Best Columns: Emerging myths, 401(k) fouls

Emerging markets are popular because

Fast growth, low return

Emerging markets are popular with investors because “faster economic growth means higher returns,” says The Economist in an editorial. Only it doesn’t. According to a London School of Economics study of 17 countries, the economies with the slowest GDP growth “returned 8 percent a year,” while the fastest-growing ones returned only 5 percent. Other studies have found similar but wider disparities. “Why should this be?” In emerging markets, investors benefit if capital is reinvested in growing publicly traded companies, but many times it’s put instead into “unquoted” firms or state-run companies. This isn’t to “deny the importance of emerging economies.” It’s just to deny their greater profitability for investors.

401(k) follies and foibles

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The world of the 401(k) plan “is far from ideal,” says Andrea Coombs in MarketWatch, and a study of almost a million workers illustrates the risks many Americans take with their nest eggs. One of the big “red flags” is that a quarter of workers 60 and older held more than half of their retirement account in their company’s stock. Investing primarily in just one company, or asset class, can have “dire consequences for retirement savers,” including lower returns and higher risks. Many investors also don’t take full advantage of matching retirement contributions, which is like turning down “free money.” Workers in lower income brackets made more investing mistakes, the study found, but “they weren’t alone.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

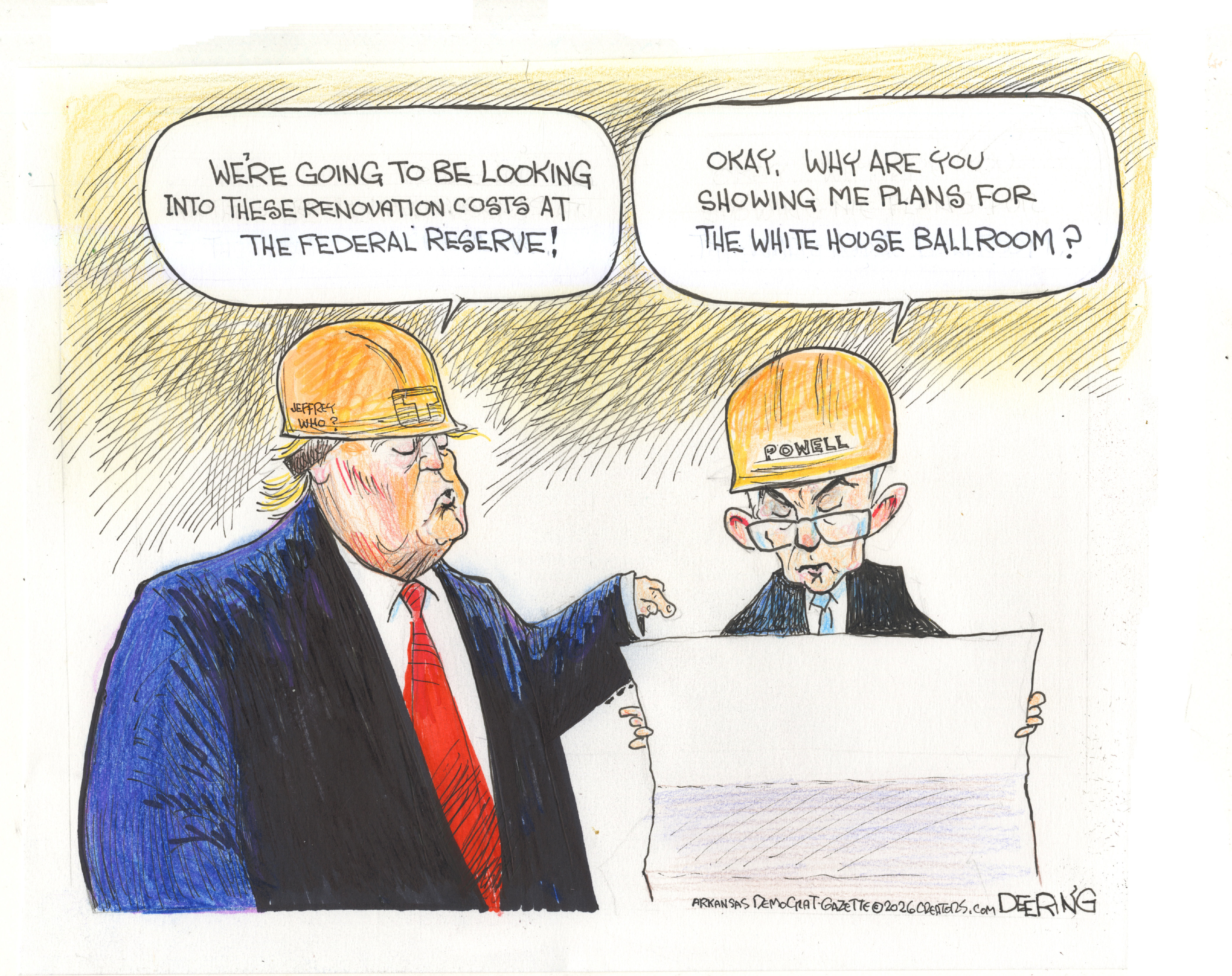

Political cartoons for January 17

Political cartoons for January 17Cartoons Saturday’s political cartoons include hard hats, compliance, and more

-

Ultimate pasta alla Norma

Ultimate pasta alla NormaThe Week Recommends White miso and eggplant enrich the flavour of this classic pasta dish

-

Death in Minneapolis: a shooting dividing the US

Death in Minneapolis: a shooting dividing the USIn the Spotlight Federal response to Renee Good’s shooting suggest priority is ‘vilifying Trump’s perceived enemies rather than informing the public’