How $30K in fertility treatments nearly tanked — and then saved — my finances

The worst part is, I never got pregnant

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

My husband, Tom,* and I have never been big spenders. We don't own an extravagant home or drive fancy cars. In fact, prior to this year, I hadn't bought a new vehicle in over a decade.

But despite our modest lifestyle, saving hasn't exactly been a strong suit for us — until recently. Whatever disposable income we had often went to short-term fun, instead of padding a rainy-day fund.

Were we jet-setting every weekend? No, but we did enjoy regular vacations, like weekend cruises and ski trips. Was I a shopaholic? Hardly, but I also didn't see anything wrong with spending a couple hundred dollars a month on clothes. In a nutshell, we were an average couple who didn't know how to save.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But that all changed in 2009.

After years of trying to start a family the old-fashioned way, Tom and I turned to fertility treatments. As we progressed through the years-long process, our financial burden neared $30,000. The kicker? We had only about $2,000 in savings.

For most people, this might sound like a recipe for disaster. But, much to our surprise, tackling our fertility debt jump-started us on the road to financial freedom.

Oh, baby! Why we chose pricey fertility treatments

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

After getting married in 2003, Tom and I immediately wanted to begin building our family. We'd used the cash gifts from our wedding for a down payment on a three-bedroom house in the Orlando area, and I was just beginning a career in marketing. We thought the timing was perfect — except that we soon hit a snag.

After about a year of not getting pregnant on our own, my doctor suggested an ultrasound to see if there was anything out of the ordinary going on. That's when we discovered that I had endometriosis, a reproductive condition that was directly impacting my fertility.

In 2004 I underwent surgery to remove some large cysts, as well as one of my ovaries, and I was told afterward that fertility treatments would give us the best chance of having a baby. Once I recovered, we took a six-month break from trying, just to let it all sink in. After that, I clung to the hope that getting pregnant on our own was possible, so we gave it another go — to no avail.

It wasn't until 2009 that Tom and I finally accepted that we needed to explore other options — and, boy, are there tons to consider. We had just $2,000 in savings at that point, but we didn't dwell on the low balance. We really wanted a baby, so we agreed to take it one step at a time, figuring out our finances on the fly.

I started with a basic drug called Clomid that helps promote ovulation, which I was able to purchase for $4 a bottle. The small expense was really encouraging — maybe fertility treatments weren't going to set us back that much, after all.

But after trying Clomid and other similar drugs for several months, we still weren't having any luck. That's when we got more aggressive with our approach.

Artificial insemination was the natural next step — and ran us about $300 per attempt. Since the cost was modest, we were able to cover it out-of-pocket, without having to dip into our savings. I can't remember how many cycles we did — I've honestly lost count — but it never put us into debt.

Yet by 2011 I still wasn't pregnant. I had mixed emotions; I wasn't quite ready to give up, but my enthusiasm was definitely starting to wane.

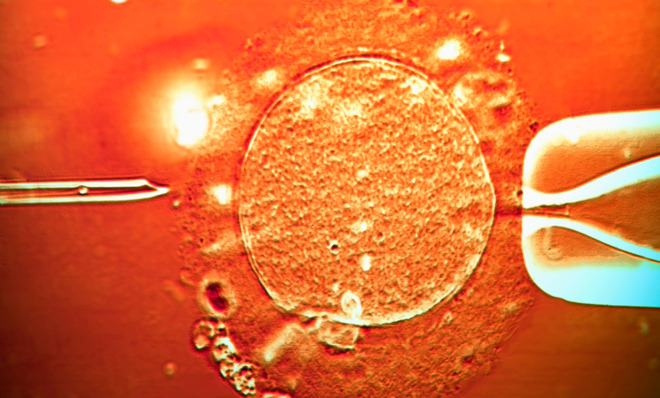

Our last-ditch effort was to try in vitro fertilization (IVF) — the granddaddy of fertility treatments. In addition to being more invasive than other options, IVF was also much more expensive.

We met with a fertility specialist and decided on a plan of action — we'd sign up for six rounds of IVF — and an $18,000, 9.99 percent interest loan to pay for it. And there was a catch: That $18,000 didn't include the cost of all the pills and injections that go hand in hand with IVF, which can set you back upward of $3,000 per cycle. Plus, my insurance considered IVF a voluntary treatment, so they weren't footing the bill.

Covering these unforeseen expenses required some creative financial footwork. Tom picked up extra shifts at his construction job, and we found someone to rent a room in our home for $450 a month, which helped us keep our savings intact and not assume any additional debt. In the end, the whole experience cost us nearly $30,000 — and the worst part is that I never got pregnant.

By the spring of 2012, I was emotionally — not to mention financially — drained.

Our get-fertility-debt-free plan

Once we finally decided to call it quits with IVF, I shifted my focus to our debt: I wanted to be rid of it — and move on with my life.

But before we could come up with a plan, I had to see it all in black and white. I'm a spreadsheets geek, so I created logs of our income — our full-time jobs, plus Tom's side gig as a motorcycle mechanic — and all of our debt. It was the first time I'd ever sat down and looked at exactly where our money was going each month.

We'd started paying off the $18,000 loan in the fall of 2011, which helped put a small dent in the balance. But we had other debt to contend with: Between our mortgage, an equity line of credit and both our student loans, we owed another $200,000.

Seeing it all laid out in front of me was overwhelming, but I was also optimistic that we could come up with a plan to get back on our feet. My goal was simply to get started, hacking away at the balances little by little.

My first order of business was to eliminate all unnecessary spending. This required sacrifices, like canceling our cable service and replacing it with Netflix and Hulu subscriptions. A friend at work also turned me onto couponing, and I began clipping for everything from groceries and toiletries to dates with Tom — a strategy that would eventually save us $5,000 a year once we got really good at it.

I also became more mindful of sales, and stopped buying new clothes so regularly. And Tom and I quit vacationing every other month, which had been the norm prior to our fertility adventure. In total, making all of these changes shaved $900 off our budget each month.

We used this "found" cash — as well as our boarder's rent — to make double payments on our IVF loan. Instead of putting $400 toward the debt each month as we had been, we paid it in $800 chunks. And any time we found extra cash in our budget, we made even bigger payments.

In less than six months, we fully paid off the IVF loan. It felt amazing — and brought a sense of closure about my infertility battle. And with our savings engines revved up, I couldn't help but ask myself: What else can we pay off?

Next up: a $2,000 student loan Tom took out and our $15,000 equity line of credit balance. By keeping to our new-and-improved frugal budget and continuing our double-payments strategy, we knocked out both debts in just 10 months. In fact, since overhauling our spending habits, we've paid off a total of about $36,000 of our debt — and I see no signs of slowing down.

Infertility and finances: The lessons we learned

In a weird way, I believe this experience has been a blessing in disguise — at least when it comes to our money. Coming face-to-face with all that debt, and having so little saved, nudged me to take stock of my financial reality.

As a result, our financial picture is the strongest it's ever been. Aside from our mortgage — we still owe roughly $93,000 — the only debt we have is $18,000 from a used car I bought a couple months back and about $70,000 in student loans that we plan to wipe out within the next three years.

We're also prioritizing retirement savings in a way we hadn't before. We're both contributing about 10% of our take-home pay to 401(k)s and Roth IRAs, and my employer kicks in another 8 percent through a match program that I take advantage of.

Another major lesson we learned? The importance of having an emergency fund. If we'd had more of a cushion, it might have been easier to finance our fertility treatments. Right now we have about two months' worth of expenses saved up, with a plan to continue beefing it up until we hit six months. This, along with paying off my $70,000 in student loans, is our current financial focus.

At the end of the day, everyone has different financial targets they want to hit. Unfortunately, for Tom and me, it took a taxing personal battle to identify what exactly ours were. But as a hardworking couple, we took away from the experience that, once you set your mind to getting financially straight, the battle isn't quite so uphill.

As for our dream of becoming parents, Tom and I may consider adoption one day. But with so many choices and financial commitments accompanying such a huge decision, we'll take our time — and make a financial plan first.

*Names have been changed.

This story was originally published on LearnVest. LearnVest is a program for your money. Read their stories and use their tools at LearnVest.com.

More from LearnVest...

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal