Finding financial freedom: How I paid off $20,000 in debt

"I had no idea how much I owed, or to whom. I was that adorable ostrich with its head in the sand."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

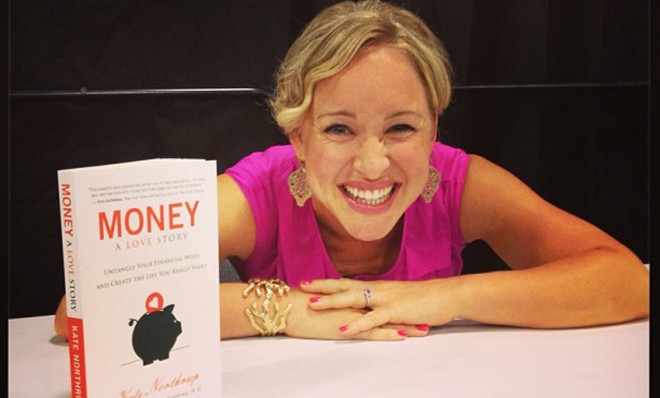

In 2009, Kate Northrup, then just 26, was making more money than most 20-somethings running a successful direct-sales marketing company, with more than 3,000 other entrepreneurs reporting to her.

There was just one problem: Northrup was deep in debt.

Despite the fact that she was earning a plum salary, Northrup hadn't managed to amass any savings. Instead, she'd spent beyond her means — eventually digging herself into a $20,000 hole.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"I didn't open my mail, so I had no idea how much I owed … or to whom," Northrup says. "I was that adorable ostrich with its head in the sand."

Once she took stock of her situation, Northrup pinpointed her financial ignorance to an unlikely source: low self-esteem or, what she calls a lack of self love. "It doesn't matter how many financial strategies you know," she says. "If you don't value yourself, you won't actually do them."

Thanks to her newfound sense of accountability, she slowly but surely climbed her way out of debt within two years — and then wrote a book about her journey. We asked Northrup to share some key insights from Money, A Love Story: Untangle Your Financial Woes and Create the Life You Really Want, including how you, too, can approach your own finances with a bit more love.

LearnVest: What inspired you to write the book?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kate Northrup: It was my own experience of getting into debt, and then getting out of it. I never had a problem making money — the hard part was keeping it. I used to hope that somebody else would just take care of it for me. I also believed that if I kept making more money, I'd eventually figure it out. Obviously, as I learned, that's not the case. I needed to pay better attention to the money I was making in a loving way. As a result, I've been able to make and keep more — and give more.

But what's love got to do with money?

Just like any other relationship, your life with money has its ups and downs, its twists and turns, its breakups and makeups. And, just like other relationships, living happily with it really comes down to love — being stressed and overwhelmed by money only makes us retreat.

So what's key to fostering a more loving relationship with money?

Pay loving attention to the money you already have by tracking your spending (the free LearnVest Money Center can help with that!), knowing where your money is going, what investments you have — and to whom you owe what.

How did you go from having $20,000 of debt to being debt-free?

For starters, I had to get super honest with myself. Until that point, I only made slightly above the minimum payments on my credit cards just to keep treading water, so I finally sat down and opened every statement that I had been ignoring.

And once I looked at the numbers, I made a spreadsheet with all of the information — the remaining balances, the APR rates, the minimum payments and the due dates. I know that sounds simple, but I'd been avoiding doing that for years! I knew I had debt, but I didn't want to know how much. Taking that first step was huge — you can't chart a new course without knowing where you are now.

I also finally forgave myself for the financial decisions that had gotten me into debt, and I stopped making myself feel like a bad person. When we spend time and energy beating ourselves up and wishing things were different, we just get more stuck. So get into action as soon as possible. Guilt and regret are wasted emotions.

A lot of people avoid dealing with money because they're scared or overwhelmed. Any advice?

I recommend finding a friend and make that person your accountability partner. Make sure it's someone who will get on the financial consciousness path with you, and with whom you can check in — and who will check in with you — on a weekly basis. Getting out of avoidance is about community. Creating a support system around a goal makes us take action and keeps us from sitting alone in the do-nothing states of fear and anxiety.

How does your book differ from other money how-tos out there?

It's fun. But, most of all, it's kind. So much of the financial advice that I come across is all about blame and shame. If you're in debt or if you haven't saved for retirement, then you're most likely already beating yourself up about it. You don't need another person wagging a finger at you! This book is as much about falling in love with yourself as it is about falling in love with your money.

More from LearnVest...