Will Obama's tax deal boost the economy?

The president and GOP leaders have a deal to extend the Bush tax cuts. But will their compromise help create jobs and spur spending?

On Monday evening, President Obama announced the outline for a tax compromise with Republicans: All of the Bush era tax cuts will be extended for two years, unemployment benefits get a 13-month extension, workers will get a year-long break on payroll taxes, and the estate tax will be re-instituted at 35 percent for fortunes over $5 million. The deal has met resistance from both the Left and the Right. If it is enacted, will it do anything to boost the economy? (Watch an MSNBC discussion about the tax cuts and jobs creation)

The deal will help... a bit: The Bush tax cuts were mostly an economic failure, says Christopher Beam in Slate. Extending them for two years, though, "will help the economy — but just barely" — "taxes don't affect the overall economy much," period. Any real boost will come from the more stimulative tax breaks Obama negotiated, especially lowering payroll taxes and extending jobless benefits.

"Here's the deal"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is a step backward: Nothing in this deal "will get us out of a recession," says Jimmie Bise, Jr. in The Sundries Shack. Continuing the Bush cuts for only two years still leaves uncertainty for companies, and Obama's additions to the deal will make things worse: Extending jobless benefits will raise costs for states and small businesses. "Turning this economy around" should be Republicans' top priority, but the GOP just got "suckered."

"The GOP's tax deal isn't a very good deal for us or the economy"

The benefits will mostly be psychological: Republicans got the better end of the deal, but both parties got tax cuts they want, says Felix Salmon in Reuters. This "Oprah-style" tax deal — "You get a tax cut! And you get a tax cut! And you!" — is bad policy, "but hey, nearly all of us will end up with extra cash for the next couple of years. Which will make us a bit happier, even if it does little good from a fiscal perspective."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

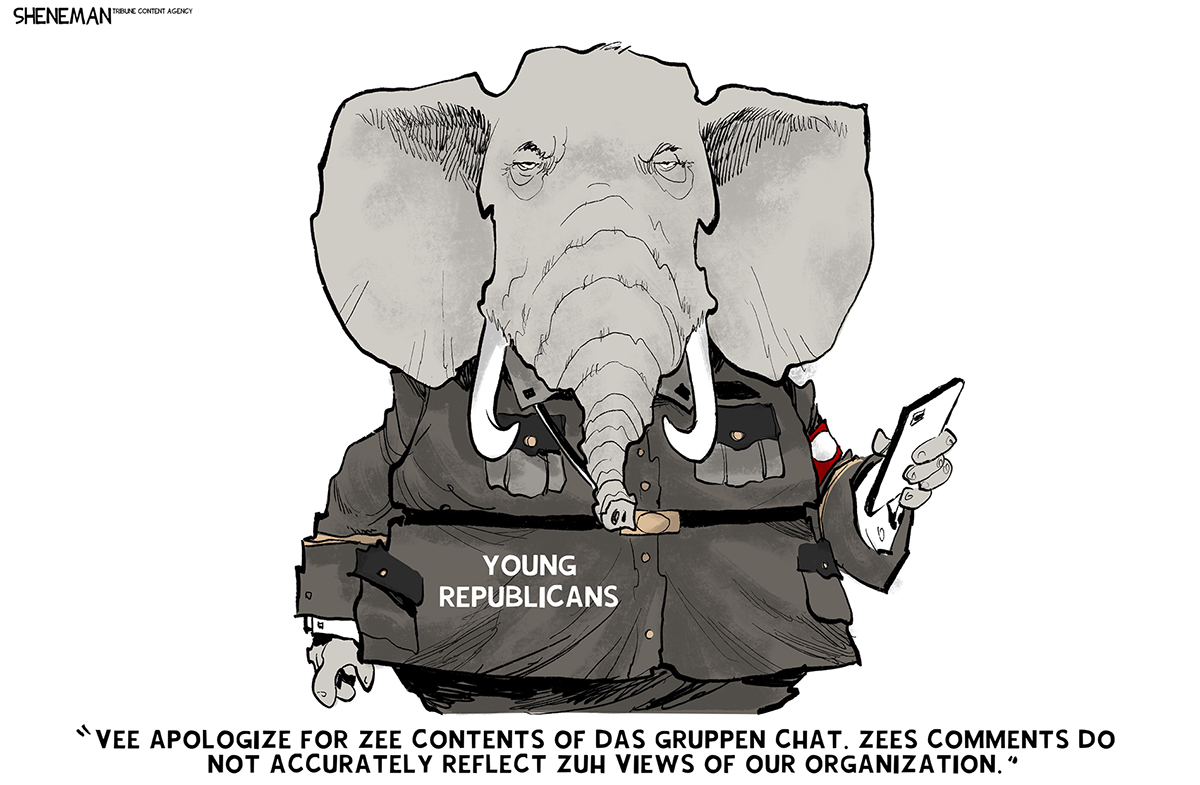

Political cartoons for October 26

Political cartoons for October 26Cartoons Sunday’s editorial cartoons include Young Republicans group chat, Louvre robbery, and more

-

Why Britain is struggling to stop the ransomware cyberattacks

Why Britain is struggling to stop the ransomware cyberattacksThe Explainer New business models have greatly lowered barriers to entry for criminal hackers

-

Greene’s rebellion: a Maga hardliner turns against Trump

Greene’s rebellion: a Maga hardliner turns against TrumpIn the Spotlight The Georgia congresswoman’s independent streak has ‘not gone unnoticed’ by the president