Why is Saudi Arabia going it alone on costly oil cuts?

The unilateral production cuts could hurt its finances while raising gas prices for drivers and OPEC

OPEC+ energy ministers met in Vienna over the weekend, and most of the gathered nations agreed Sunday to maintain previously agreed-upon reduced oil output through the end of 2024. The United Arab Emirates won permission to boost oil production. But Saudi Arabia, OPEC's most important member, announced it will unilaterally cut production by 10%, or 1 million barrels a day, starting in July.

OPEC and its Russia-led allies almost always cut or raise output in tandem, using their official meetings to rubber-stamp production plans agreed to beforehand, but last weekend saw "one of the most contentious production meetings in recent years," The Wall Street Journal reported. Saudi Energy Minister Prince Abdulaziz bin Salman wanted across-the-board cuts to boost oil prices, but other members, especially in Africa, fiercely resisted.

Saudi Arabia's surprise decision to shoulder the entire million-barrel cut by itself did boost oil prices a bit, and it could lead to higher gas prices this summer. But because the Saudis will be selling less oil, a modest price hike will leave the kingdom with less revenue. What's behind Saudi Arabia's go-it-alone production cuts?

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What are the commentators saying?

When the Saudis engineered OPEC+ production cuts in October and again in April, it was widely seen as a poke in the eye to President Biden, who had personally asked Saudi Crown Prince Mohammed bin Salman (MBS) to increase output amid stubbornly high inflation. But now it seems they maybe just need the money.

Oil revenue accounts for two-thirds of Saudi Arabia's income and global prices are still a fistful of dollars short of what Riyadh needs to even balance its budget, much less pay for "the giga-projects that lie at the heart of its Vision 2030 program to transform the economy," Eoin McSweeney wrote at CNN. The crown prince is trying to diversify the Saudi economy, but "foreign investment isn't anywhere near where Riyadh wants it to be," and there's a tremendous need for cash as MBS's grandiose Vision 2030 projects enter the construction phase.

Prince Abdulaziz, MBS's half-brother, has also recently been "fixated" on punishing "Wall Street short sellers," whose oil market "bets can cause prices to fall," the Journal reported. Some analysts see Abdulaziz's unilateral output cut driven in part by his "annoyance" at a perceived "mismatch between the underlying fundamentals of the market — which OPEC can influence — and trader sentiment, which is a tougher beast to corral," David Sheppard wrote at the Financial Times. The decision to keep July's cut open for extension, brokerage Jefferies suggested, was "likely put in place to discourage future short positioning."

What's next?

Abandoning OPEC's "all for one, one for all" playbook is a potentially "high-reward but extremely high-risk strategy" for the Saudis, and "for now, it doesn't look like the strategy is paying off," Javier Blas argued at Bloomberg Opinion. That could change if Abdulaziz's unilateral cut shocks a market "about to get tighter anyway thanks to seasonally rising oil demand" and prices jump "back to the $90 to $100 range the Saudis prefer." But the "far less rosy view" is that "the OPEC weekend didn't go Saudi Arabia's way, and Prince Abdulaziz was, effectively, forced into a solo cut," helping other members at Riyadh's expense.

As Abdulaziz knows well, Saudi Arabia tested this strategy of "desperately trying to limit its own supply to keep the market in balance" in the 1980s, David Fickling wrote at Bloomberg Opinion. It was great for slowing climate change but terrible for the Saudis: Riyadh's "Samson-like attempts to carry the entire global oil market on its shoulders ended in a shocking reversal" in the 1980s, with the Saudis slashing prices and pumping freely to an oil-thirsty world.

The world isn't quite as thirsty now, Fickling added, and "should the current run of restraint by Saudi Arabia end with another reversal," this "accelerating energy transition will present the kingdom with an alarming question. Perhaps this time when the Saudis open the taps, the world will no longer want what they're selling?"

