There was never a cupcake bubble

Not every change in taste is a bursting bubble

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Back in 2009, Slate's Daniel Gross wrote a piece entitled 'The Cupcake Bubble' in which he argued that the expansion of gourmet cupcake bakeries was just a temporary fad, and that cupcake fans had "better enjoy that vanilla cupcake with espresso-ganache icing today, because the cupcake crash is coming!"

With the announcement this week that NASDAQ-listed gourmet cupcake bake shop Crumbs will be closing all of its stores, many will say Gross' prediction was on the money.

At the very least, Gross' 2009 explanation for why the cupcake was becoming more popular in the wake of the recession sounds convincing:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The current recession, which started in late 2007, laid the groundwork for the recent proliferation of cupcake stores in American cities. Lots of people know how to make really tasty cupcakes, which are simple products with cheap basic ingredients. Baking cupcakes doesn't require a large amount of capital investment, and it's relatively easy to scale up without hiring lots of workers. It takes about as much labor to produce three dozen cupcakes as it does to make one dozen. Meanwhile, storefronts in heavily trafficked areas became cheaper with the decimation of local retail. And so in the past year, casual baking has turned into an urban industry. [Slate]

And his argument for why cupcakes would have difficulty sustaining their popularity — that gourmet cupcakes are excessively sweet, overly expensive, and difficult to scale up to mass production — looks prescient today. Indeed, with Crumbs' failure, the financial press has been full of talk of a bursting cupcake bubble.

But here's my beef: What has occurred with the cupcake industry is not in any way a "bubble." Using the term "bubble" to describe something as mundane and ordinary as the gradual changing of consumers' tastes with the economic climate renders the term meaningless. Tastes change. New products rise to take old products' market share. Not every economic shift is a "bubble." Not every product in decline is "crashing." That's just capitalism.

Here's what a real speculative bubble looks like — the price of tulip bulbs between 1634 and 1637:

(Elliot Wave International)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Note the gradual climb that became steep as interest in tulips as an investment increased, leading to a peak as the market became fearful that prices would fall — and then witness the huge crash that followed as speculative fever turned to mass panic. You can see that kind of pattern in lots of other markets too — stock in the South Sea Company, U.S. median home prices, the price of Bitcoin, the turn-of-the-millennium NASDAQ.

Now, cupcake sales have declined a little — falling 6 percent in 2012, flat in 2013, and falling 1 percent so far this year, according to NPD — but that is nothing like a bursting bubble. That's a gentle, gradual decline that's reflective of consumer tastes that have gradually changed, a marketplace that has become crowded, and snacks like the cronut and wonut that have begun to eclipse the cupcake.

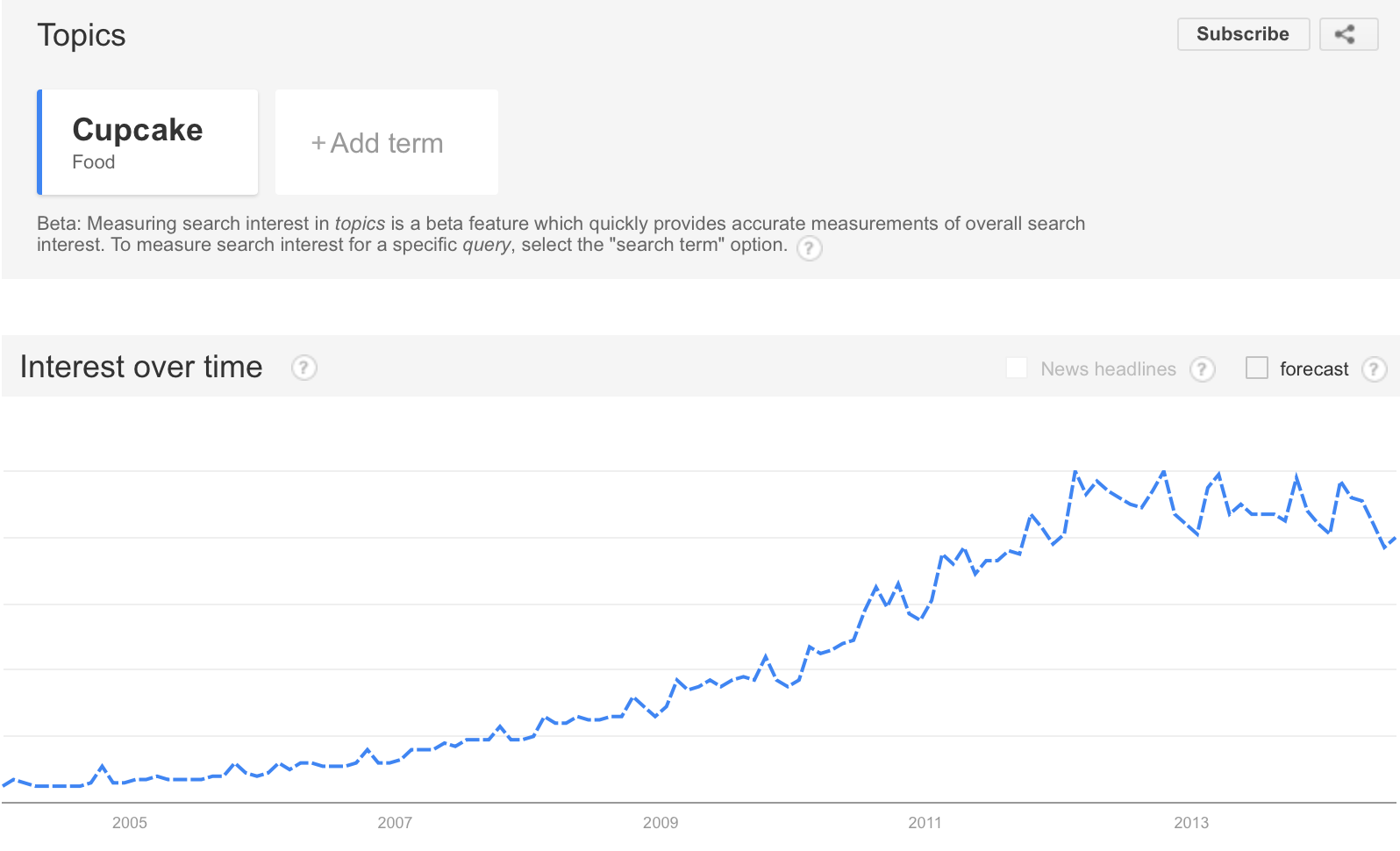

Similarly, Google Trends' data shows that the search popularity of cupcakes has only slightly dipped over the past three years:

(Google Trends)

Indeed, for Crumbs in particular we don't see any kind of speculative mania followed by a short panic. We just see a long, gradual decline in its stock price, as the company has faced falling sales, botched expansion plans, and years of financial losses including an $18.2 million loss last year:

(Yahoo! Finance)

Companies like Crumbs who botch their expansion plans, leaving themselves stuck with high levels of debt, tend to fail in whatever industry they are in. That's not a bubble bursting — that's business.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultra-conservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections.

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral