Best Business Commentary

If “you don’t quite understand this whole financial crisis,” don’t “feel sheepish,” says David Leonhardt in The New York Times. The collapse of Carlyle Capital and Bear Stearns has all the makings of a “modern-day Greek tragedy,” says Loretta Napoleoni in

Cliff’s Notes for the crisis

If “you don’t quite understand this whole financial crisis,” don’t “feel sheepish,” says David Leonhardt in The New York Times. Unfortunately, “many people who are in the middle of the crisis” don’t either. Here’s a stab, though: Starting in 1998, people began buying U.S. houses; Wall Street found a way to make the mortgage business “a global one,” bringing in investors worldwide; seeking higher profits, banks “goosed their returns” through leverage and subprime loans; and low interest rates fed a bubble where banks and homeowners made risky bets on ever-rising prices. Well, “bubbles lead to busts,” and “busts lead to panics.” But so does “uncertainty,” so maybe the panic is “partly unfounded.”

Crisis as Greek tragedy

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The collapse of Carlyle Capital and Bear Stearns has all the makings of a “modern-day Greek tragedy,” says Loretta Napoleoni in the Chicago Tribune. The “roots of all tragedies” for the Greeks lie “in men’s uncontrollable passions,” and for Bear Stearns and Carlyle Capital the fatal flaws were “greed” and hubris. Believing they were “omnipotent” gods, they haughtily passed on the “chance to avoid disaster” when their subprime “house of cards” started shaking. The Federal Reserve and JPMorgan are trying to play the part of the “deus ex machina,” rescuing Bear “against all odds.” But at this point, even the “chorus” in the markets knows the “script.” And the script is a tragedy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

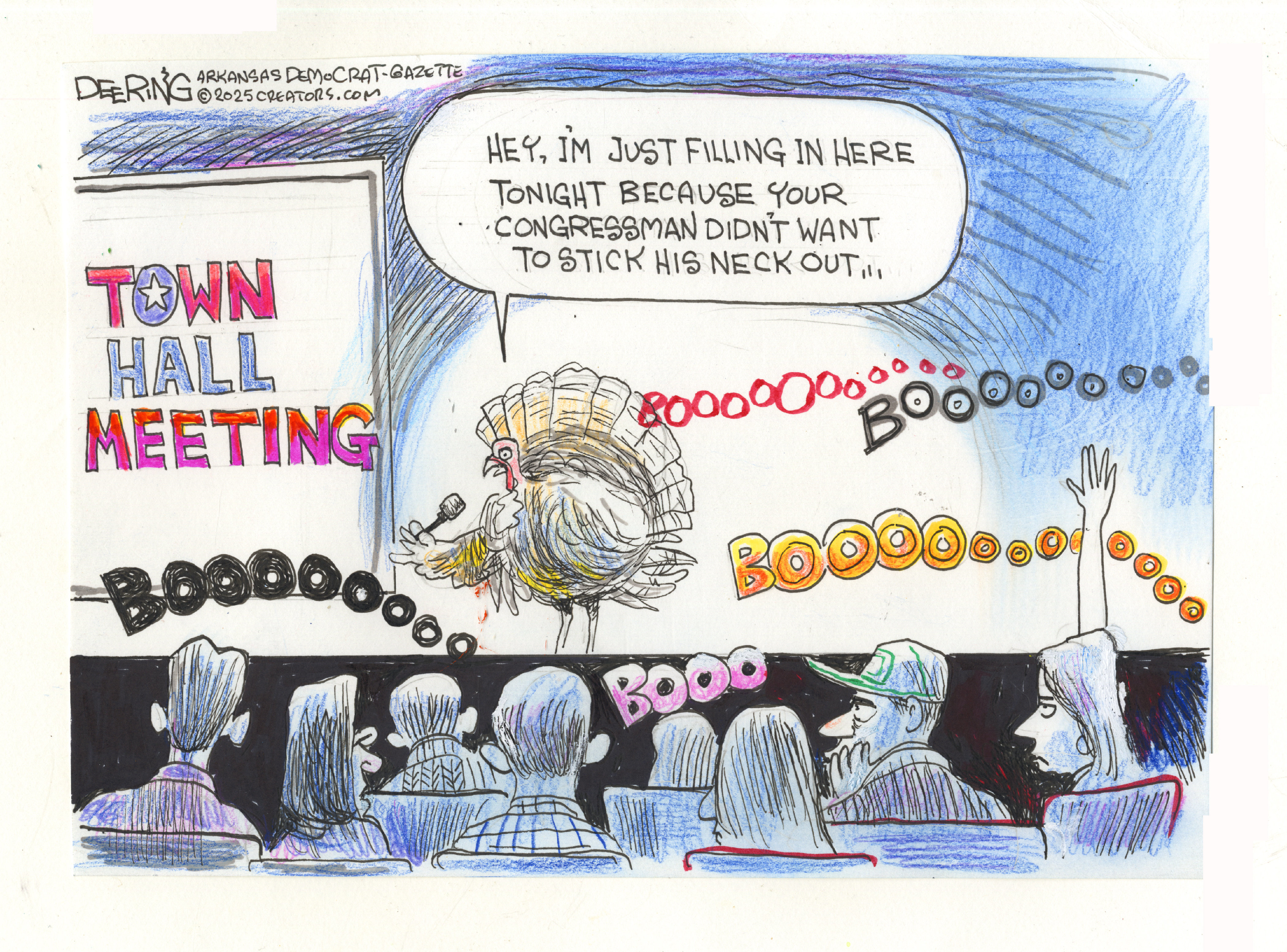

Political cartoons for November 15

Political cartoons for November 15Cartoons Saturday's political cartoons include cowardly congressmen, a Macy's parade monster, and more

-

Massacre in the favela: Rio’s police take on the gangs

Massacre in the favela: Rio’s police take on the gangsIn the Spotlight The ‘defence operation’ killed 132 suspected gang members, but could spark ‘more hatred and revenge’

-

The John Lewis ad: touching, or just weird?

The John Lewis ad: touching, or just weird?Talking Point This year’s festive offering is full of 1990s nostalgia – but are hedonistic raves really the spirit of Christmas?