Is U.S. energy independence turning out to be a pipe dream?

The U.S. shale boom may be losing steam

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The optimism surrounding the U.S. energy boom seems to be growing shakier lately.

After two decades of falling oil production, the discovery of massive rock formations rich in oil and natural gas, along with two revolutionary technologies — hydraulic fracturing, and horizontal drilling — put the U.S. back on the energy scene. The country now produces 7.8 million barrels of oil a day, says Bloomberg Businessweek, up from 5.2 million in 2005.

If production goes on as planned, The International Energy Agency has said the U.S. is on track to be the the top oil producer in the world by 2020, and some have said the ultimate goal of "energy independence" is just a stone's throw from there. On Wednesday, at the Organization of the Petroleum Exporting Countries' conference, former Secretary of Defense Leon Panetta said, “I think by 2020[…] there’s a very good chance the United States could be energy independent," reports Free Beacon.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But not everyone seems so confident. The U.S.'s energy plans rely on continuing to reap huge amounts of oil from the country's shale deposits, which could prove a lot less fruitful than originally thought, says Bloomberg Businessweek's Asjylyn Loder. "Shale wells start strong and fade fast, and producers are drilling at a breakneck pace to hold output steady," she explains.

Loder describes how this boom differs from past ones:

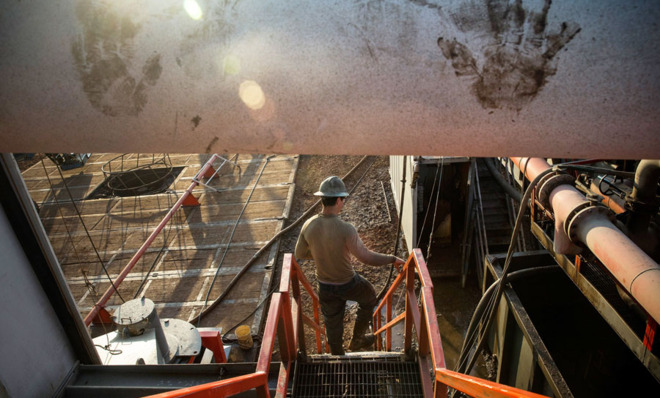

The U.S. Energy Information Administration estimates that about 29 percent of U.S. oil production today comes from so-called tight oil formations. These dense layers of rock and shale are cracked open by blasting water, sand, and chemicals deep underground, creating fissures that allow the oil to flow into horizontal pipes, some of them thousands of feet long. Production from wells bored into these formations declines by 60 percent to 70 percent in the first year alone, says Allen Gilmer, chairman and chief executive officer of Drilling info, which tracks the performance of U.S. wells. Traditional wells take two years to slide 50 percent to 55 percent, and they can keep pumping for 20 years or more. [Bloomberg Businessweek]

For now, the industry is relying most heavily on two big fields: The Bakken shale in North Dakota, and Eagle Ford in Texas, which together account for most of the country's 43 percent rise in oil production since 2008. But some predict none of the other fields — which are smaller and quickly exhausted — will ever be as productive.

Mark Papa, chairman of EOG Resources, an independent oil and gas exploration company which has flourished during the boom, told Christopher Helman in Forbes this summer that the American oil boom is "not going to be as massive as people think." In fact, he told Helman, "The chances of the U.S. being independent in oil are very slim."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Loder also points to a financial concern: Shale wells cost $3.5 million to $9 million to drill, depending on the rock, while classic oil wells runs at more like $400,000 to $600,000.

That's a lot to invest on wells that may quickly run dry.

So, what happens if the naysayers are right, and the U.S. shale boom quickly goes bust? This week, a report from the Council on Foreign Relations explains that while such an event would leave some state economies in the lurch, a few factors might make the country less vulnerable than they were to past shocks. For one, other energy resources like renewables are gaining ground. And as The American Interest explains:

The upshot of all of this: When a source of supply is disrupted, the rest of the world can do more to pick up the slack and even out price spikes. That, combined with increases in energy efficiency (resulting in lower domestic energy demand), makes the prospect of a shale bust seem a lot less threatening. [The American Interest]

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.