Is the government helping or hurting savers?

Critics say the Federal Reserve's low-interest policies are punishing those who socked their money away

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Interest rates have been painfully low for savers ever since the financial crisis. While this means that credit is cheap — allowing businesses and individuals to borrow and invest more easily — it has hurt retirees trying to live off their savings, whether they be socked away in bank deposits, money market funds, mutual funds, certificates of deposit, bonds, or annuities. These consumers cannot afford to take the risks of investing in the stock market or attempting to start a business.

Many people blame the Federal Reserve’s zero interest rate policy for these low interest rates, and accuse the Fed of "hurting prudent savers." The Federal Reserve sets the short-term lending rate target — also known as the Federal Funds Rate — at which banks lend to one another. This has been set at close to zero since the financial crisis. Banks borrowing at a cheap rate won’t pay customers a higher rate.

However, the Fed isn't penalizing savers. In fact, there is evidence to suggest that the Fed is actually helping savers.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

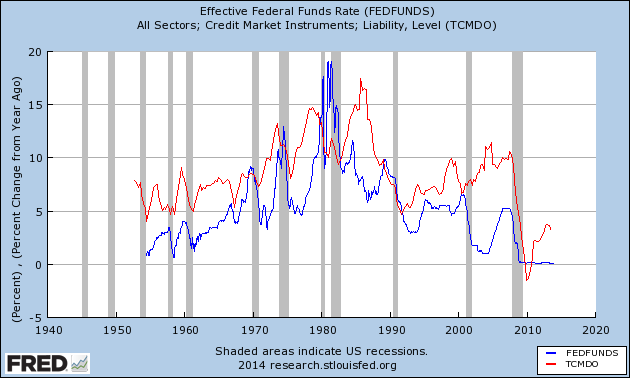

Interest rates are the price of credit. If there’s no demand for credit, then there are no interest rates. What happened in the wake of the 2008 financial crisis? Demand for credit tanked as consumers and businesses — squeezed and spooked by the recession — stopped borrowing and started deleveraging and saving heavily:

Indeed, the Federal Funds Rate was lowered to zero in response to the fall in the demand for credit, part of a larger campaign to prevent deflation. And since rates have been at zero, borrowing has recovered a little. In 2013, the deleveraging finally ended.

What would the effect have been if the Federal Reserve had not dropped the Federal Funds Rate? Even lower demand for credit. And probably deflation, which makes existing debts much harder to repay, driving up the default rate and resulting potentially in more bank failures. That's a recipe for an even bigger financial crisis, which would have posed a huge systemic threat to savings, particularly those not insured by the FDIC, such as those sequestered in money market funds, mutual funds, bonds, annuities, etc.

Starting in late 2008, the Federal Reserve began quantitative easing, swapping yielding assets like Treasury bonds and mortgage-backed securities out of the system in exchange for cash. Again, this move came under criticism for depressing interest rates and hurting savers. But actually — as this graph via The Atlantic’s Matt O’Brien shows — each time the Fed started a program of quantitative easing, interest rates in the real economy rose. During the Fed’s latest round of bond-buying, rates rose to their highest level since 2010. And each time the quantitative easing has ended, interest rates have fallen back.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This may be because by taking safe assets out of the financial system, the Fed is forcing investors to take more risk in order to receive a greater return on their money. More productive activity drives up the demand for credit, raising interest rates.

To put it another way: The policies that help savers the most are the policies that lift the demand for credit and grow the economy. A growing economy not only lifts credit demand, but creates a bigger pie for everyone — jobs for the unemployed, improved interest rates for savers, and profit for shareholders.

What would have helped savers even more is higher public sector spending. Why? Because the government is the biggest consumer of credit! Many people claim that government spending in recent years has been excessive, but the low interest rates available to government tell a different story. Rates on public borrowing were much lower after the financial crisis than before, reflecting low credit demand in the wider economy. If the federal government had been running lower deficits, demand for credit would have been lower, hurting savers even more.

And if it had been running higher deficits for, say, infrastructure improvement, demand for credit would have been higher, pushing up interest rates for savers. Plus, you would have had all these great benefits like fixed roads and bridges and a lower unemployment rate.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.