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

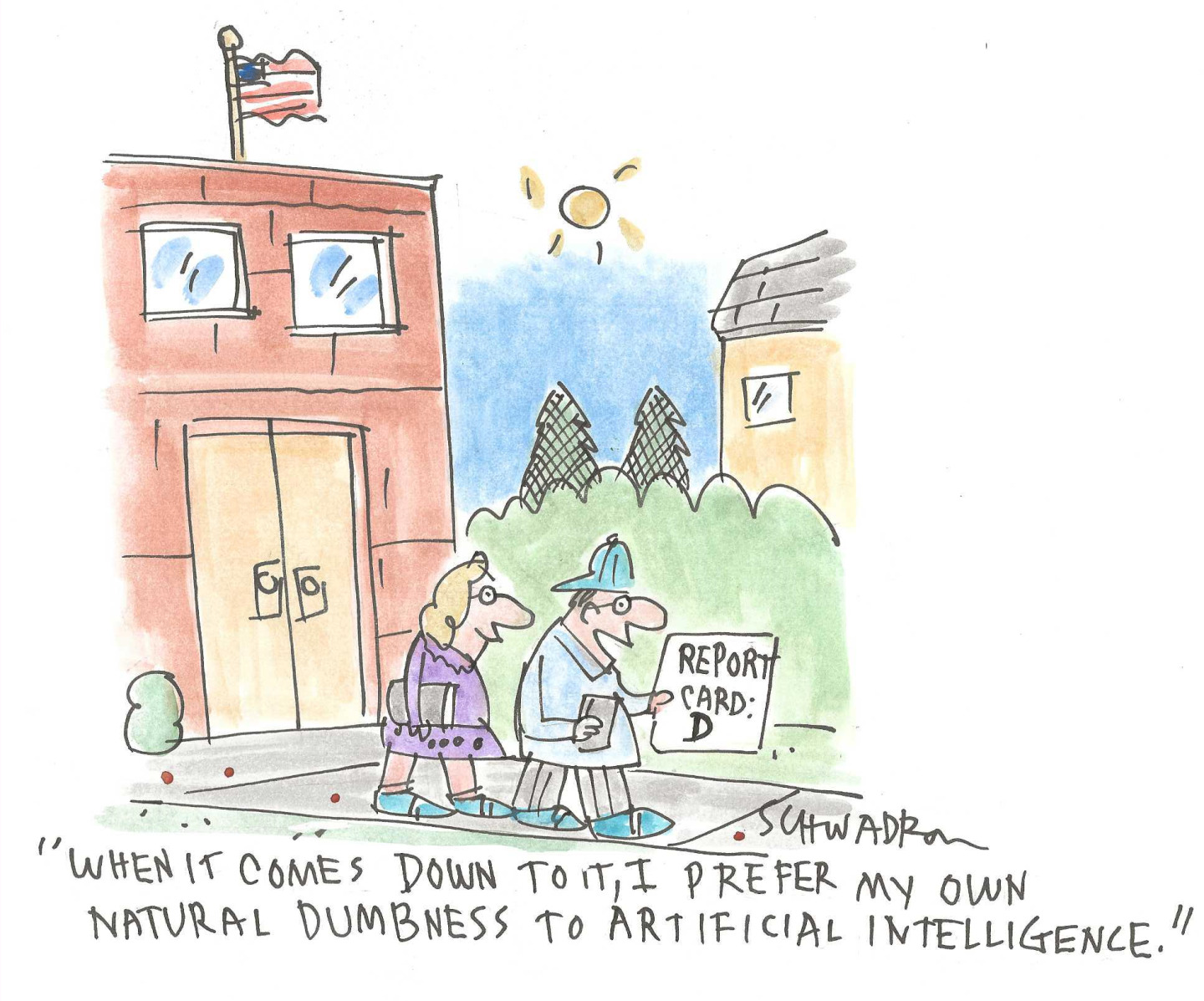

Today's political cartoons - May 10, 2025

Today's political cartoons - May 10, 2025Cartoons Saturday's cartoons - artificial intelligence, cryptocurrency, and more

