America's greatest export is its debt

Despite awful mismanagement by politicians, U.S. government debt remains the world's savings vehicle of choice

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As an observer from across the Atlantic, I am often perplexed by how much attention is paid to the U.S.'s trade and fiscal deficits. These twin deficits come with a bevy of political baggage in America, but as largely insurmountable issues, they are irrelevant to the far more important debate America should be having about its debt.

The trade deficit is a long-standing problem that is not easily solved: It principally arises from the world's demand for dollars. The U.S. dollar is the world's reserve currency mainly because much of the world's trade is settled in dollars, and all commodities and currencies are priced in relation to dollars. Since the world demand for dollars far exceeds the ability of the U.S. to produce enough goods and services to meet that demand, the U.S. imports far more than it exports.

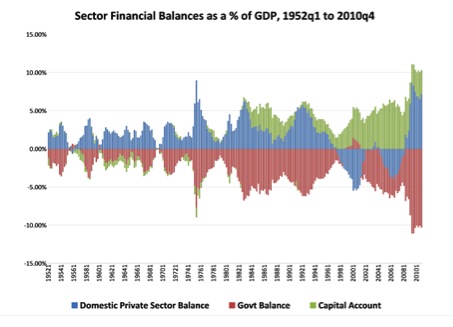

It is often argued that the U.S. could cut its trade deficit by restricting imports and increasing exports. But this would seriously restrict dollar liquidity in the world. Back in the 1960s, Robert Triffin pointed out that the U.S.'s position as provider of liquidity to the world would force it to run substantial trade deficits. He was right. And the existence of such large trade deficits also forces the U.S. government to run fiscal deficits most of the time. The few times in recent years that the U.S. government has managed to run fiscal surpluses, the cost has been a significant reduction in private sector saving:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

(chart from New Economic Perspectives)

Yet we want the private sector to save. We want corporations to have profits. We want households to provide for their futures. We bewail the lack of saving by U.S. households, and we call for more investment by corporations. None of these are compatible with the goal of running fiscal surpluses when there is a trade deficit — and the trade deficit cannot be eliminated without serious damage to the world financial system. Like it or not, the U.S. is stuck with its deficits.

But in fact, the deficits are not nearly as serious a problem as many seem to think. The enormous trade deficit makes the U.S. a massive net importer of capital. And the world loves this. The U.S. government is the market leader in the provision of safe assets to the global financial system. And it is the number one provider of quality investment products for the world's savers. That's where the "glut of capital" that Ben Bernanke talks about comes from. The savings of the world come to America. It is the world's biggest investment fund.

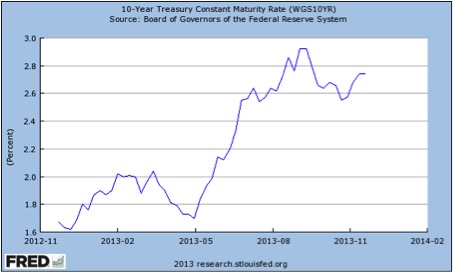

Except that it doesn't behave like it. What investment fund would try to discourage people from investing in it? And what investment fund would set out to destroy its own credibility by undermining the quality of its investments? Yet the U.S. does both of these things. Deficit reduction discourages people from investing. And flirting with debt default undermines its quality. Look what happened to the yields on U.S. debt as the stalemate in Congress over the federal budget intensified through the summer and fall of 2013, finally ending after a two-week shutdown in October:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But the fact is that despite awful mismanagement by U.S. politicians, U.S. government debt remains the savings vehicle of choice for the world. It is America's greatest export.

Embrace your debt, America. You are already the world's central bank: Your destiny is to be the world's savings bank as well. Expand your production to meet the world's demand for quality savings products. Forget this idea that deficits must be eliminated and debt must be reduced. That is not what the world is saying to you. No, the world is saying, "More! Give us more!"

But, of course, you need to take steps to ensure that the savings products you create remain the best in the world. You don't want to compromise your market leading position by cutting corners. Unfortunately, too many people seem to think that cutting corners is the best way of preserving the quality of your products. The Bank for International Settlements, for example, argues that you should always run a fiscal surplus to ensure that you can pay the interest on your savings products. And the IMF talks about achieving "fiscal sustainability" through medium-term fiscal consolidation. This is crazy. You are a bank. Do banks cut back lending in order to pay the interest on savings accounts? Hardly. They invest the money they have borrowed in productive enterprises. The money they make on their investment enables them to pay the interest on their debt, and pay their workforce handsomely, and have large expensive offices in prime locations, and STILL make a profit. You do not need "debt reduction measures." You need to invest what you borrow in productive enterprises.

America, you should spend the money you borrow on things that create real value. Invest in both physical and human capital. Build bridges and roads. Create the best education system in the world. Create the best healthcare system in the world. Develop new ways of capturing and storing the free abundant energy that is available to us from the sun, the wind, and the sea. Invest in technologies that will bring people long life, health, and prosperity.

And above all, think big. Large, long-term projects, the more grandiose the better. This is what we know and love you for — taking on the seemingly impossible and making it happen. Let's have a new space program. Or a deep-sea exploration program — since we know even less about the depths of the ocean than we do about Mars. Create a new Atlantis. Colonize the Moon. Build the Death Star. And establish trade links with Alpha Centauri. For even if none of these things in themselves generate value, the research and development done in the course of them may in the end create greater value than we could possibly imagine.

Frances is the author of the Coppola Comment finance and economics blog, an associate editor at the online magazine Pieria, and a frequent commentator on financial matters for the BBC. Although she originally trained as a musician and singer, Frances worked in banking for 17 years and earned an MBA from Cass Business School in London.