatory agency. It happened because regulators, lawmakers, and executive-branch officials failed “to heed warnings about risks in the system and to use their powers to head them off.” Intoxicated by then-fashionable free-market rhetoric, they lost “the will to regulate.” Still, “tighter rules” would help, said USA Today. The current, creaky regulatory framework is a “patchwork of rules and agencies,” some of which date back to the Civil War. It’s way past time for a new system suited to “an era of computerized global trading and exotic financial instruments.”

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

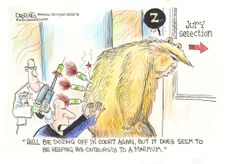

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Issue of the week: Yahoo’s ban on working from home

feature There’s a “painful irony” in Yahoo’s decision to make all its employees come to the office to work.

By The Week Staff Last updated

-

Issue of the week: Another big airline merger

feature The merger of American Airlines and US Airways will be the fourth between major U.S. airlines in five years.

By The Week Staff Last updated

-

Issue of the week: Feds’ fraud suit against S&P

feature The Justice Department charged S&P with defrauding investors by issuing mortgage security ratings it knew to be misleading.

By The Week Staff Last updated

-

Issue of the week: Why investors are worried about Apple

feature Some investors worry that the company lacks the “passion and innovation that made it so extraordinary for so long.”

By The Week Staff Last updated

-

Issue of the week: Does Google play fair?

feature The Federal Trade Commission cleared Google of accusations that it skews search results to its favor.

By The Week Staff Last updated

-

Issue of the week: The Fed targets unemployment

feature By making public its desire to lower unemployment, the Fed hopes to inspire investors “to behave in ways that help bring that about.”

By The Week Staff Last updated

-

Issue of the week: Is Apple coming home?

feature Apple's CEO said the company would spend $100 million next year to produce a Mac model in the U.S.

By The Week Staff Last updated

-

Issue of the week: Gunning for a hedge fund mogul

feature The feds are finally closing in on legendary hedge fund boss Steven Cohen.

By The Week Staff Last updated