An ominous trend: Student loan delinquencies hit a record high

Is $1.27 trillion in student loan debt weighing down the economy?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

More bad news on the student loan front.

The U.S.'s collective student loan debt is now $1.27 trillion, up $33 billion from the second quarter of 2012, said the New York Federal Reserve Bank in its consumer debt report last week. That leaves the average student borrower with about $27,000 in debt.

In addition, the report showed that more and more borrowers are wobbling under the burden. The delinquency rate, which the Fed defines as 90 days-plus with no payment, is now a record 11.8 percent, up from 10.9 percent last quarter. Recently, this trend belongs to student loans alone. Since 2010, delinquencies on other types of debt, such as auto loans or mortgages, have steadily declined.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And that's only part of the picture. Student loan delinquency rates can be greatly understated, because about half of those who are late are either in a grace period, are deferring payments, or have gotten forbearance from the lender, says BuzzFeed's Matthew Zeitlin. Meaning, the actual number of those late on their student loans may be twice as high.

Of course, it's no secret that constantly creeping student loan statistics are a drag for young people. Nor is it a secret that the lingering unemployment rate is a bigger problem for recent grads who don't yet have the resumes to compete in the job market.

But "young people" don't exist in a bubble. While much of the $1.27 trillion bill may be theirs to pay, there's some evidence that it's weighing down the broader economy as well.

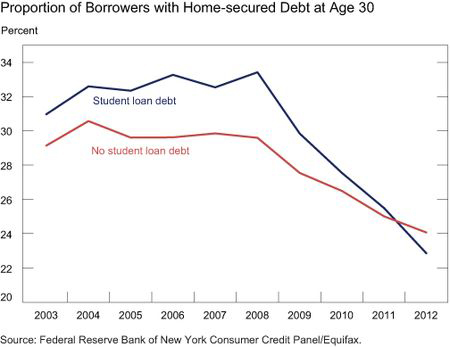

Earlier this year, the Federal Reserve Bank of New York argued that student loan debt is deterring young adults from taking on other debt. In this chart, the Fed showed that while most people are taking out fewer loans since the financial crisis, 30-year-olds with student load debt are now less likely to have taken out a mortgage or auto loan than those without.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That may not be by choice, however. It may not be the student debt itself that's dragging the group down, but rather the credit history of those who couldn't pay, said Jordan Weissmann at The Atlantic earlier this year. Weissmann wrote:

Lending standards have gotten suffocatingly tight in the wake of the housing bust, and young people with too much student debt compared to their income, or who've fallen behind on their loan payments, may simply be unable to qualify for a mortgage. As the Fed noted, student borrowers now also have worse credit scores, on average, than their ed-debt-free peers. [The Atlantic]

Therefore, "The universe of young adults who have any shot of getting a mortgage has shrunk," he says.

Meanwhile, economists have linked student debt to another "millennial" trend as well — the fact that they're waiting longer to get hitched. Ray Boshara, a senior advisor at the Federal Reserve Bank of St. Louis, spoke to the St. Louis Beacon:

"Generally, when you put your incomes together you can build a stronger balance sheet, retirement savings, first-home purchase, small business ownership,'' Boshara said. "But there's a big and generally a negative effect on the balance sheet because of unhealthy levels of student loans.''

He adds that growing delinquencies in student loans are a bad economic sign.

"Delinquencies in student loans tend to predict high delinquencies in other kinds of consumer and mortgage debt,'' he said. [STL Beacon]

This quarter, consumer debt overall rose by 1.1 percent — the highest rise since early 2008 — said Thursday's report. That's not such a bad thing. Americans are slowly starting to borrow more for mortgages and car loans, and buy more with their credit cards, all of which can boost the economy. But the trend in student loans, where defaults are growing, is starting to look like even more of a drag.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

Political cartoons for February 21

Political cartoons for February 21Cartoons Saturday’s political cartoons include consequences, secrets, and more

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more