How to cut your monthly spending by $800

No matter how little breathing room you think you have, there's almost always a way to adjust your budget

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Freeing up extra cash when you're dealing with a tight budget or heavy debt can seem next to impossible. By the time you're done paying all of your bills, buying groceries, and filling up an empty tank, saving can feel like a pipe dream.

But no matter how little breathing room you think you have, there's almost always a way to adjust your budget, so you can set aside something — and no amount is too small, says David Blaylock, a CFP® with LearnVest Planning Services.

"When you're not earning a lot of money, it can be tempting to avoid setting ambitious savings goals," Blaylock says. "However, I like to tell my clients — people in all income brackets — that the same problems and challenges will exist no matter how many zeros factor into your annual salary."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But the good news is that once you discover that it is possible to find areas where you can cut back, "it can help you get more ambitious with your savings than you initially thought," he adds.

That's what Paul Wolford, 27, and his wife Betsie, 25, are hoping will happen after they've analyzed their budget. The Las Vegas couple makes a combined income of $75,000 as an operations manager and a publicist, respectively. Once they've paid their monthly bills and expenses, they have a little more than $700 left over at the end of the month, which is a decent amount.

However, whatever they haven't spent by the end of the month typically goes toward making additional student loan payments because of the burden they feel over their college debt. As a result, they haven't added to the $1,000 they have in an emergency fund, nor have they started investing for their future.

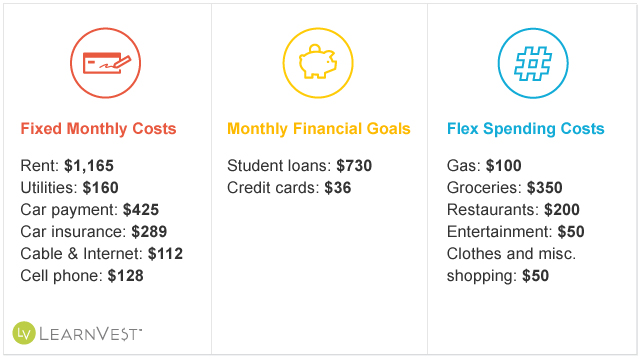

So we asked Paul and Betsie to share their monthly income and expenses with us so that Blaylock can help find ways to free up $800 that could go toward furthering their financial wish list: beefing up savings, starting to invest, and, yes, continuing to attack their student debt.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What Paul says about their monthly budget …

I don't think we're living extravagantly for our take-home pay of $4,509 a month. But I do think we can get smarter about creating a savings and spending plan that will help us pay down our debt faster and start investing.

Right now we're paying about $730 a month in private student loans. We have a total of $50,000 at a 10 percent interest rate. We also have a $25,000 car loan with a 4.6 percent interest rate. We'd like to pay these off as soon as we can so we can start investing for retirement, as well as buy a small house.

We do have a little bit of credit card debt from covering emergencies, but it's manageable, so we usually pay around the minimum. Our apartment was broken into and we had to move and replace stolen items, which wiped out our savings. So we try to keep about a $2,000 cushion in our checking account for these kinds of unexpected expenses.

Where he thinks they can cut back: When Betsie and I looked at our monthly spending, it became clear that we were eating out a lot, spending $200 a month. This is more than half of what we spend on groceries, which we know is a more economical, not to mention more nutritious, way to eat.

At $112, our cable and Internet bill is also pretty high. Since we subscribe to Netflix and make the most of that subscription, we can probably cut our cable bill in half or more if we scaled back to just paying for internet.

Where he thinks they're doing well: When Betsie and I first combined our finances, there were some growing pains when it came to melding our money philosophies. Betsie came from a family that never saved, so even though she isn't a big spender, she is still learning the value of putting money away. On the other hand, I've always valued saving — but I also like to splurge on outdoor gear and musical instruments once in a while.

So we both recognized that we had areas of unnecessary spending. Now we try to set a limit of about $25 a month each on clothes and miscellaneous shopping.

Their financial future: While Betsie is hoping to be totally out of debt before we start investing, I'd like to start socking away some money toward extra savings now, as well as retirement.

Of course, I still think it's a priority to pay off our student and car loans, but I'm hoping that we can beef up our emergency savings fund. We'd like to also start saving for a down payment on a house at some point, so I'd like to work toward putting $20,000 into a savings account for that.

