The crisis—and Geithner plan—explained

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Q: What is the problem?

A: The problem is that unemployment is rising like a rocket.

Q: Why is unemployment rising like a rocket?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A: Because those businesses that normally would be expanding and hiring right now are not expanding and hiring. This is compounded by the fact that businesses that would normally be contracting right now are indeed contracting -- rapidly.

Q: Why aren't the businesses that ought to be expanding and hiring doing so?

A: Because they cannot borrow money or sell bonds on terms that make it profitable for them to expand and hire.

Q: Why can't they borrow or sell bonds on normal terms?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A: Because banks and investors are loath to take on any more risk, they’re demanding that businesses seeking financing offer them usurious terms, which the businesses cannot do and still profitably expand.

Q: So why are the securities on Wall Street right now distressed and low-value?

A: Because banks, investors, and other financial intermediaries don't think they are worth very much.

Q: Why don't banks, investors, and other financial intermediaries think they are worth very much?

A: Six factors: (a) the housing boom was accompanied by the creation of a lot more assets--principally mortgage-backed securities and their derivatives. As supply and demand dictates, when there is more of something, it is worth less; (b) some of these securities were initially sold at prices that only a fool, thinking a bigger fool would come along to buy them at an even higher price, would ever pay; (c) there is a recession on and so firms have a greater chance of defaulting on their securities; (d) traders working for Wall Street firms are irrationally panicked after having been hammered for a year and a half; (e) those working for Wall Street firms that are now undercapitalized (because they have been hammered for a year and a half) assign a very high cost to risk because it materially increases the chance that their firm will vanish next month; (f) the risk level of these securities is much higher than normal because professional investors no longer trust their own financial models or know how their models compare to the models of other traders.

Q: And economists know how to fix this, right?

A: Well, some economists don't think we should fix this. Some welcome high unemployment, thinking it’s the best way to get workers out of declining industries and into growth industries. They consider a period of high unemployment a way of convincing people who were previously employed "pounding nails in Nevada" to go do something else -- part of the respiration of the capitalist organism, as Josef Schumpeter said. They tend to like the fact that financial asset prices are now low, and condemn attempts to raise them as efforts to keep the feckless financiers who bought them during the boom from suffering their just punishment. Followers of this line of argument -- I call them the Marx-Mellon-Hayek-Hoover axis --tend to say things like: “What's to fix?”

Q: But at least some economists know how to fix this, right?

A: We think so. We recommend four things: (a) The Federal Reserve should purchase Treasury bonds for cash in as large a quantity as needed to push their prices up as high as possible. For if Treasury bonds are expensive, then investors will likely shift some of their demand to mortgage and corporate bonds, push up their prices somewhat; (b) Even after the Federal Reserve has pushed Treasury bond prices as high as they can go, it should keep buying Treasury bonds for cash in the hope that if people's pockets are full of cash, they will spend more of it, and that extra spending will directly pull people out of joblessness and into employment; (c) The government should run big, even extra-big, deficits so that its spending--like the government's wave of spending during World War II, like the wave of spending that followed the Reagan tax cuts of 1981, like Silicon Valley's wave of spending during the late 1990s, like the wave of spending on housing in the 2000s -- will also directly pull people out of joblessness and into employment; and (d) The government should undertake additional measures to boost financial asset prices and thus make it easier for those firms that ought to be expanding and hiring to obtain finance on terms that allow them to expand and hire.

Q: "Additional measures to boost financial asset prices"?

A: Of which the Geithner Plan is one part.

Q: Ah. Finally. 900 words and you have finally gotten to the Geithner Plan.

A: Yes. The Geithner Plan is to take about $465 billion of government money, combine it with $35 billion of private-sector money, and use it to buy up risky financial assets.

Q: Why is the government making the private sector kick $35 billion into this $500 billion fund?

A: So that they have skin in the game. The Treasury doesn’t want them taking excessive risks with taxpayers' money, buying financial assets at more than their long-term hold-to-maturity value, for example. So it’s requiring that private investors put some of their own money on the line, as well.

Q: Why should private-sector investors be willing to kick in $35 billion?

A: Because they stand to make a fortune if and when markets recover and financial asset prices rise toward normal values. The government will be taking $13 billion a year out of the fund off the top in interest, and splitting the remaining profits with the private-sector fund managers. If the fund does well over the next five years—returning profits, say, of nine percent per year-- then the private investors get (a) a rate of return on their super-risky equity investment of 14 percent, plus (b) the equivalent of an "annual management fee" equal to two percent of the capital under management. If the portfolio does less well—say, profits of four percent per year-- they get a still-healthy but sub-market return of 10 percent per year on their equity. And if the portfolio does badly--loses one percent per year—they still have to pay back their loans from the FDIC and consequently lose 5/7 of their investment. Those are attractive odds.

Q: Isn't this just a massive giveaway to financiers?

A: Whether the financiers who invest in and run this program will make fortunes time alone will tell. But they will be a different set of financiers than those who got us into this mess. And if they make fortunes, they will make the government a bigger fortune. A "management fee" of two percent of assets under management per year is one that many sophisticated investors have been willing to pay to private hedge funds, and they have topped it off with an extra 20 percent of annual profits – a fee the Treasury won’t be paying.

Q: So the Treasury is doing this to make money?

A: No: making money is a sidelight. The Treasury is doing this to reduce unemployment.

Q: How does having the U.S. government invest $500 billion in the world's largest hedge fund operations reduce unemployment?

A: The sudden appearance of an extra $500 billion in demand for risky assets will reduce the quantity of risky assets other private investors will have to hold. And the sudden appearance of between five and ten different government-sponsored funds making public bids for assets will convey information to the markets about what models investors are using to value assets in this environment. That sharing of information will reduce the perception of risk somewhat. When assets are seen as less risky, their prices rise. And when there are fewer assets on the market, their prices rise too: it’s simple supply and demand. With higher financial asset prices, those firms that ought to be expanding and hiring will be able to get money on more attractive terms that make expanding and hiring more profitable, etc.

A: And the recession will end, and unemployment will drop back to normal?

A: I doubt it. My guess is that we would need to take a total of $4 trillion in assets out of the market in order to move financial asset prices to a point at which it becomes profitable for businesses that should be hiring and expanding to actually hire and expand. “Toxic” assets account for only $2 trillion of this total; the government has to sponge up additional assets because the big problem now is not the inability of some people in the desert outside Los Angeles to pay their mortgages. The problem is that among financiers everywhere, the tolerance for holding risk has collapsed. The Geithner plan supplies $500 billion to acquire assets. The Federal Reserve's quantitative easing plan will add another $1 trillion. And I should hasten to say that the administration thinks that the information-sharing effects of the Geithner plan will do three times as much good as the simple supply-and-demand analysis suggests. (I discount that entirely.) So from their perspective, the glass is 3/4 full.

Q: Oh.

A: The administration will do more. This plan consumes $100 billion of second-tranche TARP money. But there is a potential second-round stimulus in September. And there is still $250 billion more left in the TARP to be used in other ways.

Q: But if even the Obama administration thinks this plan will accomplish only 3/4 of the job, why aren't they doing more? Why not do the entire job?

A: Voinovich.

Q: Voinovich?

A: Republican Senator George Voinovich of Ohio is the sixtieth vote in the Senate--the one required to close off debate, avoid a filibuster and move to a vote on final passage of a bill. If the Obama administration wants to do anything that requires legislative action, it needs Voinovich and 59 other senators on board. The White House’s legislative tacticians appear to think that 60 senators are not on board--especially after last week's AIG scandal. The Geithner Plan is something the administration can do on authority it already has. Doing more would require a congressional coalition that, at present, does not exist.

Q: What if this goes wrong? What if the public-private investment portfolios don't earn nine percent or four percent per year -- or even lose value at one percent per year? What if instead they lose value at a rate of 10 percent per year so that in five years the government loses half its money?

A: Then we have worse things to worry about than government losses on TARP-program money--for we are then in a world in which the only things that have value are bottled water, sewing needles, and ammunition.

Brad DeLong is a professor in the Department of Economics at U.C. Berkeley; chair of its Political Economy major; a research associate at the National Bureau of Economic Research; and from 1993 to 1995 he worked for the U.S. Treasury as a deputy assistant secretary for economic policy. He has written on, among other topics, the evolution and functioning of the U.S. and other nations' stock markets, the course and determinants of long-run economic growth, the making of economic policy, the changing nature of the American business cycle, and the history of economic thought.

-

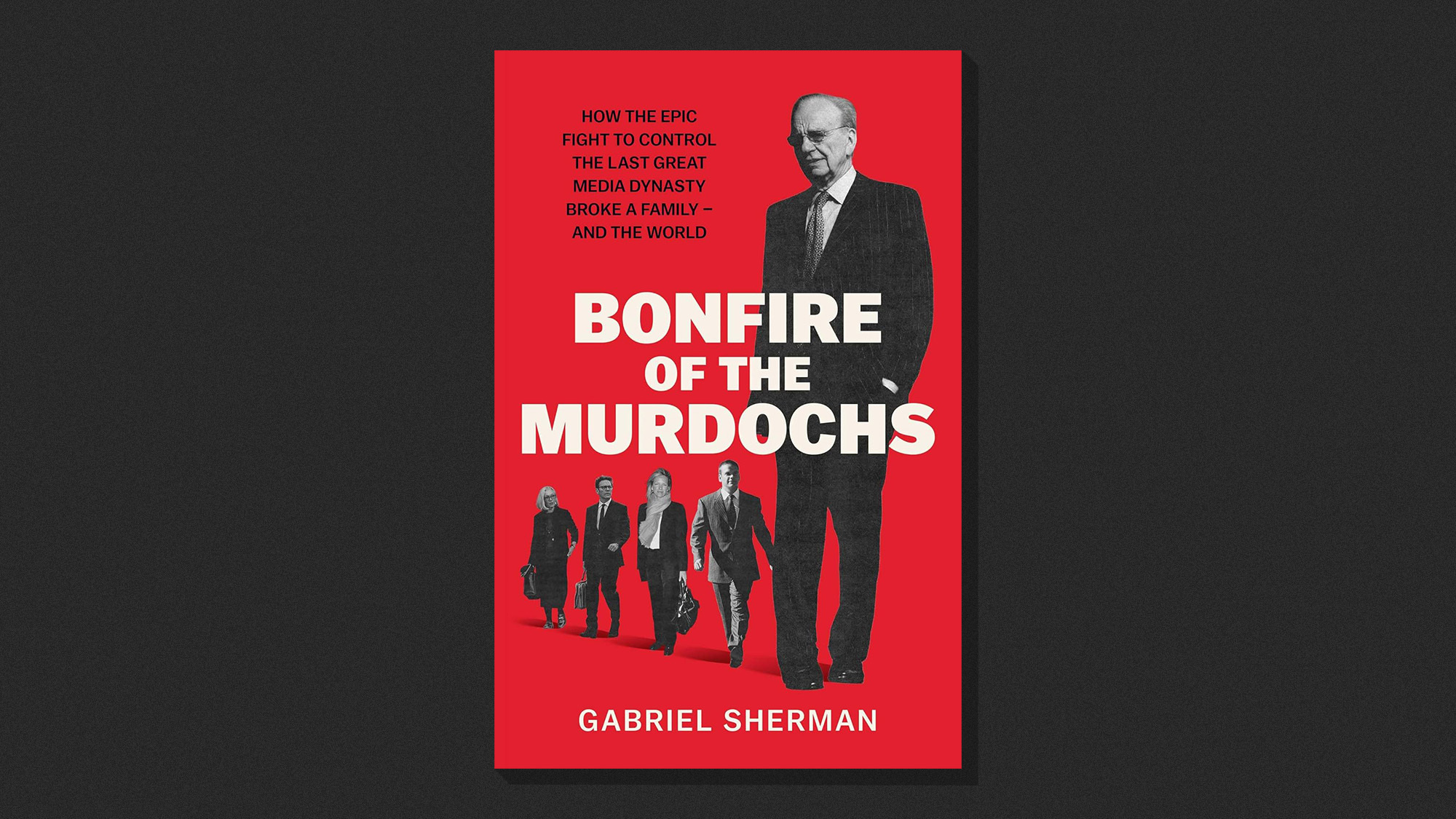

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

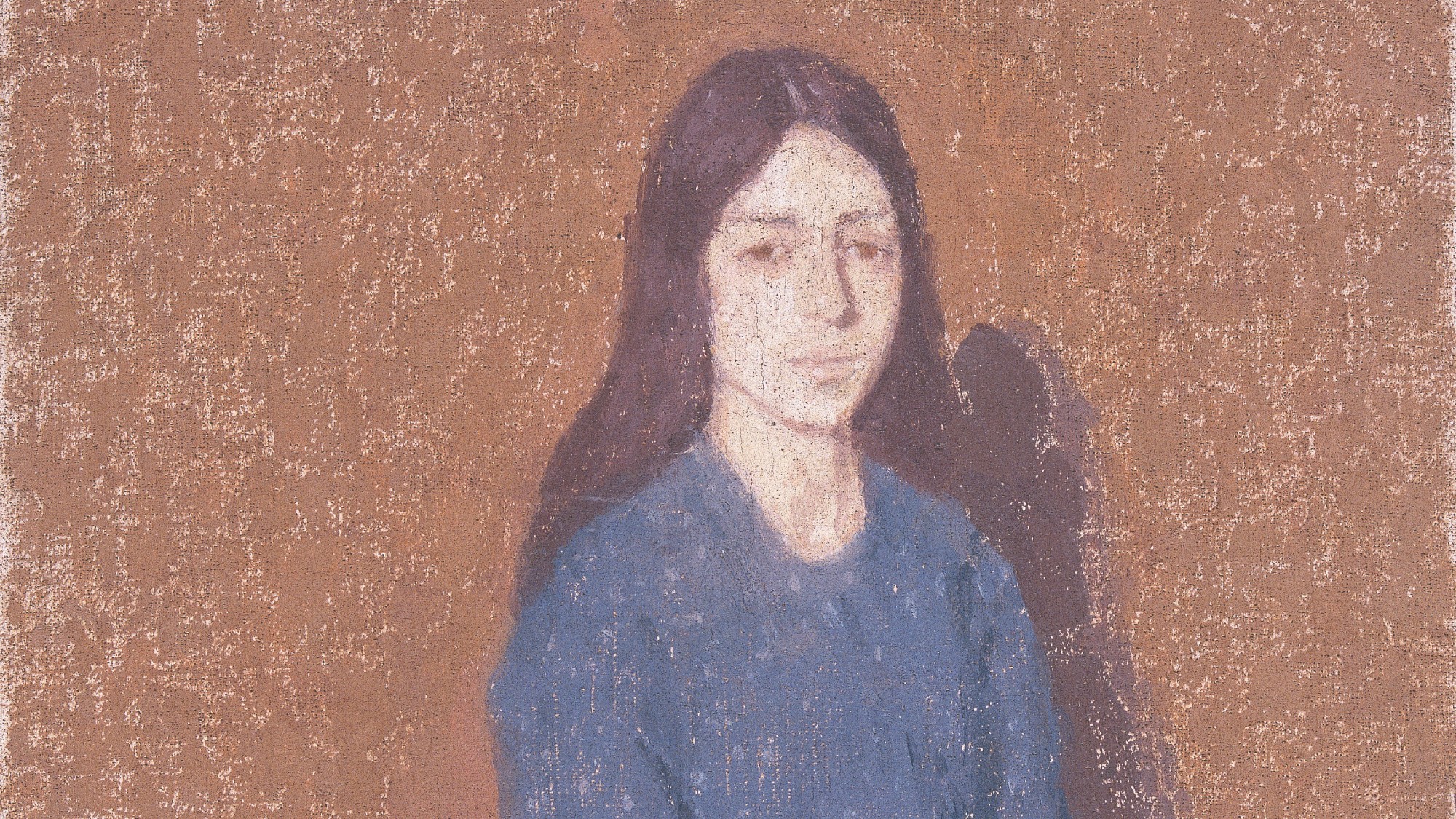

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Issue of the week: The latest fix for the euro crisis

feature The head of the European Central Bank announced an unlimited bond-buying plan for troubled euro zone countries.

-

Issue of the week: The return of the euro crisis

feature The euro crisis is back with a vengeance, and it will be with us “for many years” to come.

-

Issue of the week: Europe’s latest crisis fix

feature The agreements reached last week will create a fiscal union in Europe by allowing the EU to oversee members' national budgets and impose limits on deficits and spending.

-

Issue of the week: Greece inflames the debt crisis

feature “Not since the night when soldiers emerged from the belly of a giant wooden horse in ancient Troy has Greece engineered a more stunning surprise,” said an editorial at The Washington Post.

-

Issue of the week: Who caused the financial crisis?

feature The Financial Crisis Inquiry Commission appointed by Congress completed its report on the “culprits” involved in “the traumatic events of 2008.”

-

Making a fetish of democracy

feature From Iraq to Afghanistan and beyond, Washington remains in thrall to the idea that democratization will make other nations more peaceful and reliable allies. It isn't true.

-

France's nuclear solution

opinion What if there were a way to get around nuclear energy's big problem— radioactive waste? There is.

-

Nuclear Iran? Get used to it

feature