Personal finance tips: How to avoid investment underperformance, and more

Three pieces of financial advice — from the financial risks of aging to how to be smart about insurance

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Why investors underperform

When it comes to poor returns, investors often have only themselves to blame, said Jason Zweig at The Wall Street Journal. The average investor in all U.S. stock funds earned 3.7 percent annually over the past 30 years, but over that same period, the S&P 500 stock index returned 11.1 percent annually. Why did individuals fare so poorly compared with the overall market? "Fear and greed." Investors tend to get nervous when stock prices dip and overeager when they surge, increasing the likelihood that they sell low and buy high, and driving their average return below that of the fund in which they're invested. The best course? Stay the course. Think of a mutual fund as a train that runs from Chicago to San Francisco. Some people who boarded in Iowa might get off in Nevada, but only those who travel the full distance will get the full benefit.

The financial risks of aging

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The biggest risk to your nest egg isn't market volatility or inflation, said Howard Gold at MarketWatch. It's your aging brain. One simple fact of getting older is that there is a "massive drop-off in our own capacity to manage our investments." Because of the predominance of our frontal cortex, where cognitive functions are processed, we "get better and better at investing until we hit our mid-50s." Beyond that, the limbic system, which regulates primal emotions like fear and greed, starts to hold sway. That shift can lead to an uptick in panic selling, like "the kind we saw in 2008–2009." The best bet is to start planning in your 60s by shifting your investments away from alternative markets and individual stocks, and instead stick to a simpler "buy-and-hold strategy."

Be smart about insurance

People make irrational money decisions all the time, especially when it comes to insurance, said Jean Chatzky at Fortune. One major mistake is focusing too much on deductibles, which can artificially narrow your options. To get the best policy for your needs, sort first for benefits like preferred providers and leave the deductible comparisons to the end. And beware of bad math. Premiums are often presented in monthly or quarterly amounts, while deductibles appear as annual figures. If you don't convert to a common increment, you may think you're saving money when you're not. And don't sweat the small stuff. "If you can't afford to replace it, insure it." If you can, don't.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

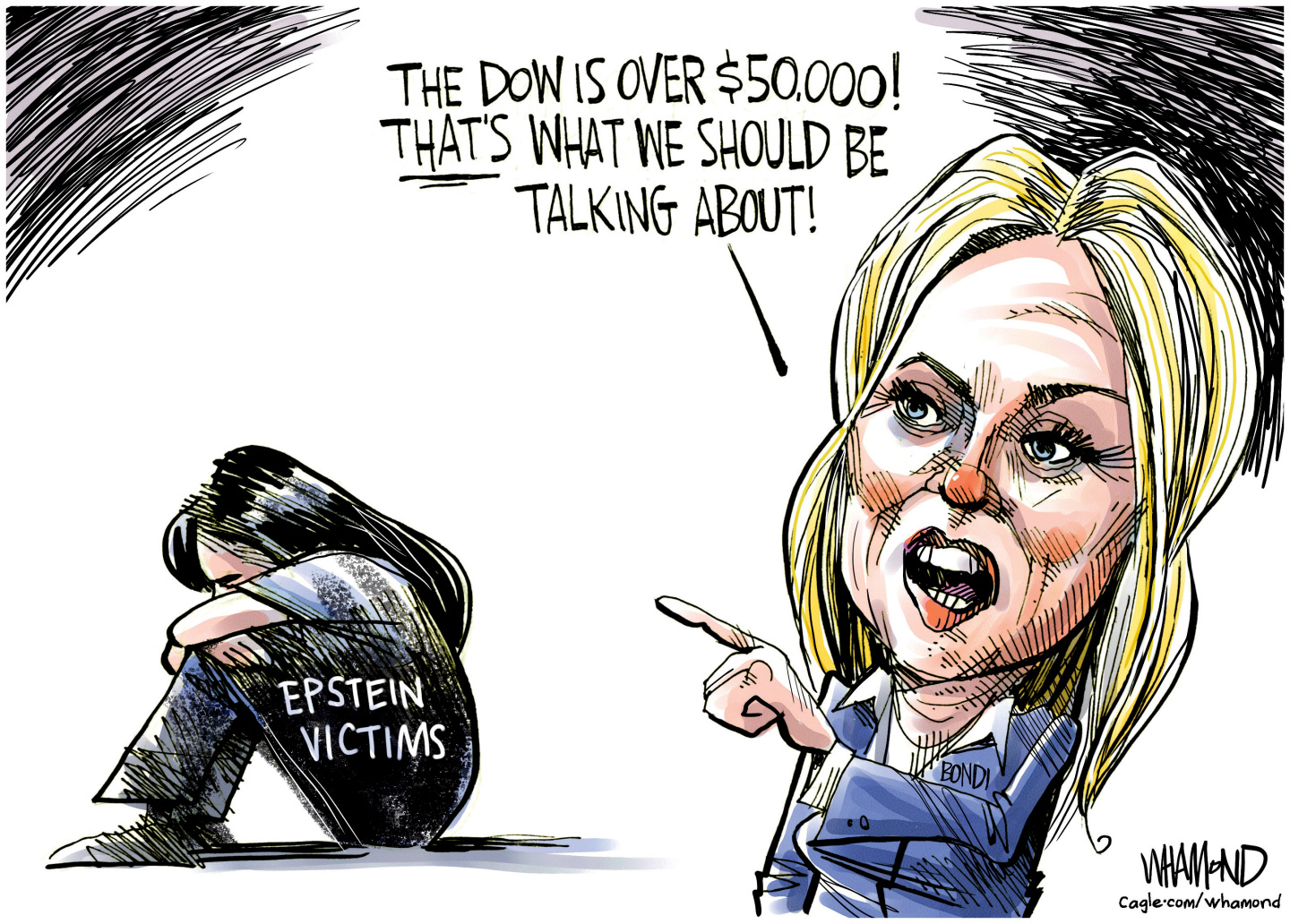

Political cartoons for February 12

Political cartoons for February 12Cartoons Thursday's political cartoons include a Pam Bondi performance, Ghislaine Maxwell on tour, and ICE detention facilities

-

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ return

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ returnThe Week Recommends Carrie Cracknell’s revival at the Old Vic ‘grips like a thriller’

-

My Father’s Shadow: a ‘magically nimble’ film

My Father’s Shadow: a ‘magically nimble’ filmThe Week Recommends Akinola Davies Jr’s touching and ‘tender’ tale of two brothers in 1990s Nigeria