How they see us

Why does a dollar buy more than a loonie?

Why does a dollar buy more than a loonie?

The party is already over, said the Red Deer, Alberta, Advocate in an editorial. Canadians threw “a little joyfest” last week to celebrate our currency’s newfound parity with the U.S. dollar. It was, after all, the first time in decades that the Canadian dollar, known affectionately as the “loonie” because of the loon pictured on the coin, traded even with the U.S. dollar on international currency markets. Suddenly, we could take our loonies south, where a pair of Rockport shoes that retails at $150 Canadian costs just $50 in greenbacks. The country went on a weekend buying spree. But our elation soon deflated. Why, we wondered, must we have to drive south to get the savings? Economists began analyzing pricing of imports, and it turns out that, even when you account for currency differences, “we’ve been paying an average of 24 percent more for a large basket of consumer items than Americans have for the same items.”

Canadians are “being ripped off royally,” said Doug Millroy in the Sault Ste. Marie, Ontario, Star. When the loonie is equal to the dollar, it is not merely annoying that there is still such a disparity in the prices north and south of the border. It is “downright wrong.” A typical hardcover book sold in Canada has the two prices right there on the jacket: $26.95 U.S. and $39.95 Canadian. That’s about 50 percent higher. “I don’t think the difference in the two dollars was ever that great.” And when you’re buying something expensive, like a car, the disparity becomes downright painful. The worst part is, it’s not the Canadian dealer or retailer who pockets the differences. It’s the U.S. wholesaler who charges a Canadian dealer more, simply because he can.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Calm down, said Alan Caplan in The Edmonton Sun. We may be paying a bit more for our imports, but the discrepancy is not as large as it seems. The fact is, the currency markets have pushed up the loonie not because traders are feeling optimistic about the Canadian economy, but because they are panicking about the American economy. The “imploding real estate market and the accompanying credit crunch in the U.S.” have persuaded traders that “the American buck is not a good place to be.” That’s why the price disparity that has many Canadians in a dither is really not unfair. It reflects the sad truth that “our dollar should actually be worth about $0.85 U.S. when reality retakes the marketplace.”

The worst may be yet to come, said Colin Campbell and Jason Kirby in the Canadian magazine Macleans. Americans are the biggest consumers of Canadian products, with more than 75 percent of Canadian exports going to the States. All signs indicate that the U.S. is heading for “a major recession,” and that means Canada will suffer. And not only Canada. “In the era of globalized trade, any serious downturn will spread around the world like an economic wildfire.” If that happens, we’ll wish our biggest problem were paying a few more loonies for a book.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

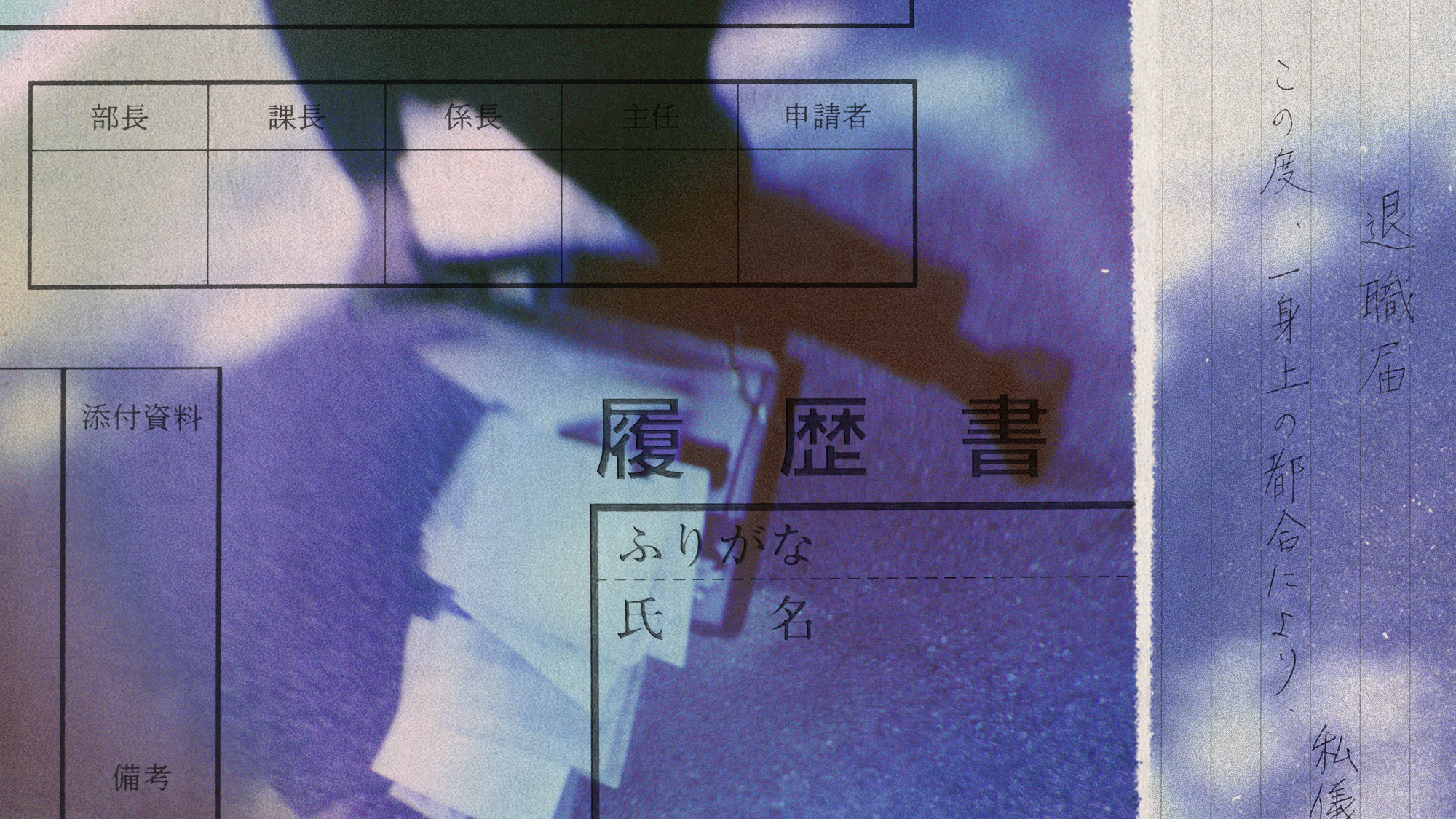

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Gavin Newsom and Dr. Oz feud over fraud allegations

Gavin Newsom and Dr. Oz feud over fraud allegationsIn the Spotlight Newsom called Oz’s behavior ‘baseless and racist’

-

‘Admin night’: the TikTok trend turning paperwork into a party

‘Admin night’: the TikTok trend turning paperwork into a partyThe Explainer Grab your friends and make a night of tackling the most boring tasks

-

No equipment for Afghanistan

feature The U.S. has reportedly decided to hand over to Pakistan some $7 billion worth of American military hardware currently in Afghanistan.

-

How they see us: Crudely insulting our allies

feature Well, at least we know now what the Americans really think of us.

-

Spied-upon Germans are not mollified

feature In the wake of revelations last year about the NSA's spying activities, relations between Germany and the U.S. have been at an all-time low.

-

Is a deal with the U.S. in Iran’s interest?

feature The “unprecedented enthusiasm” of Western diplomats after the talks in Geneva suggests they received unexpected concessions from the Iranians.

-

How they see us: Sowing chaos in Libya

feature The kidnapping of Abu Anas al-Libi is an outrage committed against Libyan sovereignty—and it will have repercussions.

-

Europe is complicit in spying

feature It’s not just the Americans who have developed a gigantic spying apparatus.

-

Protecting Snowden

feature American whistle-blower Edward Snowden has proved a master spy with his “meticulously timed operation.”

-

Listening in on Europeans

feature Europeans are apoplectic over the U.S. National Security Agency's massive PRISM surveillance program.