Will cutting 30,000 jobs save Bank of America?

The struggling banking giant tries to save $5 billion a year by laying off 10 percent of its staff

Bank of America, the nation's largest lender, announced on Monday that it will cut 30,000 jobs — 10 percent of its workforce — over the next few years. The layoffs should save the company $5 billion annually by 2014, as the massive bank trims its consumer, small-business, credit card, and other operations to focus on international and corporate lending. The news boosted Bank of America's battered stock, but BofA is still facing billions in damages from its purchase of Countrywide Financial and all its toxic loans. Will the job cuts put Bank of America back on track?

This is a necessary first step: This "is a fairly significant downsizing," says Bert Ely at PBS. But it will take a lot more than this to fix things. Bank of America has the same problems as the rest of the industry — declining revenue and bloated expenses. The big difference is that compared to other banks, BofA has "those problems in spades." Bank of America can survive, but "it's going to be a long, hard slog."

"Amid major job cuts, is Bank of America 'too big to manage'?"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Bank of America should fix its legal problems first: This streamlining "may be for naught," says William Alden at The Huffington Post. Bank of America is facing massive lawsuits — insurer AIG alone is demanding $10 billion for losses on mortgage-based securities — and the savings from job cuts could be erased by a single defeat in court.

"Bank Of America job cuts fail to address looming legal costs, experts say"

This won't solve the real problem — excessive government regulation: It's a no-brainer that Bank of America, and every other bank, "needed to shrink after the bubble years of easy money," says The Wall Street Journal in an editorial. But the thing that made such a massive layoff necessary was punishing overregulation. Last year's Dodd-Frank financial law, for example, limited the "swipe fees" banks can charge merchants when customers use debit cards. That cut into banks' profits, and now 30,000 workers are paying the price.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

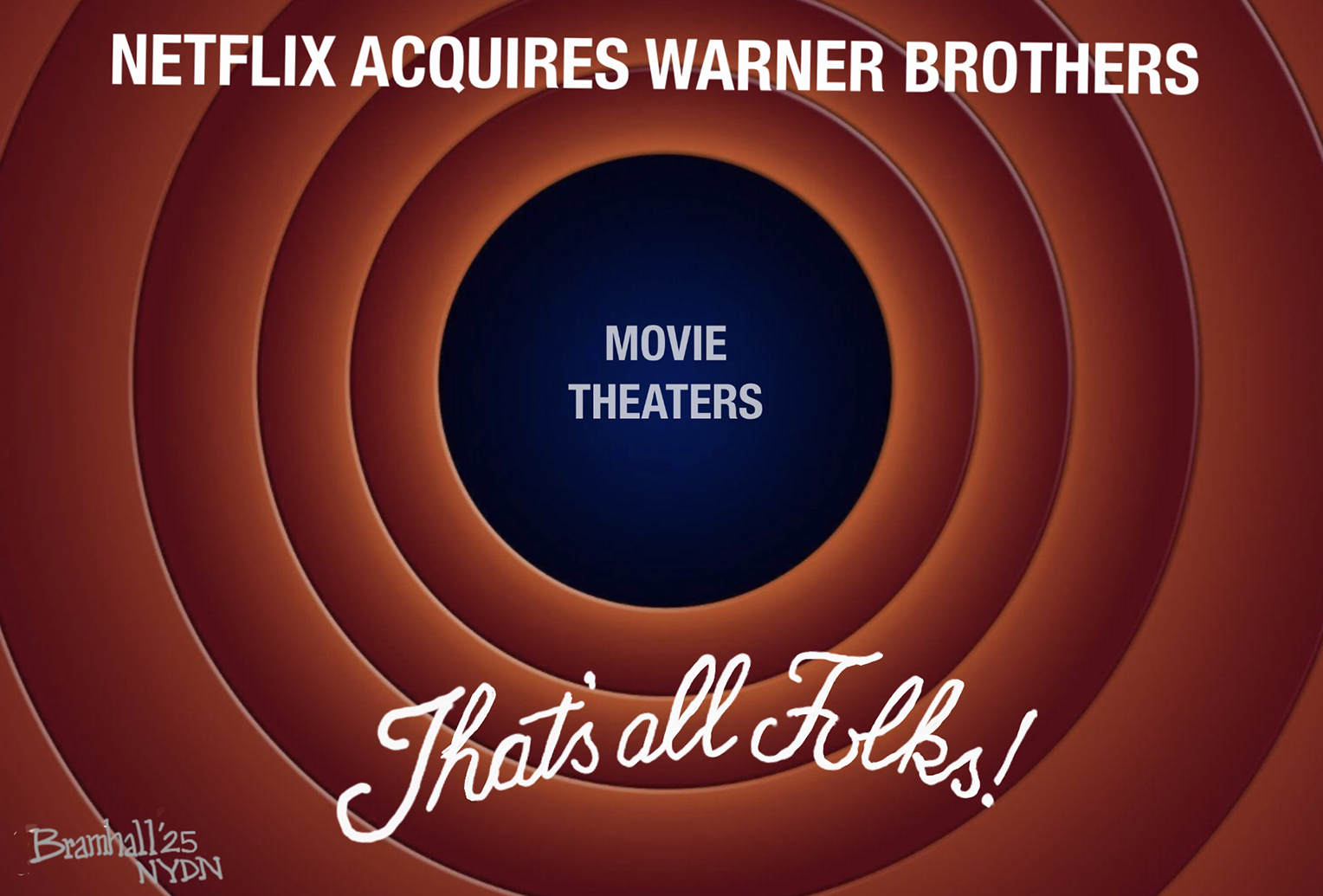

5 loony toons about the Warner Bros. buyout

5 loony toons about the Warner Bros. buyoutCartoons Artists take on movie theaters, high quality cinema, and more

-

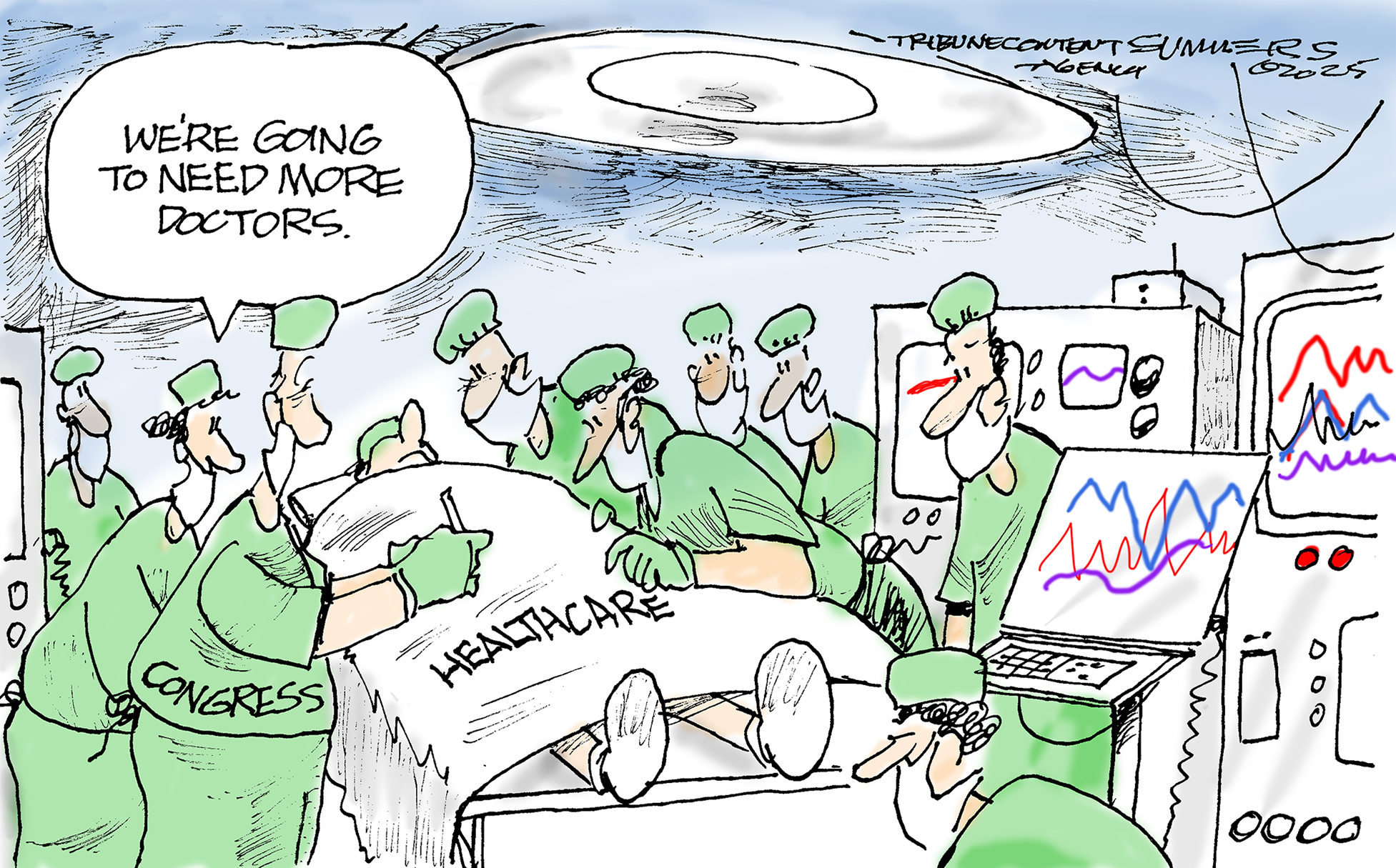

Political cartoons for December 13

Political cartoons for December 13Cartoons Saturday's political cartoons include saving healthcare, the affordability crisis, and more

