A proposal for new oversight of financial markets

The Bush administration this week proposed the most sweeping reform of the financial regulatory system since the Great Depression, offering a blueprint that would give the Federal Reserve broad powers over virtually all financial institutions. Treasury Se

What happened

The Bush administration this week proposed the most sweeping reform of the financial regulatory system since the Great Depression, offering a blueprint that would give the Federal Reserve broad powers over virtually all financial institutions. Treasury Secretary Henry Paulson billed the plan as a “more flexible” structure “designed for the world we live in.” Under the administration proposal, the Fed would become the “market stability regulator,” with the power to inspect the books not only of banks but of any institution that poses a risk to the overall financial system. The Fed would turn over the task of monitoring the day-to-day operations of banks to a “prudential financial regulator” that would also oversee savings-and-loans and credit unions. A separate agency would protect investors and customers of banks, securities dealers, and insurance companies.

The White House acknowledged that the proposed reforms, most of which require congressional approval, were unlikely to be adopted during President Bush’s tenure. Trade groups for industries affected by the proposal said it went too far, while consumer groups said it didn’t go far enough. Massachusetts Democratic Rep. Barney Frank, chairman of the House Financial Services Committee, called it “a recognition, maybe a reluctant one, that you have to enhance regulation.” But his Senate counterpart, Sen. Christopher Dodd of Connecticut, dismissed the proposal as “a wild pitch.”

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What the editorials said

The administration’s reforms appear dead on arrival, thank goodness, said The Wall Street Journal. After a financial panic, politicians typically “demand more power for the same regulators who failed to use the powers they already have.” But today’s credit panic isn’t some “crisis of capitalism” that proves the need for a vast new regulatory overseer. The sub-prime mortgage fiasco reflected a “societal credit mania fueled by excessive money creation,” and the markets are already “providing more punishment and reform than Washington ever will.”

At least Paulson has launched the debate, said USA Today. At its core is a simple question: Should institutions such as investment banks and mortgage brokers “be left alone to decide what level of risks to undertake?” Of course not. Free of government oversight, institutions such as Bear Stearns placed “enormous bets” without caring how much damage those bets could do to the economy if they went wrong. With so much at stake, “there’s no sense allowing so much of the financial world to play by its own rules.”

What the columnists said

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Paulson’s plan would actually shrink government influence over the market, said Nelson D. Schwartz and Floyd Norris in The New York Times. That’s because while it gives the Fed more oversight, it cuts into its power to impose remedies. But what do you expect from the former CEO of investment bank Goldman Sachs, a man who believes “that any effort to substantially tighten regulation could hamper the ability of American markets to compete with foreign rivals.” His plan reflects “the traditional Republican view that new rules and agencies are no substitute for market discipline.”

That view, said Michael Mandel in BusinessWeek.com, “belongs in a fictional world where financial institutions do a good job in regulating and monitoring themselves.” In the real world, both commercial and investment banks have demonstrated that they can’t even measure the risk they’ve taken on. It would be madness to let them unilaterally decide how much risk is too much.

Washington can’t do the job any better, said John Tamny in RealClearMarkets.com. “Our Washington minders” have forgotten that the U.S. embraced laissez-faire economics “precisely because heavy regulation proved so wanting when it came to fostering a high level of economic vitality.” Have they forgotten, for instance, that the Great Depression of the 1930s was triggered in part by the ill-fated Smoot-Hawley law, which imposed huge tariffs on imports and led to an economic slowdown? Capitalism works. “Now is not the time to abandon it.”

What next?

With homeowners crying out for relief in an election year, Congress is likely to set aside the administration’s proposal in favor of measures to stem the flood of foreclosures. Both Paulson and Fed Chairman Ben Bernanke favor allowing lenders to forgive a portion of mortgage principal in exchange for federal guarantees that the remainder will be paid. Congress is fast-tracking legislation to set up such a guarantee program.

Create an account with the same email registered to your subscription to unlock access.

-

The hunt for Planet Nine

The hunt for Planet NineUnder The Radar Researchers seeking the elusive Earth-like planet beyond Neptune are narrowing down their search

By Chas Newkey-Burden, The Week UK Published

-

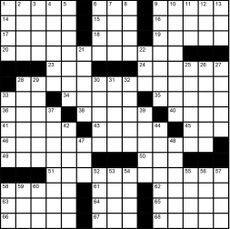

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

The final fate of Flight 370

feature Malaysian officials announced that radar data had proven that the missing Flight 370 “ended in the southern Indian Ocean.”

By The Week Staff Last updated

-

The airplane that vanished

feature The mystery deepened surrounding the Malaysia Airlines flight that disappeared one hour after taking off from Kuala Lumpur.

By The Week Staff Last updated

-

A drug kingpin’s capture

feature The world’s most wanted drug lord, Joaquín “El Chapo” Guzmán, was captured by Mexican marines in the resort town of Mazatlán.

By The Week Staff Last updated

-

A mixed verdict in Florida

feature The trial of Michael Dunn, a white Floridian who fatally shot an unarmed black teen, came to a contentious end.

By The Week Staff Last updated

-

New Christie allegation

feature Did a top aide to the New Jersey governor tie Hurricane Sandy relief funds to the approval of a development proposal in the city of Hoboken?

By The Week Staff Last updated

-

A deal is struck with Iran

feature The U.S. and five world powers finalized a temporary agreement to halt Iran’s nuclear program.

By The Week Staff Last updated

-

End-of-year quiz

feature Here are 40 questions to test your knowledge of the year’s events.

By The Week Staff Last updated

-

Note to readers

feature Welcome to a special year-end issue of The Week.

By The Week Staff Last updated