How to stop the epidemic of student debt defaults

Let's really cut out the middleman next time

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

While analysts debated the seriousness of the student debt crisis last week, one statistic went unchallenged: Student loan defaults are at their highest rate in 20 years, affecting over seven million borrowers.

Delinquent borrowers carry higher debt-to-income ratios and damaged credit scores, making it difficult to make large credit purchases, clear rental applications, or even pass a job interview. Lower household formation, decreased net worth, and greater financial stress can all follow.

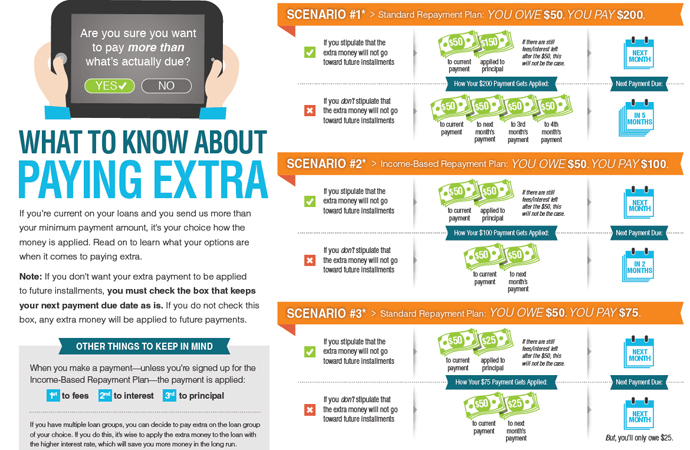

There's no real reason for student debtors to default, though. Student debt can be collected in a multitude of ways (even through Social Security payments) and cannot be discharged in bankruptcy, so you can't shake the payments. And the government offers a number of programs to help avoid default, including hardship deferrals and repayment options tied directly to income, effectively forgiving payments if the borrower loses their job. It would be better if this were done seamlessly through employer withholding, but there are enough alternatives out there that almost nobody should be defaulting, and certainly not seven million borrowers. So why are there so many defaults?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Two researchers from Elon University and the University of Michigan looked at this question, and found their answer in the for-profit companies that service student loans. Eric Fink and Ronald Zullo allege that financial incentives tilt servicers away from helping borrowers and toward maximizing profits. They propose a federal alternative, where the government collects payments and advises borrowers themselves. This would improve the borrower experience, reduce defaults, and save money.

The report, funded by Jobs With Justice, a coalition of faith, community, labor, and student groups, notes that the student loan program was largely federalized in 2010, something President Obama routinely boasts about in speeches. "We said, let's cut out the middleman," Obama said recently, describing how the government shifted from guaranteeing loans issued by private banks to simply issuing the loans themselves.

But that didn't eliminate the middleman, it just shifted it. The Education Department issues student loans directly, but it contracts with four private companies — Navient (formerly part of Sallie Mae), FedLoan Servicing, Great Lakes Educational Loan Services, and Nelnet — to service the loans. These companies process payments, communicate with borrowers, and assist with loan modifications. Last year, the Education Department paid servicers more than $1 billion in fees.

It turns out these private servicers don't perform well for borrowers, argues Chris Hicks, the Debt-Free Future campaign organizer for Jobs With Justice. "What we see in student loan servicing is similar to what we saw in mortgage servicing," Hicks said, referencing the incompetent and often illegal behavior in the mortgage industry. Servicers fail to notify borrowers about different options to avoid default. They lose paperwork, miscalculate incomes, and intentionally miss deadlines to enroll in these programs, Hicks claims.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As a result, only two million student borrowers are currently enrolled in alternative repayment plans, while seven million are in default. Meanwhile, servicers have been accused of additional abuses, such as pushing debtors into plans that increase their overall burden, illegally blocking payments from accruing to loans with the highest interest rates, and harassing borrowers when their co-signers die. The Consumer Financial Protection Bureau (CFPB) has repeatedly fielded complaints about student loan servicers, as has the Federal Student Aid section of the Education Department. And the Justice Department recently fined Sallie Mae and its former loan servicing unit Navient $139 million for improperly overcharging service members.

The Education Department would argue that their contracts with servicers try to properly align incentives by rewarding servicers more for keeping borrowers current on their loans. However, this relatively minor incentive (the difference in payment between a current borrower and one 60 days delinquent is a mere 28 cents a month) is dwarfed by the expense of effective, responsive servicing.

Especially for borrowers at risk of default, servicing is a "high-touch" business, requiring multiple interventions to assist customers and find them the best options. The operational costs of hiring enough experienced staff to accomplish this simply outweigh the meager incentives, especially because the Education Department places a hard cap on the revenue servicers can earn from any single borrower. So a profit-maximizing company will skimp on staff.

Using the average salary of customer service representatives, the study finds that "it would take 140 months of current and uninterrupted loan payments to recoup the cost of a single, 30-minute intervention on an account 31–60 days delinquent." It's just not cost-effective for servicers to do right by student loan borrowers.

Servicers have other bad incentives as well. When Sallie Mae serviced federal loans, they also owned a debt collection agency contracted with the government, Pioneer Credit Recovery. So pushing more student borrowers into default increased debt collection business for the subsidiary. In addition, CFPB has demonstrated that servicers process partial payments to maximize late fees, which is another stream of revenue for the companies.

The Education Department also allocates new loan accounts based on a formula measuring default volume, borrower satisfaction, and monitoring surveys. But the four servicers are judged against one another, not an independent standard. "There's not a big incentive to outperform the others because you know you're getting new customers," said Chris Hicks of Jobs With Justice. "It creates a system of the status quo where if they all do poorly together, no one gets hurt."

Improvements could come through better monitoring of servicers, the study concluded. But the cheaper and potentially more effective option would be to have a federal agency collect the payments, rather than subcontracting it out to private companies who have shown themselves unwilling to do the job in the best interest of the borrowers. "We need a new option mandated to help borrowers and not maximize profits," Chris Hicks said.

This has precedent in the U.S. Department of Agriculture's handling of direct loans to farmers. The Farm Service Agency services those loans without difficulty; "there is nothing inherent to the loan-servicing function that calls for private sector expertise," Fink and Zullo write. Indeed, the government houses the largest accounts receivable agency in the world: the Internal Revenue Service.

Private servicers offer no legitimate value, and indeed harm outcomes for borrowers. And the government actually knows this. In President Obama's recent set of executive actions for student loans, he included several measures to literally go around the servicers and directly provide aid to borrowers. For instance, the Treasury secretary will work with private companies like Intuit and H&R Block to identify at-risk borrowers and make them aware of the government's array of repayment options. This is a good explanation of a core part of the servicer's job!

Last week, the Education Department renewed its contracts with private student loan servicers, claiming they will rework incentives to reward good borrower outcomes. But the best practice here is staring Education officials in the face. If they're concerned about up-front servicing costs — a weak argument considering they already spend $1 billion a year on servicers — they could always farm it out to the U.S. Postal Service, which already has the employees and physical space to do the job. This could line up with a potential post office foray into offering financial services, as outlined in a recent USPS Inspector General report. The ubiquity of post office branches, particularly on college campuses, would allow for face-to-face counseling and consultation. Not-for-profit postal loan servicers would not have incentives to push customers into default. And the whole enterprise would fulfill the Postal Service's mission to promote commerce and economic growth.

Private student loan servicing disproves the myth that private enterprises automatically perform tasks more efficiently and effectively than the federal bureaucracy. This study shows conclusively that injecting the profit motive into student loan servicing has distorted it, and that a public model would achieve the government's stated goal of helping student borrowers avoid default. Simply put, private student loan servicers should not exist. As Chris Hicks of Jobs With Justice concluded, "It makes little sense to have a middleman in this business."

More from The Fiscal Times...