Millions facing financial difficulty after missing bill payments

Major study says 4.1 million consumers have failed to pay domestic or credit bills in last six months

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Millions of people are facing financial difficulty due to unpaid domestic or credit bills, a major new study has found.

The Financial Conduct Authority (FCA), which surveyed 13,000 people, found that 4.1 million, most aged between 25 and 34, have failed to pay a bill over the past six months.

The financial regulator also warns 25.6 million consumers could be vulnerable to financial harm, meaning they lack internet access or an overdraft, so their finances would be at an increased risk if something went wrong.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Financial Lives research, the first of its kind from the FCA, also concluded 15 million had a “low level of resilience” to bill shock, eight million were struggling with debt and 100,000 had used an illegal money lender in the past year.

With the Bank of England set to raise interest rates, there was also a warning for those on the property ladder: one in six of those with a mortgage or renting said they would struggle if monthly payments rose by less than £50.

Rent, car loans, mortgages, credit cards, pay day loans, unsecured credit, overdrafts – “when it comes to the build up of debt, this is a classic story of supply and demand”, says BBC Economics Editor Kamal Ahmed.

“The digitisation of financial products - making many loans little more than a mobile phone swipe away - has meant that supply has become broader and easier,” he adds, “[and] historically low interest rates have also made products cheaper, meaning that taking on debt appears to be low cost, in the short term at least.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The findings also highlighted the worrying burden of debt being assumed by young adults.

-

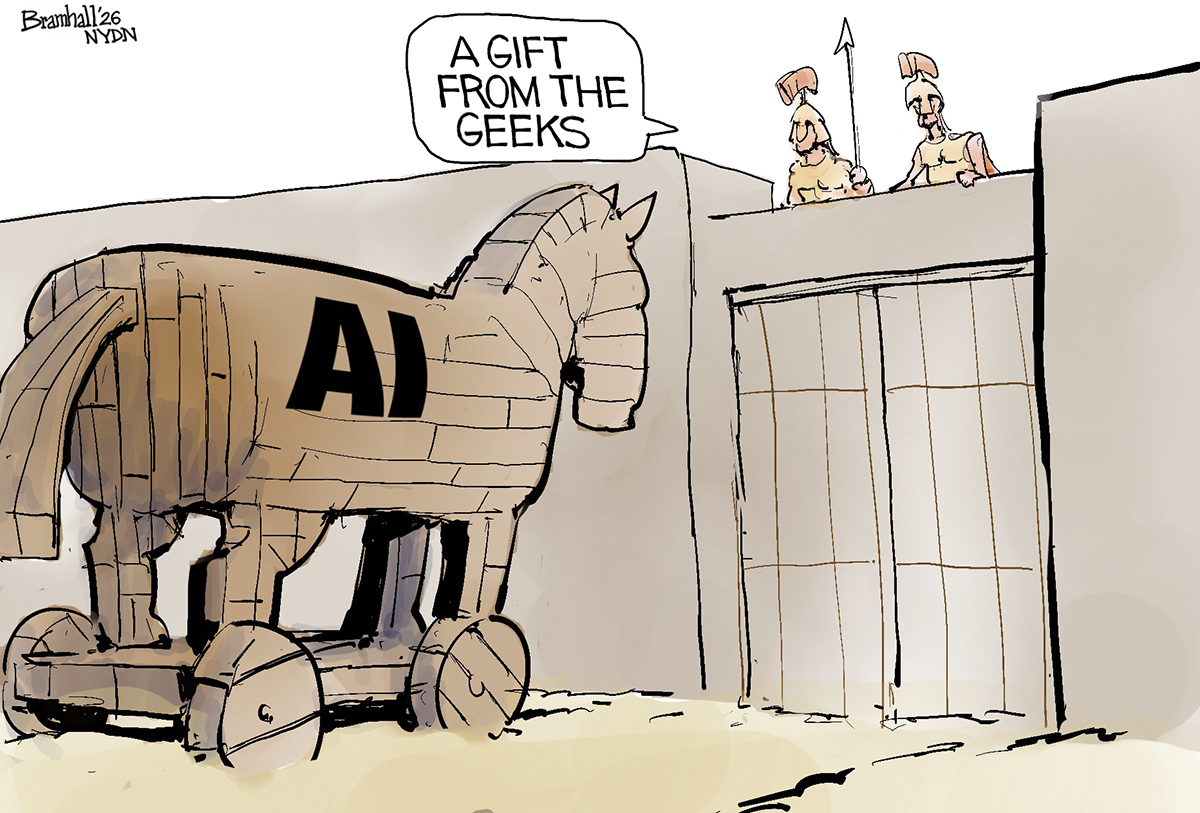

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Brits keeping 21 million ‘money secrets’ from friends and family, survey reveals

Brits keeping 21 million ‘money secrets’ from friends and family, survey revealsSpeed Read Four in ten people admit staying quiet or telling fibs about debts or savings

-

London renters swap cramped flats for space in suburbia

London renters swap cramped flats for space in suburbiaSpeed Read New figures show tenants are leaving Britain's cities and looking to upsize

-

Should the mortgage holiday scheme have been extended?

Should the mortgage holiday scheme have been extended?Speed Read Banks warn that some homeowners may struggle to repay additional debt

-

RBS offers coronavirus mortgage holidays

RBS offers coronavirus mortgage holidaysSpeed Read Taxpayer-owned bank follows measures taken in virus-struck Italy

-

What are the changes to National Savings payouts?

What are the changes to National Savings payouts?Speed Read National Savings & Investments cuts dividends and prizes for bonds

-

China clears path to new digital currency

China clears path to new digital currencySpeed Read Unlike other cryptocurrencies, Beijing’s would increase central control of the financial system

-

Why are donations surging to the RNLI?

Why are donations surging to the RNLI?Speed Read Charity enjoys flood of funding after criticism for overseas work

-

PPI deadline day: how to claim

PPI deadline day: how to claimSpeed Read Final chance for consumers to apply for compensation