Why Bear Stearns collapsed

Bear Stearns was purchased by rival J.P. Morgan Chase for a fraction of its former worth, said Megan McArdle in an Atlantic blog, and the

What happened

Bear Stearns, the fifth-largest U.S. investment bank, was purchased by rival J.P. Morgan Chase for about $236 million, or $2 a share, after being bailed out by the federal government on Friday. Bear Stearns had a market value of $3.5 billion on Friday, and $20 billion in January 2007. The Federal Reserve is guaranteeing $30 billion in the bank’s “less-liquid assets”—mostly mortgage-backed securities that Bear can’t sell. “At the end of the day, what Bear Stearns was looking at was either taking $2 a share or going bust,” said one unidentified person involved in the deal. (The Wall Street Journal)

What the commentators said

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Less than ten days from rumor to ruin,” said Megan McArdle in The Atlantic’s Current blog. The “terrifying speed of Bear’s collapse” has stunned everyone. Bear Stearns was hit hardest by the subprime crisis, and “speculation about its balance sheet has been floating for months.” After rumors started spreading that other financial institutions were getting skittish about doing business with Bear, it was over. In finance, “if no one will loan you money or trade with you because your firm might go under, your firm will go under.”

Bear Stearns will blame its implosion on everyone but the “one party to blame: Bear Stearns management,” said Henry Blodgett in Silicon Alley Insider. “Give me a break.” The “first responsibility” of any brokerage firm is to retain the confidence of their short-term lenders, at all cost, and running “hat in hand to the Fed” doesn't cut it. The party now shoring up confidence in whatever junk Bear Stearns has “piled onto its beleaguered balance sheet” is, ultimately, “you.”

This all started when “Bear Stearns bet too heavily in the mortgage debt market,” said USA Today in an editorial. Bear put “itself behind too many mortgage-backed portfolios,” and failed to grasp the risks involved in them. “In so doing, it helped inflate a housing bubble, driven in part by the proliferation of wildly inappropriate subprime mortgages.” Bear executives got huge bonuses for inflating profits, and now we’re all going to pay.

And it’s going to be a doozy of a bill, said Paul Krugman in The New York Times (free registration). The federal bailout of the savings and loan crisis in the 1980s cost taxpayers “the equivalent of $450 billion today.” J.P. Morgan buying Bear is “an OK resolution” for this particular crisis, but we’re in “an unholy financial mess that will cause trillions of dollars in losses,” and a “big bailout is coming.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Well, “you can’t really call this a bailout of Bear,” said Justin Fox in Time’s Curious Capitalist blog. It’s more like “an extremely sweet deal” for J.P. Morgan. Bear Stears’ midtown Manhattan headquarters alone is worth $1.2 billion. The $2 a share price is mostly a “token incentive” to win support from Bear Stearns’ shareholders, who were “virtually wiped out” in the meltdown—$2 is better than “nothing.” The Fed has its reasons for handing Bear to J.P. Morgan “on a platter,” but if we “didn’t know better,” we “might be tempted” to call it “crony capitalism.”

-

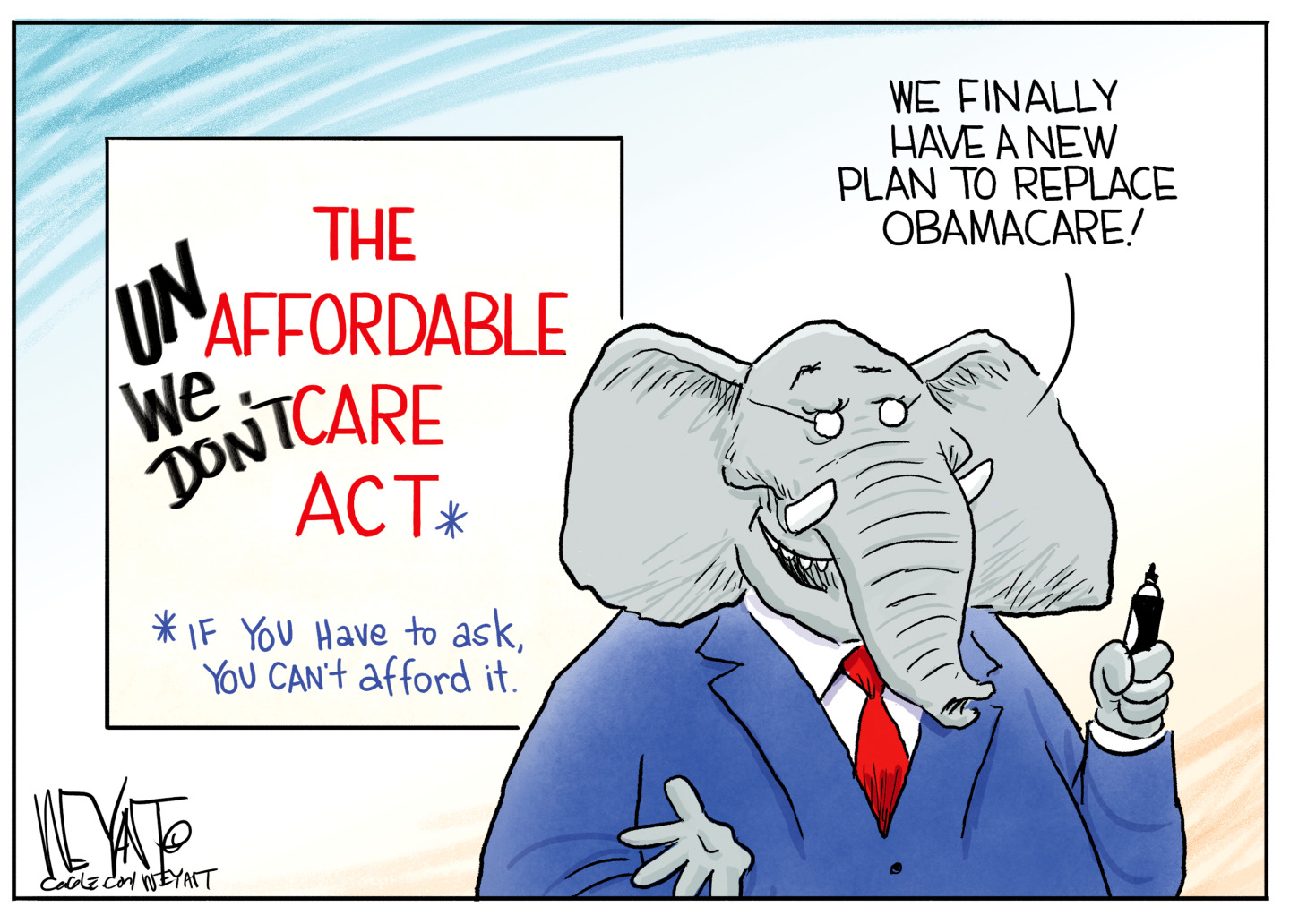

Political cartoons for December 17

Political cartoons for December 17Cartoons Wednesday's political cartoons include healthcare costs, the affordability hoax, giving up pencils, and more

-

Trump vs. BBC: what’s at stake?

Trump vs. BBC: what’s at stake?The Explainer The US president has filed a $10 billion lawsuit over the editing of Panorama documentary, with the broadcaster vowing to defend itself

-

Animal Farm: has Andy Serkis made a pig’s ear of Orwell?

Animal Farm: has Andy Serkis made a pig’s ear of Orwell?Talking Point Animated adaptation of classic dystopian novella is light on political allegory and heavy on lowbrow gags