We expect that both of our salaries will continue to increase — maybe even within the next year. Neither of us need more formal education for our fields, so I don't foresee us getting into more student loan debt in order to climb the salary ladder at our jobs.

What Blaylock says about their monthly budget…

Overall, Paul and Betsie have all of the basics in place: They're making good money compared with their cost of living, which means the framework they need to save is there — it's just a matter of taking a more strategic approach to setting and achieving their goals.

I like that they are realistic and don't have pie-in-the-sky goals, and I think it's good for them to keep the $2,000 buffer in their checking account. It helps ensure that money is in their account when the bills are due, so they don't incur any late charges.

I also give kudos to this young couple for their smart budget. It's reasonable, and they already have a good grasp on where they can scale back. That cable bill can definitely be slashed — if they scaled down to just internet, I'm guessing that could save them between $60 and $65.

Eating out is also a big, avoidable expense, so I think it's fantastic that they're encouraging each other to make more meals at home. Depending on how much they are willing to cut back, they could save $50 or more there.

The one thing that really stands out to me, however, is how much they're putting toward student loans. Their monthly student loan payment of $730 seems like a lot compared to their total loan debt, and it's because of that high 10 percent interest rate. However, allocating all of their extra $700 per month toward their student loans will prevent them from making strides on other goals, such as retirement savings.

Paul and Betsie are zeroing in on one particular problem, and because of this, they're losing time on their other goals. Since they're so young and have such a long time to retirement, even a small contribution each month can make a big difference over the next 40 years.

Because their budget is mostly devoted to fixed costs, what I'd suggest is that they ditch the hyper-focus on paying off those student loans and start taking a more balanced approach toward their savings goals. This, along with the other small cutbacks in food and cable, should help get them to the $800 in savings they are looking for.

Paul and Betsie's to-dos: The first order of business is to grow their emergency savings from $1,000 to about $4,500, which is one month of their net income. Eventually, they should have six months' worth of net income in this account, but it's OK if it takes five years or so to reach that goal. This will give them the cash cushion they need to start working on their other goals without worrying about the unexpected stuff that can pop up.

For the next four months, I want Paul and Betsie to put every last penny of the $800 they save toward their emergency fund. Once they hit $4,500, they can then split the $800 a month between paying off any high-interest credit cards and student loans, continuing to build emergency savings and contributing to retirement accounts.

To do this, I recommend they take 75 percent of that $800 (or $600 a month) and put $300 toward any credit card debt they have and $300 toward student loans.

For the remaining $200, $100 should go into emergency savings and $100 toward retirement savings into their 401(k)s or Roth IRAs. While $100 might not seem like a lot between the two of them, getting started now is crucial and will add up over time. I don't recommend they invest outside of retirement accounts until they're doing all they can to contribute to retirement first because of the tax advantages retirement accounts provide.

Once those credit cards are paid off, they can redistribute that $300 evenly between student loans, emergency savings, and investing for retirement.

I know Paul mentioned that he would also like to save for a house, but I think that goal needs to come off the table for a while. That can be a longer-term goal they revisit once some of the other goals are achieved.

What Paul says about the advice…

We are glad to hear that we're on the right track!

I agree with what David says about having to focus on emergency savings and retirement while we pay off our debt. Life is so unpredictable, and having a bigger emergency fund will help ensure we don't get into credit card debt. Betsie had been obsessed with paying off our debts, but after hearing the suggestions, she's on board with taking the more balanced approach.

David told us he appreciated that our goals were realistic and not pie-in-the-sky, and similarly, I feel encouraged that these suggestions are very doable. I'm also going to look into refinancing our student loans because a 10 percent interest rate seems way too high. We also just refinanced my car down to 2.7 percent, so that will help us save a lot in the long run.

As far as saving for retirement, Betsie can get a SIMPLE IRA from work and they match 3 percent, so we will be looking into putting some money there, and I plan to invest in my 401(k).

I want our money to grow — not just sit in a big savings account — so the thought of starting our retirement investing now makes me hopeful that we will see our money increase over time.

This story was originally published on LearnVest. LearnVest is a program for your money. Read their stories and use their tools at LearnVest.com.

More from LearnVest...