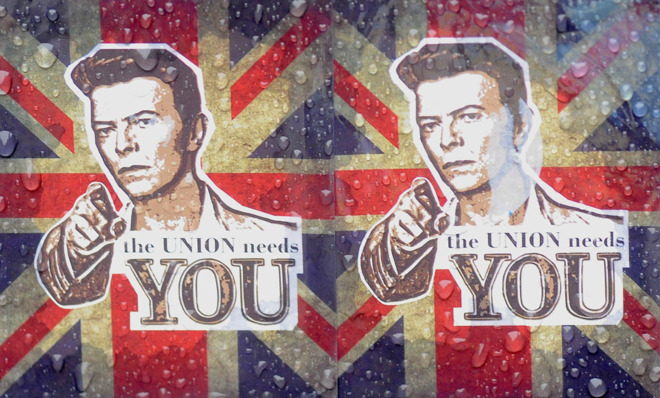

The impossible promise at the heart of Scotland's campaign for independence

The "Yes" campaign wants to leave Britain and join the European Union. And that means adopting the dreaded euro...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The surprising resonance of Scotland's "Yes" campaign for independence from the U.K. can be in part attributed to its promise to end the hated austerity programs pursued by the British government since 2010. Promising to reverse cuts to social programs and increase public spending through government borrowing, the campaign argues, "Ending austerity can mean big gains for people living in Scotland":

The current Scottish Government has set out proposals to increase public spending by 3 percent a year compared to the 1 percent increase planned by Westminster. That would deliver an additional £2.4 billion of investment in job creation, economic growth, and stronger public services per year by 2018/19. [Yes Scotland]

There's just one problem: It's an impossible promise.

The "Yes" campaign has made sets of competing claims when it comes to its finances that undermine the seriousness of its policy. The trouble comes down to execution: The "Yes" campaign's claims about retaining the British pound while simultaneously joining the European Union betray a profound misunderstanding.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

First, even if the "Yes" campaign succeeds, it will try to keep the British pound, a move which would necessarily hand control of Scotland's finances over to Britain. As I wrote earlier this month, a currency union between Britain and Scotland would have to involve a degree of political union. Scotland giving up its monetary sovereignty to London would expose Scotland to the effects of decisions by the Bank of England over which it would have no control. As countries in the eurozone are discovering, loss of monetary sovereignty can be damaging and can severely prolong and worsen downturns. Furthermore, Scottish banks would lack a lender of last resort, exposing the country to massive risk of bank runs and financial crises.

But here's where things get strange: An independent Scotland won't get a chance to remain on the pound anyway. That's not just because the Bank of England has ruled out a formal currency union between England and Scotland (which it has). It's because the "Yes" campaign plans to join the European Union after seceding from Britain. And E.U. membership would require that Scotland join the eurozone and adopt the euro.

The Spanish foreign minister confirmed as much yesterday — and said the new European Commission President Jean-Claude Juncker is in agreement. The E.U. rules are also very clear on this. Chapter 17 of the conditions for new members states:

New Member States are also committed to complying with the criteria laid down in the Treaty in order to be able to adopt the euro in due course after accession. [European Commission]

So, post-independence, the Scottish government would have to choose between two key promises they have made: whether to keep the pound and abandon the European Union, or jettison the pound for the euro and join the E.U.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Let's say, for arguments' sake, that Scotland chooses the latter option. What then? Well, it would have to abandon its anti-austerity agenda immediately.

Membership of the euro not only means loss of monetary sovereignty to the European Central Bank — a body which has left the continent mired in a massive economic depression — it also means constraints on government spending under the Stability and Growth Pact. Governments are not allowed to have deficits larger than 3 percent of GDP, nor are they allowed to have debt exceeding 60 percent of GDP. Scotland's national debt is already 60 percent of its GDP, meaning that under the terms of the Stability and Growth Pact, Scotland couldn't take on additional debt to reverse cuts to its social programs.

Now, Scotland could violate the treaties and ignore the Stability and Growth Pact, as some eurozone countries, including Germany, France, Greece, and Portugal, have done at various points. But it wouldn't diminish the risks posed by giving up its monetary sovereignty. Without monetary sovereignty, Scottish government risks running out of money, making a debt crisis a very real possibility. After all, Scotland's finances, with the country's oversized financial sector, would more likely resemble Ireland's — a country whose debt crisis and union with Europe forced it into harsh fiscal austerity — than Germany's.

The only real option, then, for Scotland to end austerity is for it remain part of Britain and vote in a new government. That remains a likely prospect. The center-left Labour party, which has been critical of the U.K. government's austerity program leads the 2015 election polls in Britain and is projected to gain an overall majority in the next election. If Scotland wants to end austerity, it can do so next year if it stays in the UK.

Yet if it leaves and joins the E.U., as the "Yes" campaign intends to do, it will be committing not only to austerity now, but under the terms of eurozone membership, austerity forever.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day