Is our national debt problem solved?

The Congressional Budget Office just lopped $200 billion off the federal deficit. Laissez les bon temps rouler?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

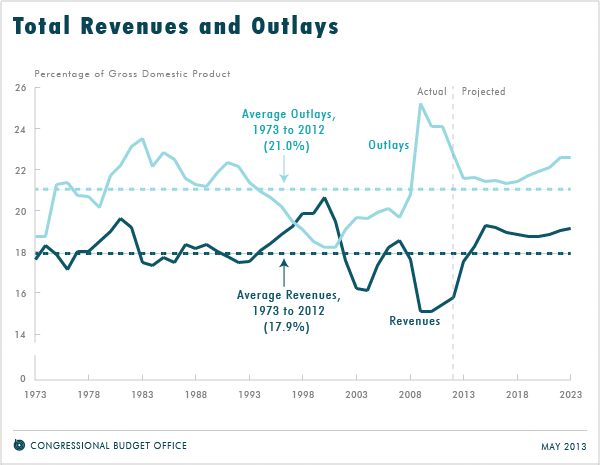

On Tuesday, the Congressional Budget Office revised its estimates about the federal deficit, and it was music to fiscal hawks' ears. "If the current laws that govern federal taxes and spending do not change, the budget deficit will shrink this year to $642 billion," the CBO says. That's $200 billion less than the CBO's last estimate, in February, and the smallest deficit since President Obama took office.

As a percentage of gross domestic product, things look even better. This year, the deficit should be 4 percent of GDP, from 10.1 percent in 2009, and it should fall to 2.1 percent of GDP by 2015 — that's better than the average of "3.1 percent of GDP over the past 40 years and 2.4 percent in the 40 years before fiscal year 2008," the CBO says.

What accounts for this surprising turn of fiscal events? In the short run, the CBO says, we can thank "higher-than-expected revenues and an increase in payments to the Treasury by Fannie Mae and Freddie Mac." Go figure, says Steve Benen at MSNBC. "Thanks in large part to higher taxes on the wealthy, which Republicans said would not reduce the deficit, deficit reduction is picking up speed at a pace few could have predicted."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Let's say this plainly: For those who saw the federal budget deficit as a "problem," it's fair to say this problem has been largely fixed. And while we're at it, let's also not forget that Republican talking points on fiscal policy have effectively been left in tatters, and every conservative political figure who's declared "Socialist Obama is turning America into Greece!" looks incredibly foolish right now.... It's time to stop worrying about a shrinking deficit and start worrying about creating a more robust economic recovery. [MSNBC]

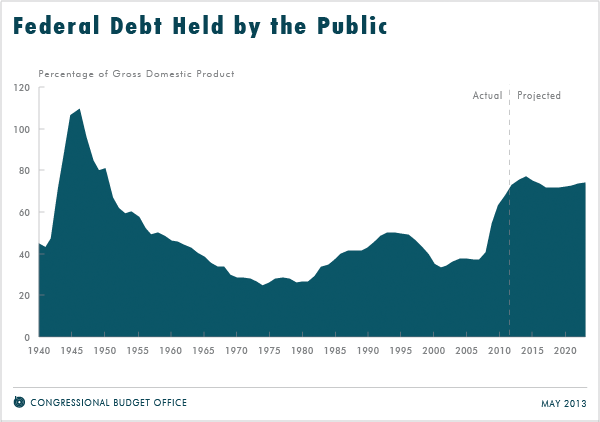

Let's not pop open the champagne just yet, says Veronique de Rugy at National Review. While things are looking up "on a superficial level," she says, the national debt isn't shrinking much. Right now, the debt-to-GDP ratio is at around 76 percent, and while that drops to 71 percent this year, it rises back to 74 percent by 2023. And "that's if Congress doesn't overturn sequestration and if all the CBO projections materialize." The bottom line is that the government is still spending too much money, de Rugy argues. "Now is not the time to fall asleep on the switch and stop worrying about spending. The government is still too bloated and its size and scope need to be reduced."

This reduction in our fiscal situation is "like the quiet before a storm," says Romina Boccia at the Heritage Foundation. With entitlement programs like Medicare and Social Security only growing, "the nation's long-term spending trajectory remains on a fiscal collision course."

It's true that "the important budget deficit problem is actually outside the 10-year window," says Matthew Yglesias at Slate. For 10 years, thanks mostly to slowing health care costs, the deficit shrinks by $618 billion compared to the last estimates, but then, assuming nothing changes, it will "grow and grow forever." The lesson to take from this welcome short-term news is that "a stronger-than-expected economy leads to a smaller-than-expected deficit." The big takeaway, Ygelsias adds, "is that there's really no need to panic or think that there has to be a grand bargain. What we need are more measures to reduce the cost of health care and more measures to boost economic growth."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day