-

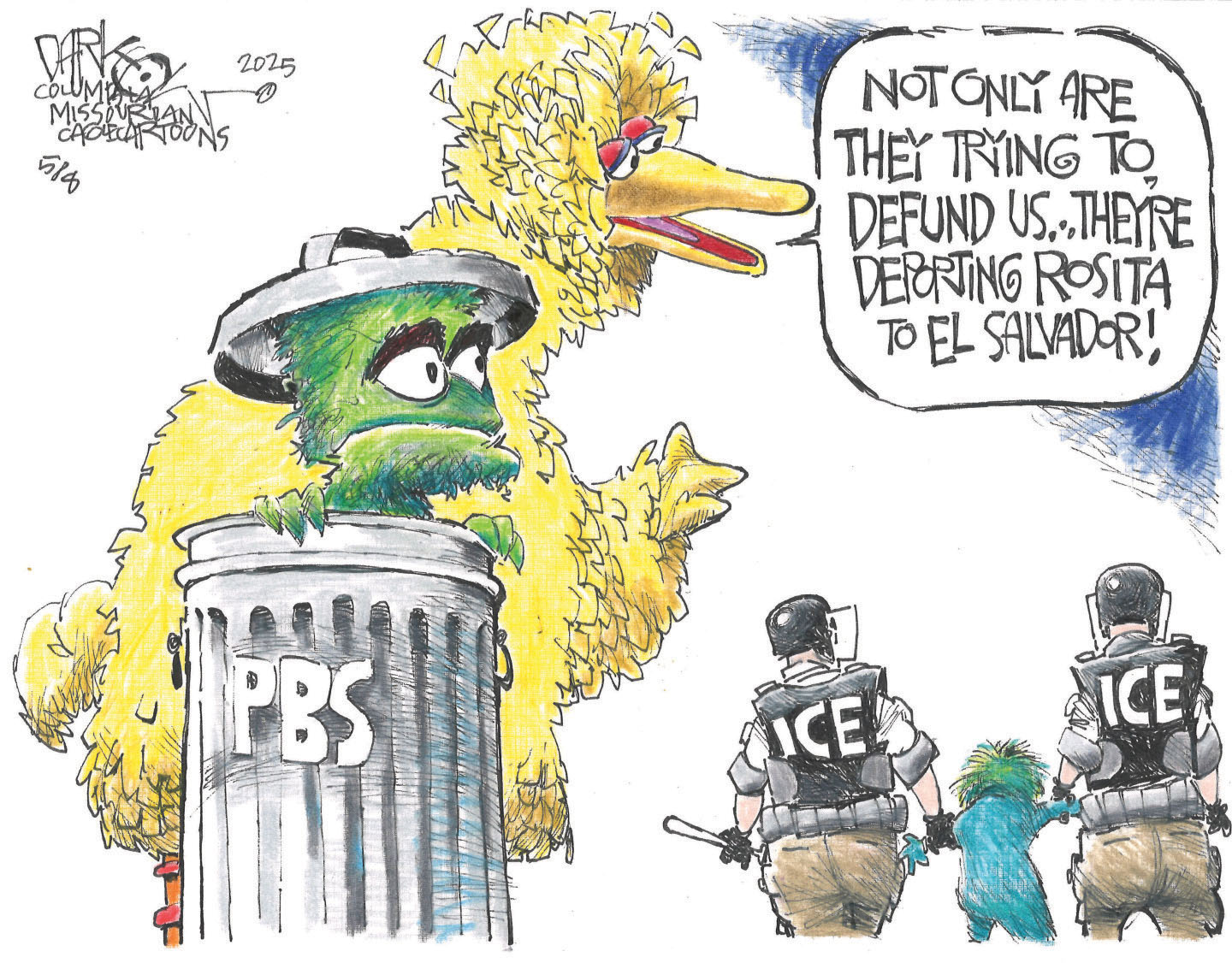

5 streetwise cartoons about defunding PBS

5 streetwise cartoons about defunding PBSCartoons Artists take on immigrant puppets, defense spending, and more

-

Dark chocolate macadamia cookies recipe

Dark chocolate macadamia cookies recipeThe Week Recommends These one-bowl cookies will melt in your mouth

-

Enron mystery: 'sick joke' or serious revival?

Enron mystery: 'sick joke' or serious revival?Speed Read 23 years after its bankruptcy filing, the Texas energy firm has announced its resurrection

-

Big Oil doesn't need to 'drill, baby, drill'

Big Oil doesn't need to 'drill, baby, drill'In the Spotlight Trump wants to expand production. Oil companies already have record output.

-

The PGA gets a Saudi makeover

The PGA gets a Saudi makeoverfeature Fans and players are reeling after the league announced a surprise merger with its Saudi-backed rival

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

Great British Nuclear: one step forward to take two steps back?

Great British Nuclear: one step forward to take two steps back?Talking Point New flagship agency to deliver UK’s next generation of reactors delayed as nuclear output is set to decline further

-

Clashes: Modi's favored billionaire fights fraud claims

Clashes: Modi's favored billionaire fights fraud claimsfeature What does this mean for India's clean energy plan?

-

Russia's weaponization of oil and gas exports to neuter Europe on Ukraine is backfiring badly

Russia's weaponization of oil and gas exports to neuter Europe on Ukraine is backfiring badlySpeed Read

-

The end of energy life-support: bad for business?

The end of energy life-support: bad for business?Talking Point Companies have lost their guaranteed handouts – but it’s a relief for the taxpayer