Biden's unlikely allies

Billionaires who want to ... raise their own taxes?

President Biden has apparently found some unlikely quasi-allies in his quest to pay for his infrastructure package with higher taxes: Jeff Bezos, former CEO of Amazon and the world's richest person, and Jamie Dimon, CEO of JPMorgan Chase, the biggest bank in the country.

Amazon is "supportive of a rise in the corporate tax rate," wrote Bezos in a brief statement Tuesday. In a letter to shareholders published Wednesday morning, while Dimon said the current corporate tax rate is about right, he also suggested it would be good to increase taxes on the wealthy more generally to fund infrastructure, and that the "maze" of tax breaks that benefit the rich should be abolished — including the carried interest loophole, which benefits hedge fund managers exclusively. A few other wealthy executives and financiers have also expressed various levels of support.

Frankly, this is a rather shocking development. My instant reaction, of course, is suspicion — what are these jokers up to? Alas, I am not close personal friends with Bezos or Dimon, so any analysis of the situation must be somewhat speculative. But it is evidence at least that the neoliberal consensus that has dominated American politics since the 1980s is crumbling.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are two developments that would explain most convincingly what these two are doing. The first is that the ultra-rich have done spectacularly well over the last year, and at least some of them are getting a little bit nervous about populist backlash. Amazon's sales exploded from all the online shopping during the pandemic, and as a result Bezos' wealth has increased from $115 billion at the beginning of 2020 to $190 billion today. Financial markets have boomed in part thanks to all the pandemic rescue packages, and as a result, JPMorgan Chase increased its assets from $2.7 trillion to $3.4 trillion during 2020 (though its profits were actually down slightly, apparently due to low interest rates and new accounting rules).

The rest of the citizenry is not doing nearly so well. Now, a great many ordinary people have seen modest improvement thanks to the survival checks, super-unemployment, and other payments in the pandemic rescue packages; on average household debt payments are down and incomes are up. But that is small potatoes compared to the mountain ranges of money the billionaire class is raking in — and meanwhile, a large minority of Americans are in dire straits. Unemployment is still very high, and a big fraction of people who qualify for various rescue benefits have not actually been receiving them, thanks to the country's hollowed out bureaucracy. Millions of people have been evicted even in spite of orders banning the practice, and outright hunger is endemic.

Worst of all, some 556,000 Americans and counting are dead. Even a billionaire might feel a little queasy about profiting so handsomely during such a tsunami of sickness and death.

My best guess is that the more politically astute billionaires are figuring that this horrific inequality is dangerous to them. (It's notable that Dimon received the exact same salary in 2020 as he did in 2019, something he almost certainly arranged personally.) If so, they are likely correct — from their perspective, it would be wise to make a small sacrifice to cut the citizenry in on a little of the fruits of economic production. Slicing a few percent off corporate profits or billionaires' net worth would be a small price to pay to deflate a potential populist backlash that might expropriate them altogether. They might be thinking of how Bernie Sanders, whose tax plan would have increased the top marginal tax rate on ultra-billionaires to 98.2 percent, came within a whisker of locking up the Democratic presidential nomination for a few weeks in 2020.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Whatever the reasoning, it's a marked departure from classic neoliberal ideology, which holds that capitalists fairly earn their "marginal product" in the market, and hence taxes should be as low as possible. (When President Obama suggested raising taxes on private equity firms in 2010, Blackstone chief Steven Schwarzman compared it to Hitler's invasion of Poland.)

Such a strategic calculation on the part of business titans would be unusual. As John Kenneth Galbraith said about Ancien Régime French aristocracy, "People of privilege almost always prefer to risk total destruction rather than surrender any part of their privileges." We are also only talking about a few people — the majority of the billionaire class is surely dead set against any increase in corporate tax or any other populist policy, no matter how mild. But such a move is not unheard of, either. It was the arch-reactionary Otto von Bismarck who passed Germany's first state-backed health care program, in an effort to buy off the working class.

The second possible explanation is a huge change in thinking about economics. The financial and business press, for instance, is almost unrecognizable compared to a decade ago, when it published a steady drumbeat of pro-austerity coverage after the financial crisis. On Wednesday, Grep Ip at The Wall Street Journal published a straightforward explanation of "Bidenomics" as being a clean break with the neoliberal economics, and described the writings of socialist economist J.W. Mason(!) as being a "handbook of post-neoliberal thought."

In that vein, the most remarkable part of Dimon's letter to shareholders is not the call for closing tax loopholes. It is the call for a sweeping overhaul of economic policy writ large. Dimon argues that the weak recovery after the Great Recession was caused by insufficient fiscal stimulus, and that the massive pandemic rescue packages saved the economy last year. He outlines a plan for a "comprehensive, multi-year national Marshall Plan" that would include raising the minimum wage and boosting welfare payments so that every job pays a living wage. He calls for "intelligent industrial policy," particularly in the form of a massive increase in federal research spending, for making it easier for ex-convicts to get jobs, and for special programs to help non-white businesses and workers.

