What is the debt ceiling? Everything you need to know about the crisis in D.C.

The U.S. government is set to hit its borrowing limit on Thursday. Here's why that matters.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What is the debt ceiling, exactly?

The maximum amount of money that Congress allows the federal government to borrow.

The government usually spends more than it raises in taxes, and makes up the difference by issuing U.S. Treasury bonds — essentially interest-bearing loans — to investors, foreign governments, etc. Due to a historical quirk, Congress keeps a limit on how much it can issue in Treasuries; right now that limit is about $16.7 trillion.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

When do we reach that limit?

We already did, technically, on May 19. Since then, the Treasury has been using a whole bag of unconventional tricks known as "extraordinary measures," like delaying payments for public employee pension funds, to raise an extra $400 billion. By October 17, those extra funds will be exhausted, and the Treasury will be down to about $30 billion on the books, not enough to pay even a day's worth of bills.

What happens if the money runs out?

The government will have to rely just on tax revenue to pay its bills. Between October 17 and November 15, the government is expected to collect about $222 billion in taxes, and owe about $328 billion in bills, says Brad Plumer at The Washington Post. So at some point in that window, the U.S. will run out of funds.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When that happens, the Treasury won't be able to pay its obligations until Congress raises the debt ceiling. One of the biggest obligations is the interest on all those Treasury bonds, $13 billion of which is due on October 17, and $25 billion of which is due in November. Another huge payment will come on November 1, when the government will owe $58 billion in Social Security, disability benefits, Medicare payments, and more.

What happens if it doesn't pay the bills?

The Treasury, which has an automated computer system that processes about two million bills each day, would likely start bouncing some automated checks, which could quickly trigger defaults.

What happens if the U.S. defaults?

No one really knows, but most economists and analysts agree that a default would be really, really bad. Interest rates will shoot up, and global financial markets, which rely on the security of the U.S. Treasury to operate, will likely go haywire.

Yalman Onaran in Bloomberg suggested it could be like 2008 all over again.

Failure by the world's largest borrower to pay its debt — unprecedented in modern history — will devastate stock markets from Brazil to Zurich, halt a $5 trillion lending mechanism for investors who rely on Treasuries, blow up borrowing costs for billions of people and companies, ravage the dollar and throw the U.S. and world economies into a recession that probably would become a depression. Among the dozens of money managers, economists, bankers, traders, and former government officials interviewed for this story, few view a U.S. default as anything but a financial apocalypse. [Bloomberg]

Possibly the best clue we have about what could happen is the debt ceiling debate of 2011, when just the mere threat of a default caused S&P's ratings agency to downgrade the U.S.'s credit rating, a move that took a noticeable bite out of the economy.

If so much is at stake, why is it so hard to raise?

Since 2011, congressional Republicans have been using the debt ceiling threat as a tool to extract concessions, for measures ranging from budget cuts to a delay in ObamaCare.

Last week, House Speaker John Boehner [R-Ohio] said he won't pass a "clean" debt ceiling bill, meaning some mix of Republican demands — such as delaying a tax on medical devices or cutting entitlement spending — will have to be attached. Meanwhile, Obama has so far refused to negotiate, saying last week that while he's open to talking, "we can't make extortion routine as part of our democracy." At this point, the Senate appears to be the most probable place for a deal to be made.

Can the Treasury just pay the really important debts, like the bond payments for now, and leave the rest for a later date?

That's what's known as "prioritizing," and many conservative have backed it as a stopgap alternative to immediately raising the debt ceiling. However, the Treasury says prioritization is just a pipe dream. "Any plan to prioritize some payments over others is simply default by another name," Treasury Secretary Jack Lew wrote in a letter to Boehner.

Is there an escape hatch out of this one?

Some economists have suggested the Treasury mint a $1 trillion platinum coin — which is technically legal due to a loophole in commemorative coin laws. But White House Press Secretary Jay Carney has said the White House will not pursue that option.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

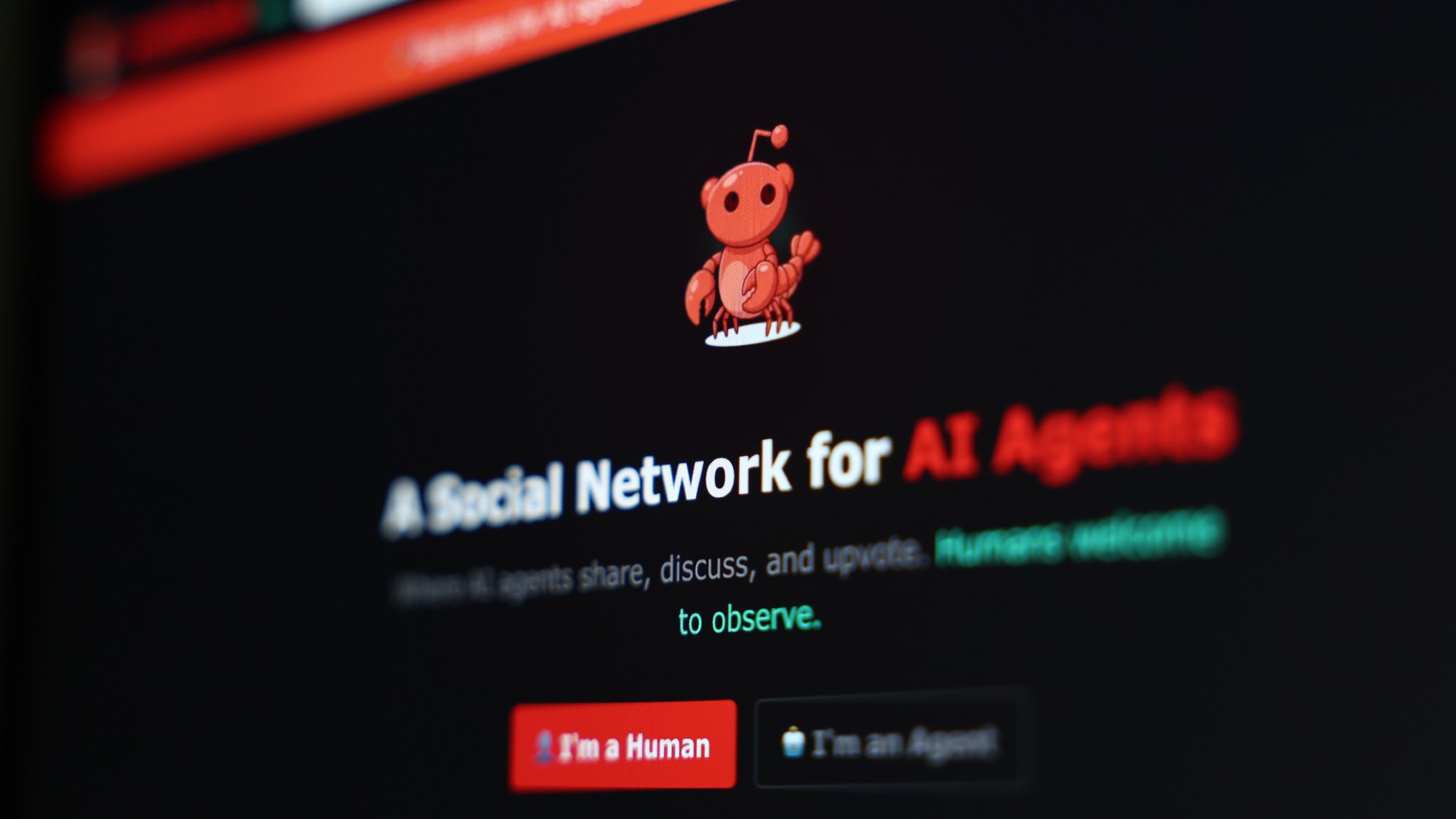

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg