Issue of the week: The return of regulation

Josef Ackermann, CEO of Deutsche Bank, neatly summed up the sea change that has swept through the financial world, said Michael Skapinker in the Financial Times.

Josef Ackermann, CEO of Deutsche Bank, neatly summed up the sea change that has swept through the financial world, said Michael Skapinker in the Financial Times. “I no longer believe,” Ackermann said last week, “in the market’s self-healing power.” Not long ago, no self-respecting capitalist would have voiced such heresy and essentially admitted the need for more government regulation. But faith in the wisdom of the free market has been shaken by “the great financial unraveling” that has played out since last summer. That unraveling began, of course, with shaky mortgages arranged by unregulated mortgage brokers. Securities linked to those mortgages have now brought down unregulated hedge funds as well as lightly regulated investment banks, prompting widespread calls for “better ways to regulate and police our financial industry.” And U.S. policymakers of all stripes are listening, said Elizabeth Williamson in The Wall Street Journal. Free-market views have long held sway in Washington. Yet suddenly, the mortgage crisis and its fallout “are driving both political parties to reconsider how much companies and markets should be relied upon to police themselves.”

There’s one thing that the Bush administration and Democratic lawmakers can agree upon immediately, said Edmund L. Andrews and Stephen Labaton in The New York Times. “The meltdown in credit markets” exposed troubling weaknesses in the regulation of financial markets and institutions. But not surprisingly, there’s sharp disagreement about how to fix those flaws. Congressional Democrats want to “subject Wall Street firms to the kind of strict oversight that banks have had for decades.” The Federal Reserve already sets stringent limits on the amount of money commercial banks can borrow and the amount of cash they must keep on hand. Wall Street’s investment banks have traditionally enjoyed much greater flexibility. But last week, the Fed took the unprecedented step of allowing investment banks to borrow directly from the Fed on the same terms as commercial banks. If Wall Street is going to benefit from the Fed’s largesse, Democrats argue, it should be covered by the Fed’s rules. But President Bush and Treasury Secretary Henry Paulson “remain philosophically opposed to restrictions and requirements that might hamper economic activity.”

That’s not an economic policy, said Paul Krugman, also in the Times. That’s “willful amnesia.” The Great Depression of the 1930s made it clear that “unregulated, unsupervised capital markets can all too easily suffer catastrophic failure.” Over time, though, we’ve forgotten that lesson and allowed the emergence of “a shadow banking system” that skirts the rules and regulations “designed to ensure that banking was safe.” Now, in an eerie echo of the bank runs of the 1930s, people are “pulling money out of the shadow banking system,” setting off “a vicious circle of financial contraction.” Belatedly, the Fed is doing what it can to “break that vicious circle.” But the Fed’s efforts are only short-term patches. When the dust settles, Washington will have to get to work on wide-ranging, systematic reform. “It’s time to relearn the lessons of the 1930s, and get the financial system back under control.”

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

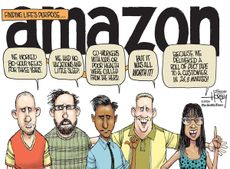

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published

-

Issue of the week: Yahoo’s ban on working from home

feature There’s a “painful irony” in Yahoo’s decision to make all its employees come to the office to work.

By The Week Staff Last updated

-

Issue of the week: Another big airline merger

feature The merger of American Airlines and US Airways will be the fourth between major U.S. airlines in five years.

By The Week Staff Last updated

-

Issue of the week: Feds’ fraud suit against S&P

feature The Justice Department charged S&P with defrauding investors by issuing mortgage security ratings it knew to be misleading.

By The Week Staff Last updated

-

Issue of the week: Why investors are worried about Apple

feature Some investors worry that the company lacks the “passion and innovation that made it so extraordinary for so long.”

By The Week Staff Last updated

-

Issue of the week: Does Google play fair?

feature The Federal Trade Commission cleared Google of accusations that it skews search results to its favor.

By The Week Staff Last updated

-

Issue of the week: The Fed targets unemployment

feature By making public its desire to lower unemployment, the Fed hopes to inspire investors “to behave in ways that help bring that about.”

By The Week Staff Last updated

-

Issue of the week: Is Apple coming home?

feature Apple's CEO said the company would spend $100 million next year to produce a Mac model in the U.S.

By The Week Staff Last updated

-

Issue of the week: Gunning for a hedge fund mogul

feature The feds are finally closing in on legendary hedge fund boss Steven Cohen.

By The Week Staff Last updated