Again, there is surely a large dollop of cynicism in this reasoning, and Dimon also has a lot of self-interested complaints about financial regulation. But I think we see here how heterodox economic thinking has seeped into Wall Street. Financiers rely on economic analyses to make their bets, and neoliberal models have performed terribly over the last decade — indeed, some years ago many traders lost their shirts betting against U.S. debt using that style of reasoning. More importantly, economics provides crucial political legitimacy to Wall Street. Big Finance justifies its wealth and power by portraying itself as critical to the functioning of the economy. Because neoliberal models have been discredited, financiers are pushed into using different arguments to justify themselves — something Dimon does repeatedly in his letter.

Honestly, it makes my head spin to see the head of the biggest bank in the country making many of the same arguments I have for years. But I don't think progressives or socialists should see this is a bad thing. There is a risk that Dimon and Bezos' strategy might work — that billionaires will be able to buy off the American people at a bargain rate. But there is also a risk that if Biden's bill is not passed, nothing will be get through at all. Conversely, if tax hikes are passed, the working class can pocket the gains and keep demanding more. I say take what is on offer today, and tomorrow turn up the pressure even higher.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

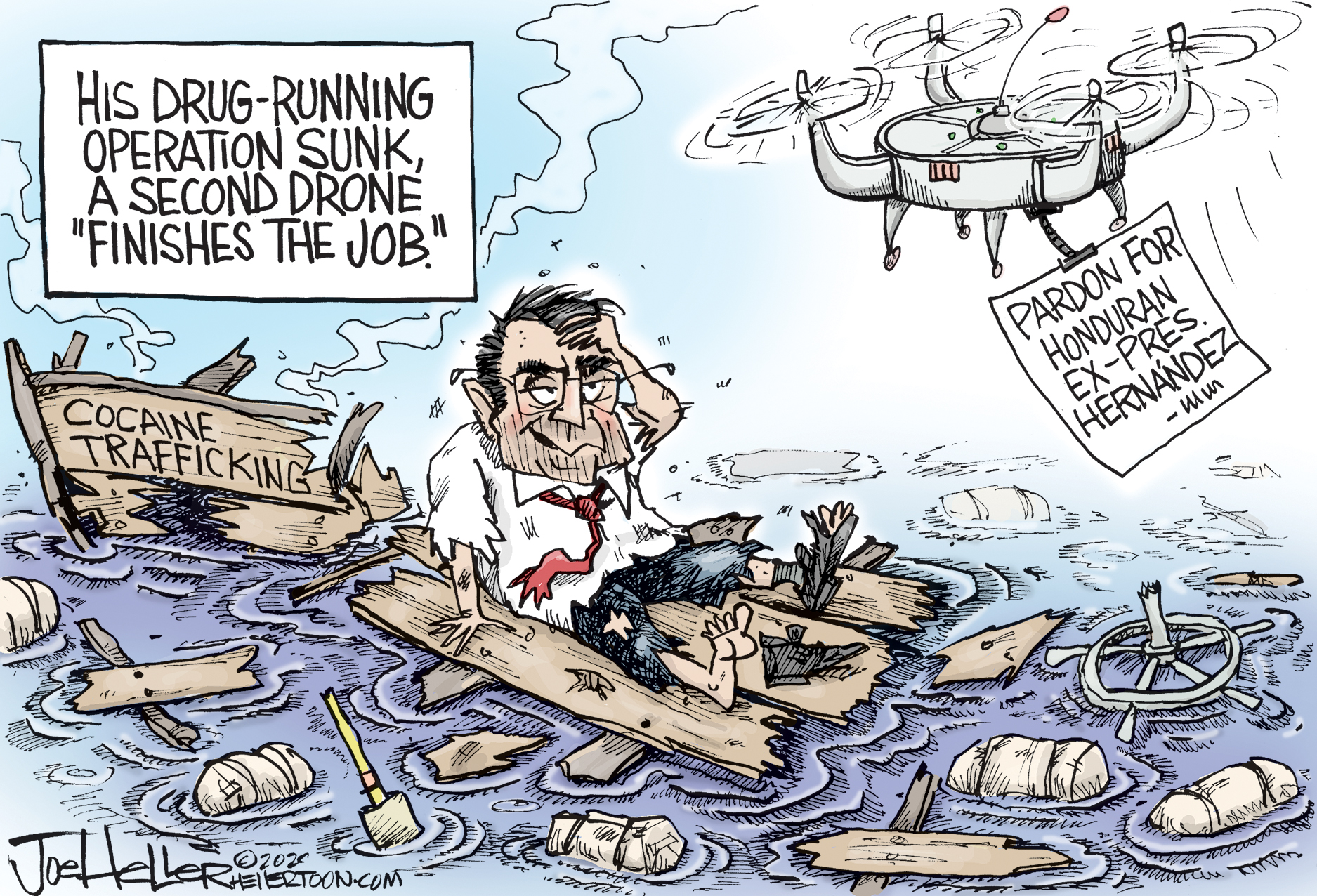

Political cartoons for December 6

Political cartoons for December 6Cartoons Saturday’s political cartoons include a pardon for Hernandez, word of the year, and more

-

Pakistan: Trump’s ‘favourite field marshal’ takes charge

Pakistan: Trump’s ‘favourite field marshal’ takes chargeIn the Spotlight Asim Munir’s control over all three branches of Pakistan’s military gives him ‘sweeping powers’ – and almost unlimited freedom to use them

-

Codeword: December 6, 2025

Codeword: December 6, 2025The daily codeword puzzle from The Week

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration