Should you give your kids their inheritance before you die?

They might need it sooner rather than later

While the word "inheritance" typically conjures up images of a will being read after a loved one's passing, Virginia Colin says she doesn't want to wait that long to give money to her children.

"I plan to give my daughter about $20,000 soon — money that might have waited until I died, but I think now is a better time," says Colin, age 63. The money, she says, will go toward the down payment on a home for her daughter's growing family.

Colin says the experience of losing her own mom to Alzheimer's led her to think twice about how she wanted to handle her own estate planning.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"My mom died in her 70s, and I got a nice inheritance from her," says Colin, "but by then I didn't need the money anymore, because I was remarried to a guy who earned a nice living."

Colin says she would have really appreciated having the money earlier on in life, when she was struggling to support her children as a single mother. The experience, she says, has shaped her and her husband's decisions when it comes to leaving her children their inheritance.

A recent study from U.S. Trust shows that the majority of wealthy individuals feel it's important to leave an inheritance of some kind. In fact, 64 percent of those ages 49 to 67, and 72 percent of those 68 and older say they want to leave the next generation money. And at the same time, more than half say they have provided or are providing significant financial support to adult children — just like Colin plans to do.

Leaving money to family earlier than expected isn't uncommon. But is it for you?

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Who is giving early inheritances?

Estate planning attorney Kelly Gill, a partner at Boston-based firm Belcher Fitzgerald, LLP, says Colin's desire to give to her family now — rather than wait until her death — is increasingly common.

"The stock market is coming back up, and the federal government has cleared up uncertainties regarding federal estate taxes, so it's encouraged more gifting," says Gill.

She says the recession that began in 2008 caused a temporary slowdown in early inheritances, as even the very wealthy grew concerned about their shrinking portfolios. But as the economy gains steam, wealthy, aging boomers are once again considering the best way to pass on money to their loved ones.

"The big trend I'm seeing now is grandparents paying for large family trips with children and grandchildren," says Gill. "They want to enjoy their money now with their family, and they realize their children may not have the cash flow to take the 10-day cruise and go skiing as well," she explains. "So they're choosing to enjoy the funds now, with their family." While a trip to Tahiti may not seem like a traditional inheritance, Gill says travel is one option many consider when viewing their estate-planning options.

Another major trend among her clients is paying for their grandchildren's educations. "You can pay colleges directly," explains Gill, "without incurring the gifting tax, which taxes gifts greater than $14,000."

For those with grandchildren still too young for college, Gill says clients are opting to fund 529 accounts, which are used to pay for higher education. "You're allowed to front-load a 529 account for up to five years. So each grandparent can deposit five times the gifting limit (five times $14,000) all at once," she says.

If there are no specific big-ticket costs on the horizon, Gill says many clients will set up and fund trusts in the name of loved ones. This option can give you some measure of control over how the money is used: If you're concerned about the spending habits of your kids, or want the money to be used in a certain way, Gill says you can create restrictions for the use of the trust — although, of course, it's not always necessary.

Should you give now or later?

Though it may seem merely like a matter of preference, there are both financial and emotional pros and cons to early inheritances. Here, Gill shares both the good and bad when it comes to passing on money to your family while you're still around to enjoy the experience.

Why you should give early…

1. There may be tax benefits

For extremely wealthy individuals (those who pass away with estates greater than $5.25 million), there's an obvious upside to giving early: If they don't, they will get hit with an estate tax of 40 percent. For people in this camp, Gill says early inheritances are a great tool for shrinking an estate to avoid this tax, and to make sure that more of your money actually reaches your loved ones, instead of going to the government in the form of taxes.

Gill also says if you have assets that may appreciate very rapidly before your death (like property in an up-and-coming neighborhood or a hot stock), there can be tax benefits to giving those assets now, rather than letting your children inherit them after your passing. This way, they're taxed as a smaller gift, rather than as a larger gift later on.

2. You get to see it

If you know that your own retirement is well in hand, there can be joy in giving to your loved ones while you're able to witness the fruits of your labor.

Be it bringing together the family for an over-the-top vacation, putting down the down payments for your children's first homes or telling your grandkids they don't need to worry about college, many want to feel the satisfaction that comes with spending your hard-earned money on a good cause.

"I'll be helping them when they most need it," says Colin, of giving her daughter and her husband help with their new home. "It's a big gift at a good time."

… and why you shouldn't

1. You could come up short later

Wanting to help your loved ones is natural. But unless your own retirement and long-term care are healthily funded and planned, giving a gift now means you may come up short later on — which helps neither you nor your beneficiaries. Make sure your own financial needs are 100 percent taken care of before considering giving an early inheritance. It's just like they say on airplanes: Secure your own safety before helping others.

Additionally, you'll want to discuss any major gifts with a financial professional to make sure you won't be shelling out more than you'd planned by incurring major tax bills you could have easily avoided. (For instance, keep in mind that if you give gifts like cash, stocks or property worth more than $14,000 to any one individual within a one-year period, it will be taxed. That said, if you have multiple children or grandchildren, you can make multiple gifts worth up to $14,000 to each of them, every year, without getting taxed.)

2. Early giving can spur family drama

Everyone knows that mixing family and money can cause some pretty major blowouts. One downside to early giving is that it may cause resentment among loved ones who aren't (or feel they aren't) the recipients of your generosity.

For most families, Gill recommends bringing everyone together and having your attorney explain your intentions.

She often sees issues arise in families where one child is in line to take over the family business, while the siblings pursue their own, unrelated career paths. To try and mitigate any ill will, Gill says she helps families try to equalize their giving by, for instance, giving a smaller share of assets to the child who's already inheriting the business.

If you're in a complicated family situation, and you aren't prepared to deal with the fallout, you may even want to reconsider your early inheritance plan.

The bottom line: Like most financial choices, giving an early inheritance isn't always the right move. If it's on your mind (or even if it isn't), it's important to consult a financial professional to help you decide which option can best help you provide for your loved ones without compromising your own financial health.

More from LearnVest...

-

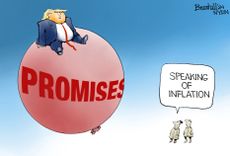

Today's political cartoons - December 14, 2024

Today's political cartoons - December 14, 2024Cartoons Saturday's cartoons - runaway inflation, eau de Trump, and more

By The Week US Published

-

5 bitingly funny cartoons about Bashar al-Assad in Moscow

5 bitingly funny cartoons about Bashar al-Assad in MoscowCartoons Artists take on unwelcome guests, home comforts, and more

By The Week US Published

-

The best books about money and business

The best books about money and businessThe Week Recommends Featuring works by Michael Morris, Alan Edwards, Andrew Leigh and others.

By The Week UK Published