The revealing differences between the House and Senate tax bills

The House and Senate tax bills look very similar — but they still have some crucial differences

Eventually, if the GOP dream of tax reform is to be realized, the House and Senate tax plans will have to be unified into a single, coherent whole. But for now, each chamber's proposal remains separate and distinct. And we can learn a lot from the differences.

Let's start with cutting the federal tax rate that corporations pay on their profits from 35 percent to 20 percent. This is the crown jewel of the GOP's tax reform aspirations, and both the House and Senate include it as a centerpiece of their plan. But while the House would cut the tax right away in 2018, the Senate would delay it until 2019.

Why? Well, the Republicans have 52 votes in the Senate. And they're relying on a Senate procedural tool called reconciliation to pass the bill with a simple majority, thereby avoiding the filibuster's 60-vote requirement and any need to negotiate with Democrats. But reconciliation comes with a few catches: First, to use reconciliation, the Republicans had to pass an overall budget blueprint. And their own internal negotiations forced them to limit any total increase in deficit spending over the next 10 years to $1.5 trillion. Additionally, bills passed via reconciliation can't add anything to the deficit beyond that first decade.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The corporate tax brought in almost $344 billion in 2015. Cutting it drastically obviously loses you a lot of revenue. A one-year delay saves about $100 billion. It's one of the many revenue savers Republicans are trying to piece together to stay within the $1.5 trillion limit.

But another big piece of this is probably just raw institutional differences: Representatives in the House face re-election every two years, while senators face them every six. So plenty of Republicans in the latter institution don't have re-election waiting for them just around the corner, and can afford to take a bit more time before delivering the goodies for their donors.

Another interesting difference between the House and Senate plans is the fate of the federal deduction for state and local taxes. Republicans have been gunning to kill this series of deductions, again because doing so would raise plenty of offsetting revenue — about $1.3 trillion over 10 years. But the deduction is also valuable to a lot of Americans. Under pressure, the House Republicans eventually caved and went for a more limited deduction.

The Senate, on the other hand, is killing the deduction entirely.

Again, institutional differences explain a lot of this. The state and local tax deduction is obviously most valuable in high-tax states. Those tend to lean Democratic, so for the most part GOP senators don't hail from them, and have little to lose by pissing off those constituencies. And they need the revenue. But representatives in the House serve congressional districts, and plenty of Republican-leaning districts can still be found in Democratic-leaning states. So they're more likely to anger voters by going all in on eliminating the deduction.

Interestingly, the situation is reversed with the mortgage interest deduction. The House GOP wants to cut the cap for the deduction in half — from $1 million to $500,000. The Senate GOP isn't going to touch the deduction. What explains the difference? While the people who benefit the most from the state and local deduction are more likely to be in Democratic-leaning states, upper-class homeowners are a lot more evenly spread across all states. So senators are more likely to be sensitive to meddling with that deduction compared to the state and local deduction. Meanwhile, the House GOP is a bit more populist — albeit in a very, very confused way — and capping the deduction at $500,000 will mostly inconvenience the upper-class and the rich.

Then there's the individual income tax: The House GOP wants to reduce the current seven brackets to four, while the Senate would leave them at seven — though it would slightly lower the top tax bracket rate from 39.6 percent to 38.5 percent. The Senate is in the right here: Lowering the number of tax brackets does nothing for the complexity of the tax code, as Republicans often claim. It's purely a gimmick that's causing other needless complications for the GOP's efforts to stay within its budgetary limits.

Overall, you could think of the difference between the House and Senate like this: The House is more populist and thus more likely to go off script and stick its thumb in the eye of some elites somewhere. But it's also more flighty and prone to symbolic flourishes that don't actually count for anything, like the tax brackets business. The Senate, meanwhile, has a bit more distance from the immediate pressures of politics, and that allows it to produce cleaner and more rational legislation in many ways.

But it also means the Senate is more coldly devoted to the demands of the GOP's uber-wealthy donor base. Ultimately, a one-year delay in the corporate tax rate cut won't make much difference to big business. They're playing the long game, and if that one-year delay gets them through the budgetary hurdles to a big and permanent corporate tax cut, I'm sure they're fine with that. (Most of the protests against the delay seem to be coming from President Trump, an individual not exactly known for his policy knowledge or strategic acumen.)

And none of this should overshadow the one big way House and Senate Republicans all agree: Massive tax cuts for corporations and their wealthy owners.

In a refreshingly honest (if cynical) moment, Sen. Lindsey Graham (R-S.C.) lamented that if his party doesn't pass tax reform, the "financial contributions will stop." Indeed, Republicans across both chambers have bought hook, line, and sinker into the idea that corporate tax cuts will somehow translate into higher wages for regular workers — or at least have bought into the idea that that's the way to sell the plan.

The big corporate tax cut is the central thing causing the GOP all its other budgetary challenges, the one thing forcing Republican lawmakers to cut and paste and tweak and rework every other detail of the bill. And it's the one hill they're all willing to die on.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

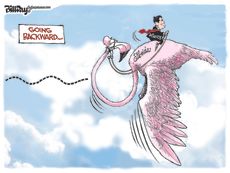

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

Arizona court reinstates 1864 abortion ban

Arizona court reinstates 1864 abortion banSpeed Read The law makes all abortions illegal in the state except to save the mother's life

By Rafi Schwartz, The Week US Published

-

Trump, billions richer, is selling Bibles

Trump, billions richer, is selling BiblesSpeed Read The former president is hawking a $60 "God Bless the USA Bible"

By Peter Weber, The Week US Published

-

The debate about Biden's age and mental fitness

The debate about Biden's age and mental fitnessIn Depth Some critics argue Biden is too old to run again. Does the argument have merit?

By Grayson Quay Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

Henry Kissinger dies aged 100: a complicated legacy?

Henry Kissinger dies aged 100: a complicated legacy?Talking Point Top US diplomat and Nobel Peace Prize winner remembered as both foreign policy genius and war criminal

By Harriet Marsden, The Week UK Last updated

-

Trump’s rhetoric: a shift to 'straight-up Nazi talk'

Trump’s rhetoric: a shift to 'straight-up Nazi talk'Why everyone's talking about Would-be president's sinister language is backed by an incendiary policy agenda, say commentators

By The Week UK Published

-

More covfefe: is the world ready for a second Donald Trump presidency?

More covfefe: is the world ready for a second Donald Trump presidency?Today's Big Question Republican's re-election would be a 'nightmare' scenario for Europe, Ukraine and the West

By Sorcha Bradley, The Week UK Published