Does the Federal Reserve really control the money supply?

The Fed has been pushing trillions of dollars into the financial system. But the money supply has barely grown.

The Federal Reserve, which issues the United States' monetary base (bank notes, coins, and bank reserves), has vastly increased its size since 2008 through quantitative easing programs — buying assets including Treasury bonds and mortgage-backed securities in open market operations with newly-created money:

With such soaring quantities of new money resulting from quantitative easing, many economists including John Williams, Peter Schiff, and Marc Faber have predicted imminent high or hyper inflation. But by the broadest measures, like MIT's Billion Prices Project, the predictions haven't played out. Inflation hasn't soared along with the monetary base.

And the money supply, which is different from the monetary base (the actual currency), hasn't really grown either. Bank notes and coins are the most tangible kind of dollars, but there are many more kinds of things called "dollars" that are used for exchange. Most obviously, credit. Banks create money through the fractional reserve banking system. Banks can lend — and thus create credit — up to 10 times their reserves on hand.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This means that while the monetary base has tripled, the M2 money stock — which includes both checking and savings accounts as well as traveler's checks, time deposits, and money market deposit accounts — has not increased nearly as much:

But even M2 does not encompass the entirety of the money supply. There exists another banking system — the shadow banking system— where credit expansion also takes place. Shadow credit creation takes place via securitization, a process by which debt-based assets like mortgages, credit card debt, and auto debt are pooled together and sold, and via repo, through which assets are pawned to a lender as collateral for credit.

One of the stories behind the 2008 crisis was the huge outgrowth of shadow credit creation that preceded it. Yet when the crisis hit, credit markets became spooked, shadow credit creation dried up, and the level of shadow assets began to deflate:

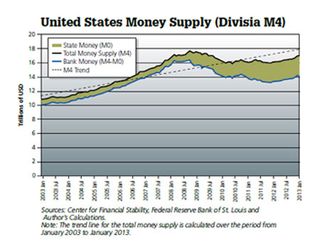

So the hidden story behind the quantitative easing programs is that the new base money that the Fed has pushed into the financial system has been replacing shadow credit that dried up after 2008. The Fed does not control the money supply — most of the money supply has been created through credit. The Fed can only control one small part of the money supply. This is shown in this chart of M4 — the total money supply, including shadow money — created by Professor Steve Hanke of the Cato Institute, with the monetary base issued by the Fed in olive:

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Even after all that quantitative easing, the money supply has still shrunk.

In fact, quantitative easing may be choking off shadow credit creation. As the Fed buys more and more assets, there are less assets left in the market that can be used as collateral for credit creation. This so-called "safe-asset shortage" is one factor that has driven the price of Treasuries as well as corporate bonds and even junk debt to record highs. If choking off shadow credit creation and replacing shadow money with traditional money was the Fed's implicit goal, then it is succeeding. But the money the Fed has issued since the crisis hasn't even made up for the shrinkage.

Create an account with the same email registered to your subscription to unlock access.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.