-

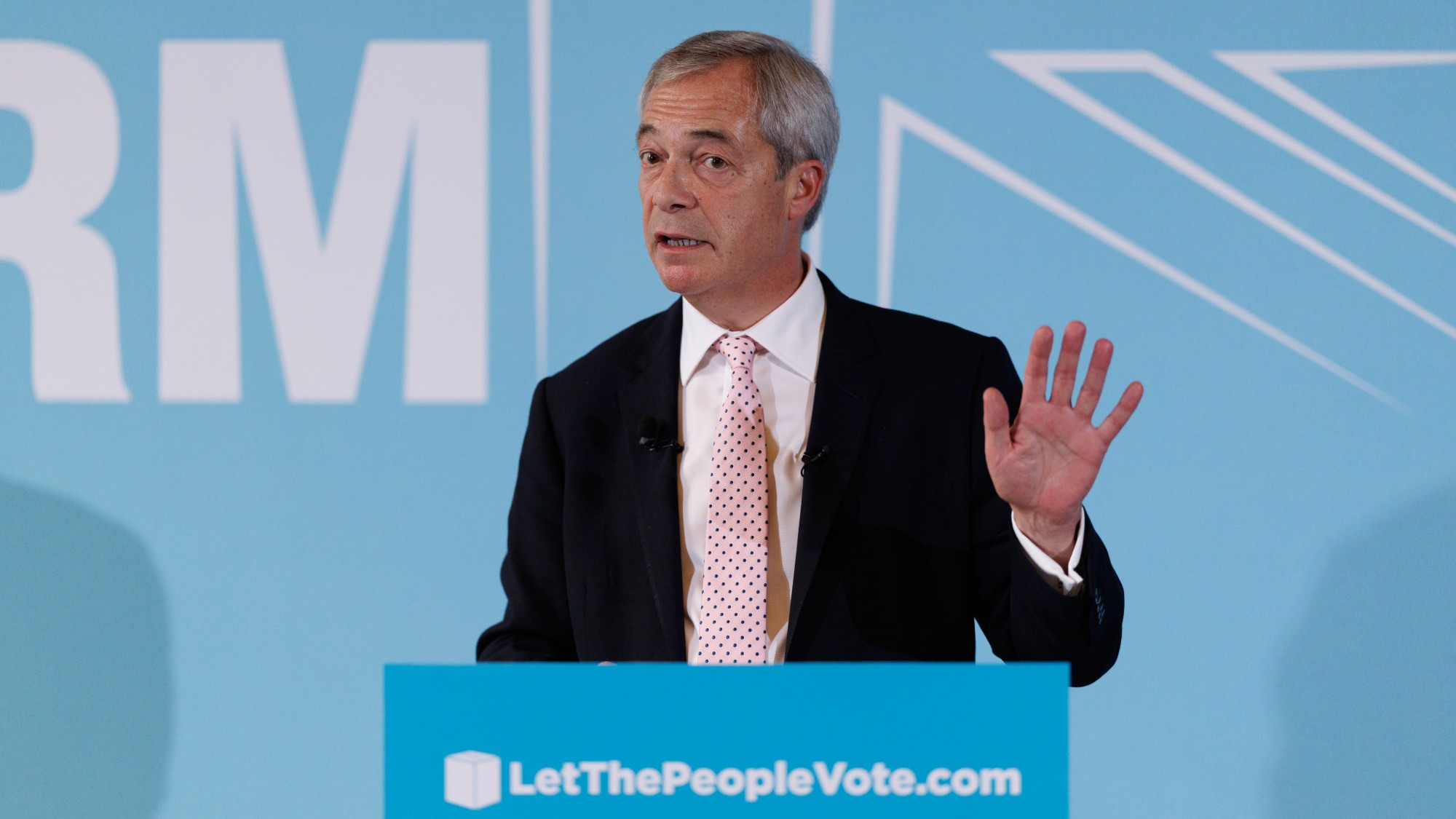

Farage’s £9m windfall: will it smooth his path to power?

Farage’s £9m windfall: will it smooth his path to power?In Depth The record donation has come amidst rumours of collaboration with the Conservatives and allegations of racism in Farage's school days