10 fictional companies on TV you wouldn't want to invest in

From Arrested Development's Bluth Company to Lost's Oceanic Airlines, a rundown of small-screen companies too risky for your hard-earned cash

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It was just this year that the long-awaited fourth season of the cultishly beloved sitcom Arrested Development hit Netflix — but in news that will make you feel older than an evening with Lucille 2, tomorrow marks a full decade since the show premiered on Fox.

On November 2, 2003, audiences were first introduced to the Bluth family, the comic clan around which Mitchell Hurwitz's sitcom was built. It was also American armchair dwellers' first glimpse into the family's notoriously unreliable business: An Iraqi home–building, cornball-frying, banana-freezing Bluth Company, which has fluctuated between "triple sell" and "don't buy" during the show's run.

But the Bluth Company isn't the first risky business to grace the small screen. In honor of Arrested Development's anniversary, join us we crunch the numbers on nine other fictional corporations you probably shouldn't invest in:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

1. Dunder Mifflin Paper Company (The Office)

Sure, there's a surprisingly fun atmosphere at this unassuming little company that helps to punctuate the drudgery of the nine-to-five. But with a top-down corporate structure that seems more obsessed with indulging its staff than selling reams of paper, competing pulp purveyors won't be too worried about this office supply upstart. A short-lived buyout from scandal-blighted printer conglomerate Sabre and a recent managerial reshuffle has done nothing to revive the company's flagging fortunes.

2. Goliath National Bank (How I Met Your Mother)

Yes, Goliath National Bank is "the world leader in credit and banking" — but for how long? Even a glitzy new addition to the New York skyline isn't enough to massage the public image of a corporation whose own employees describe as "the most evil place in history."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

3. Vandelay Industries (Seinfeld)

The self-proclaimed industry leader in importing and exporting fine latex products, Vandelay Industries is a corporate enigma. It's a problem that might be due to the other interests of the company's founder/owner/sole "employee," one George Costanza, which include architecture, marine biology, and beatnik poetry. But while Vandelay might not make a sound investment, it is great for gags — particularly George's pants-round-ankles dash, which helped to cement the company's name in the public consciousness.

4. Oceanic Airlines (Lost)

Though its fortunes were higher during appearances on The X-Files and Alias, this onetime aviation leader has been in a tailspin since Oceanic Flight 815 crashed on a flight between Los Angeles and Sydney in 2001 — and the bizarre events that followed the crash didn't exactly redound to the company's benefit. Don't buy.

5. Ewing Oil (Dallas)

Crude to the core, Dallas' most famous oil conglomerate kept the Ewing family flush with black gold for more than 13 years during the show's original run. Forever linked with its iconic owner — played by the late great Larry Hagman — the company has since endured bitter power struggles, public scandals, and stiff competition from the Middle East that has seen the company name dragged through the mud. A recent rebrand has done nothing to salvage its reputation, leaving the company to be forever associated with the shoulder-padded excess of its 80s heyday.

6. Springfield Nuclear Power Plant (The Simpsons)

An ill-equipped workforce, a miserly owner, and an unenviable safety record are just three of the reasons why this small-town nuclear plant is one of the worst investments since Enron. It's estimated that it would cost between $57 million to $100 million just to get the plant up to standard, fixing some 340 safety violations that include luminous rats, plutonium paperweights, and leaking pipes. Investment is also needed to retrain a "lazy," "incompetent" workforce — and to install proper emergency exits in place of the existing murals that stand in their stead.

7. ACME Corporation (Looney Tunes)

The company has one enormously dedicated customer, but the ACME Corporation — built entirely on do-it-yourself tornado kits and rocket-powered roller skates — is one lawsuit away from closure due to a kaleidoscope of inventions that are at best comically faulty, and at worse deadly for their users.

8. Central Perk (Friends)

You need more than six customers to have a successful business, and coffee shops are all about turnover — not pleasing patrons with comfy chairs and cauldron-sized cups of caffeine. Put your money into Starbucks instead.

9. Wolfram and Hart (Angel)

Though further investigation into its Special Operations department would be required, this Los Angeles law firm actually promises a healthy return on investment for shareholders — as long as they're willing, quite literally, to sell their souls in order to get on board. (On second thought, given the state of play on Wall Street, maybe it's a safe investment after all.)

Daniel is a freelance writer, an Englishman abroad, and a pop culture junkie. He writes about film, TV, and lifestyle for outlets including MSN, The Guardian, The Times, The Independent, The Evening Standard, and Yahoo.

-

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

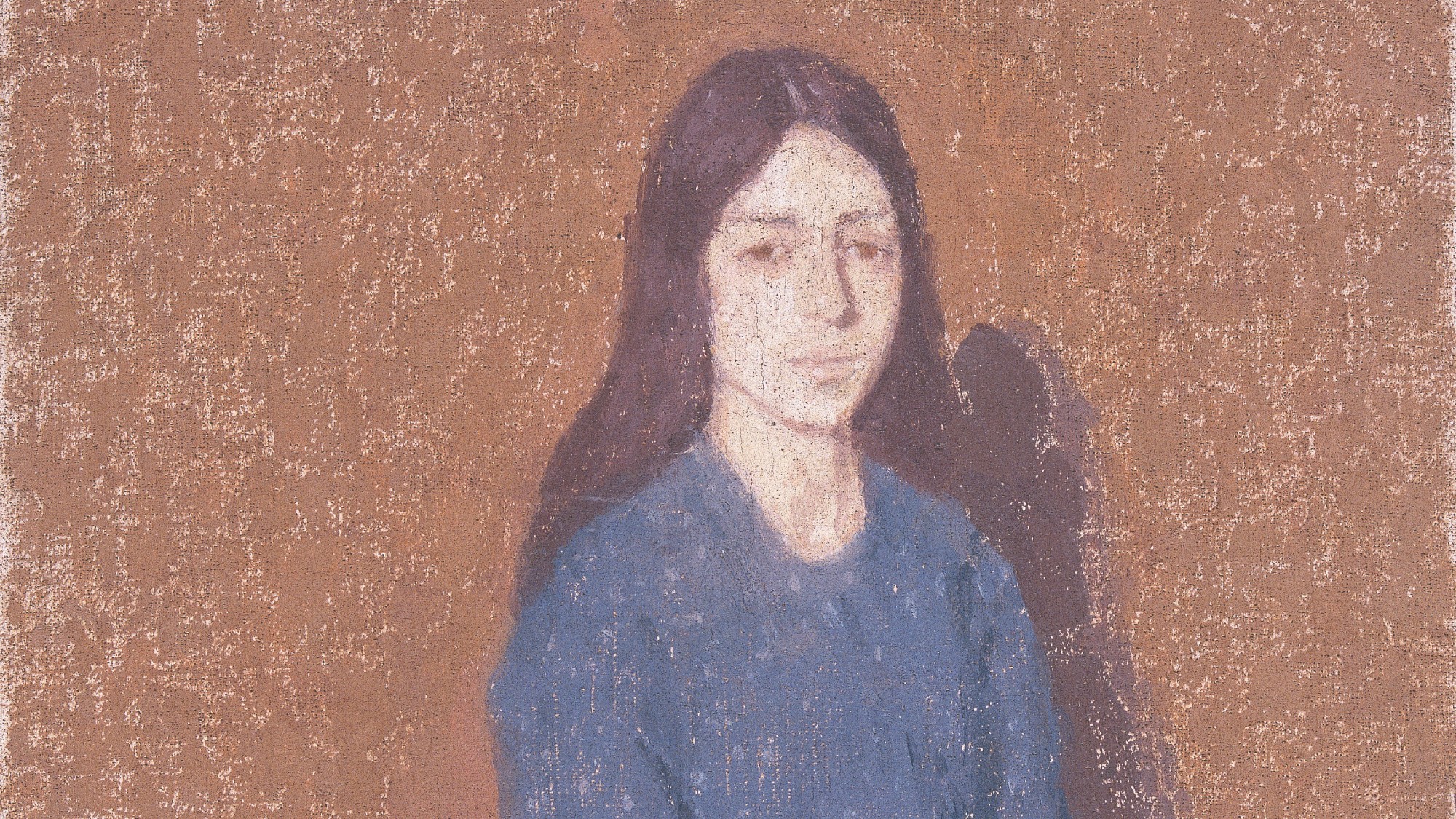

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed