4 dual-income families reveal their budgets

Two incomes don't ensure you'll make ends meet

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Households that have one "breadwinner" and one "homemaker" certainly still exist, but they are becoming increasingly rare.

Between 1996 and 2006, the number of dual-income families in America increased 31 percent, according to the Department of Labor. In fact, among families with children, 59 percent have two working parents, 2012 data from the Bureau of Labor Statistics shows. In other words, two adults bringing home the bacon is the new norm.

What's more, in a 2013 survey conducted by LearnVest and Chase Blueprint®, six in 10 Americans told us they believe you need dual incomes these days to afford your dreams.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But with college costs rising and employers slower to give raises due to the recession, not even pulling in two paychecks may offer a magic bullet when it comes to making ends meet.

So how do dual-income couples allocate their resources? There isn't a one-size-fits-all solution, but these four married couples — who live in different U.S. cities and earn different amounts of money — have all found a way to make it work, being mindful of their incomes, expenses, and what they value most. We shared their budgets, and we asked Stephany Kirkpatrick, a CFP® with LearnVest Planning Services, to highlight what each family is doing well — as well as ways they can save even more money.

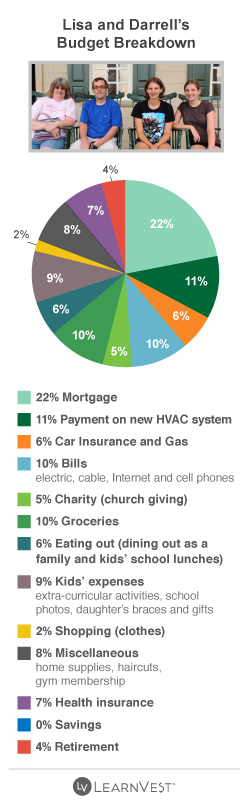

Lisa Kroulik, 45, a freelance writer in Minneapolis, Minn.

Five years ago, I fell into credit card debt, filed for bankruptcy, and lost my home when I divorced the father of my two girls (Rachel, 17 and Abby, 14). We lived without health insurance for several months. It was terrifying.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Since then, I have been very focused on rebuilding my finances. Three years ago, I married my second husband, Darrell, 49, and we bought a house together two weeks later. So now all four of us live together, and we finally feel financially stable. It's Darrell's first marriage, and he has no debts or dependents to support.

I use Quicken to keep track of our income and bills each month, so I can make sure we don't fall behind on payments. Darrell works as a manufacturer and makes $50,000. My income fluctuates since I'm a freelance writer, but between my earnings and the child support I receive from my ex-husband, I make about $35,000.

We use Darrell's credit card to pay for several expenses, from our cell phone service ($252) and cable and internet ($196) to our gym membership ($34), groceries ($600), and restaurant costs ($250). But we make sure to pay them off in full each month. By doing this, we're able to take a vacation every year because we rack up rewards points, which we use on hotels and airfare. Last summer, we traveled to Washington, D.C. for five days.

My daughter Rachel does color guard as an extracurricular activity at school. It costs $250 per season for uniforms and equipment. I was paying for that each year, but she's a senior now, and she recently got a part-time job as a personal care attendant. I'm trying to teach her how to manage money, so she's going to use her earnings to pay for color guard. I want her to learn that you have to work for things you want. Just because our standard of living is better than it was several years ago, I don't want her to take that for granted.

There have been some unexpected costs. In February, our HVAC system broke down (it was 25 years old), and we had it replaced. So we're currently on a $658-a-month plan to pay for the new system. If we complete our payments by the spring, we'll avoid paying interest.

Money for our retirement ($245/month) and health insurance ($380/month) is automatically taken out of Darrell's paycheck. We have two cars that are paid off. But we pay $250 a month for gas and about $89 a month for insurance. Our insurance rate is higher because Rachel recently got her license.

Our other monthly expenses include our mortgage ($1,263), utilities ($150), donations to our church and charities ($300), school lunches ($100), random kid expenses ($355), haircuts ($35), clothing ($100), home supplies and other miscellany ($300), and braces for Rachel ($139).

We currently have no debt and have $2,500 in savings (though we're not currently adding to this amount) and $215,184 saved for retirement. I'd like to build up our savings more, so we can have an emergency fund and contribute more to Rachel's future college tuition.

What Stephany says: I am so proud of Lisa for making sure that she has health insurance for the whole family now. It's also terrific to see Rachel working and contributing to her color guard expenses! In fact, now might be a great time for Rachel to get a student checking account. And it's time to shop car insurance rates with other vendors and ask about a good student discount.

The HVAC payment is making things tighter than usual, so Lisa should consider a home warranty to cover other major appliances, which could prevent big costs in the future. (Here's one place to look.) To prevent a surprise with taxes at the end of the year, Lisa should set aside a little bit of every freelance paycheck just for that purpose. She can also set up her own Roth IRA, and cut back on one to two costs here and there in order to save another $50 a month for retirement right away.

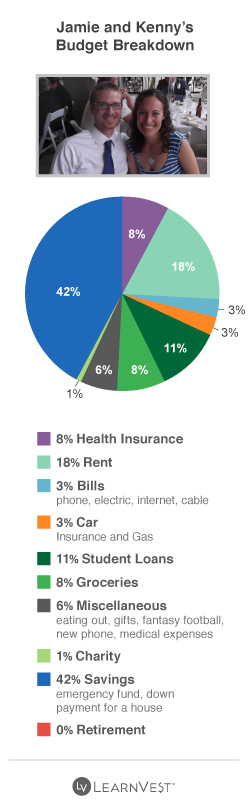

Jamie Falahee, 30, a personal trainer, yoga instructor and speech pathologist in Ann Arbor, Mich.

One thing that has been financially challenging for me and my husband of three years (Kenny, 30) has been our student loans. Initially, we owed a total of $160,000 — he is still paying for his bachelor's degree in history and I am still paying for my master's degree in speech pathology. So we have made paying off those loans a top priority.

Over the past few years, we've paid off $120,000, so now we have only $40,000 left, and I'm proud of that. We pay a total of $651 a month. We were both really naïve when we were students about how much school costs. We should have picked more affordable schools! I think kids should be taught more about finances when they're growing up.

We currently rent a one-bedroom apartment ($1,112 a month) and we'd like to buy a home and have kids in the next couple of years. We've just started saving toward a down payment and a mortgage, so in the near future, we will begin to put our aggressive student-loan repayment on the back burner.

I create a budget each month and run it by Kenny. We don't stick to it perfectly. Something always comes up. For instance, if our friends suddenly decide to come visit, we might go over our monthly eating-out budget. But we do have an overall game plan.

Kenny and I are both personal trainers at the same gym. I also have one to two speech pathology clients on the side. I make a total of $35,000 and he makes $40,000.

We try to cut back wherever we can. We pay a total of $95 a month for our cell phones — we don't have smartphones, just old-school phones. We try to limit eating out to only twice a month (maximum). We chose to live in an apartment that's walking distance from where we work and the local grocery store. We share our one car, which is paid off, when we want to visit family or friends. We won't take a vacation for the next few years. We get free gym use, because of our jobs. I refuse to have credit card debt — that was one thing my parents taught me. I spend time doing free activities, like writing my blog and reading library books.

We didn't have cable for a long time, but we recently gave in because Kenny wanted it for football season. He also needs his fantasy football league, which can cost upward of $50 a month. He spends every waking hour obsessing over it, so for him, it's worth it!

Other monthly expenses include: electric ($45), internet ($20), cable ($25), gas ($100), groceries ($500), medical bills ($150), charity ($50), car insurance ($55).

Health insurance is taken out of our paychecks automatically — we pay $500 per month. I have $15,000 in a Roth IRA. I'm not currently contributing to it, due to our student loan debt, but I'd like to ramp that up in the future. Kenny doesn't have a retirement account. Our company doesn't offer a 401(k). We have nearly $4,000 in a savings account that we're earmarking as both an emergency fund and a house fund.

What Stephany says: It is truly amazing that you have been able to pay off $120,000 in student loans already! But retirement can't fall by the wayside, and, with 30 years or more to save, time really is money. So each of you should be contributing to your Roth IRAs every month. Start small and set a goal to increase every January and July (just put it on the calendar!) and any time your income increases.

Buying a home is very exciting, but it comes with a lot of extra costs beyond the mortgage payment, so it is critical to have a healthy cash cushion in your emergency savings before you really focus on a down payment. Since you both work for the same company, your income situation carries more risk than most dual-income households, so protect yourselves now by saving. Focus on getting up to six months worth of living expenses and set up a weekly transfer from your checking account to a savings account.

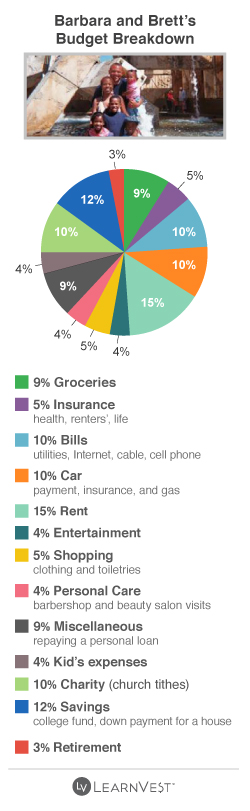

Barbara Ann Lane-Snowden, 34, runs a fashion PR company in San Antonio, Texas

My husband of six years (Brett, 50) and I were living paycheck-to-paycheck for a while. We have one child of our own (Ellyse, 5), and I have three children from a prior relationship (Elijah, 14, and twins Isaiah and Iyanna, 10). With six people in our house, anything we do — whether it's going bowling, going to a museum or going to an amusement park — gets expensive very fast! I was anxious about our financial situation at first, but a few weeks ago Brett landed a promotion at work, and that has given us a cushion. With commission, he now makes a total of $68,000 ($20,000 more than before) as an insurance adviser, and I make $31,000 running a fashion PR company.

We rent a three-bedroom apartment for $1,005 a month. We have two cars — one is paid off and the other costs $400 a month. Then there's $102 a month that goes to car insurance and another $160 to gas.

One big expense for us is ... hair. From weekly visits to the barber for my husband and the boys to beautician appointments for me and my two daughters, the costs add up. In the past month, we spent a total of $270 on all of us.

A lot of money goes toward the children. We've started a savings account for college tuition. We put $400 into that account this month — $100 for each child. Then we spent $250 on random kid expenses, such as classroom snacks, school project materials, and football cleats and pads.

Other monthly expenses: groceries ($600), internet/cable ($115), cell phone bills ($200), rental insurance ($20), life insurance ($110), utilities ($375), entertainment ($250), clothes ($275), toiletries ($75), miscellaneous supplies and gifts ($325), and bank loans ($280).

We are a very religious family. We go to church every week and also do Bible studies. We believe in tithing — we give $650 a month to our church, which goes toward food drives and supporting Christian families in other countries.

We hardly ever eat out — we love to cook. My husband makes delicious enchiladas and I like to make lasagna or a slow-cook meal. We have never been on a family vacation. In fact, Brett and I didn't even have a honeymoon. We are lucky that we have no student loans or credit card debt.

My husband and I don't really keep a strict budget, though. We'll, of course, check our account first to make sure money is there before we spend it, but we don't have a plan. We each use separate bank accounts and take turns paying bills.

Our health insurance ($216/month) and retirement contributions ($190/month) are deducted from Brett's paycheck. We currently have $103,000 saved for retirement and $1,600 in a savings account that we're building up to eventually use to buy a house. We put $400 into that account last month. Next year's tax returns will go there, as well.

What Stephany says: Congratulations on the promotion! Now that you have some extra money to work with, create your first budget, and set aside time once a week to review things together. That way, you have a plan in place and you're on the same page when expenses come up. Have you considered making a contribution to your church via volunteering? This might be a way for your entire family to have some (free!) fun together, and it could offset a portion of the amount you tithe. You save a whopping 6 percent of income for college, and I think it's great that you are thinking ahead. It sounds like it's time to get that money into a 529 plan, and not just a savings account, so that you're getting tax-deferred growth.

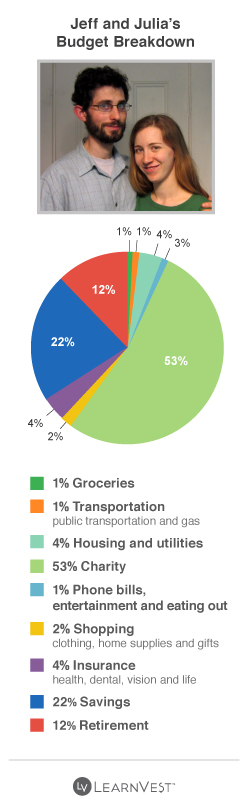

Jeff Kaufman, 27, computer programmer in Medford, Mass.

I do a decent amount of budgeting on a spreadsheet with my wife of four years (Julia, 28). We use a joint account and plan for any major expenses. We give ourselves separate spending money — $45 a week for clothes, entertainment, or going out to eat. We don't get stressed about money. We're pretty organized.

We don't have kids right now, but we would like to someday. Julia makes $51,000 as a social worker and I make $125,000 as a computer programmer. But we find that we don't need that much money to live a comfortable life, so we give away about $72,000 a year to charity.

Charity is very important to us. My wife Julia has always been extremely giving, and she has inspired me to follow suit. We would like to make other people's lives better and do as much good as possible. A small change in our lifestyle can make a huge difference in someone else's life. There's so much income inequality in the world.

We use recommendations from GiveWell.org, a site that reviews charities, to see where exactly donations go and how much they help. One month, for example, we gave $10,000 to the Against Malaria Foundation, which distributes mosquito nets in sub-Saharan Africa. That's the #1 ranked charity on GiveWell.org. In a typical month, we give $6,000 to charity.

Some people would probably say that we live a very frugal life, but Julia and I never feel deprived. We seek out free and cheap activities. We both love to go contra dancing, which is kind of like Irish dancing or square dancing. You dance as a couple with a bunch of other couples to live music. It costs $5 to $10 per dance, and we go four times a month. I also play the mandolin in a band called the Free Raisins. Sometimes I pay for equipment and travel, but the band makes a little money per gig — so I end up breaking even.

We buy all our clothes and some home supplies (our toaster, our Crock-pot) at the local thrift store ($173 per month). We don't have gym memberships, because the dancing we do is a pretty good form of exercise. We really like the T-Mobile phone plan, which is $30 a month for each of us for unlimited text and data and 100 voice minutes. We buy most of our food from a communal food share ($144 per month).

We both work in the city of Boston but chose to live in the suburb of Medford and commute, because it's cheaper. We don't have a car, so we use public transportation, which costs $167 per month. We live in a shared house with a total of eight people, which cuts down on our housing and utility costs (just $400 a month for rent and utilities for both of us).

Health, dental, vision and life insurance ($443/month) and retirement contributions ($1,300) are all deducted from my paycheck. So far, we have saved a total of $107,733 for retirement. My wife and I finished paying off $25,000 in student loans in 2009. We currently have no debt. We have an emergency fund with $10,000, which is about what we each could live off of for six months if either of us lost our jobs. In addition to our emergency cushion, we've also begun adding $2,500 a month to that savings account, which we're earmarking for a down payment on a house.

What Stephany says: You both have a remarkable outlook and make it clear that how much you spend does not control how much fun you can have in life. I love it! You've made a lot of room in your budget for charitable giving and have made a meaningful impact while still taking control of your own financial well-being. Your $10,000 of savings would last in your current living situation, but if you have kids and buy a house, you should re-evaluate. Be sure to create a mock budget that includes a mortgage payment and make a placeholder for larger utilities payments and unexpected repairs. With so much charitable giving each year, if you get a tax refund, you could use that to increase your emergency savings and your down payment. So, sit down now and talk about how you'd like to use any refund money that might come in annually.

More from LearnVest...

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’