College loans: Getting a grip on a deepening crisis

Be very wary of taking out student loans

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Be very wary of taking out student loans, said Shanthi Bharatwaj in TheStreet.com. A new report says that student debt and delinquencies are skyrocketing at an “eye-popping” rate, and that’s bad news for the economy. Student debt is now the second-largest category of household debt, behind mortgages, having “essentially tripled” to $966 billion in the last eight years. As many as 6.7 million people, or 17 percent of all student loan borrowers, are more than 90 days behind on their payments and considered “seriously delinquent.” So before you laden yourself with student debt, be aware that it can become a “dark cloud” later in life. Students who take on too much debt “might also face difficulty accessing mortgage credit in the future,” thanks to rules that say borrowers can’t qualify for a mortgage if they spend more than 43 percent of their income on other loan payments. They may also struggle to get other credit, including credit cards and auto loans.

The reasons for this disaster are clear, said Tim Fernholz in QZ.com. “Higher education gives students a greater chance of prosperity, making it a sought-after commodity. But the cost of it has far outstripped inflation.” So it’s a good thing that the White House is finally trying to force colleges to be more transparent about how their graduates fare in the job market. Let’s hope Congress also acts to allow student debt to be discharged in bankruptcy, like every other kind of debt.

At least for those with private loans, there might be a light at the end of the tunnel, said Ann Carrns in The New York Times. The Consumer Financial Protection Bureau is seeking “more detailed information on ways to encourage the development of more affordable loan repayment mechanisms for private student loan borrowers.” While most student debt is made up of government-backed loans, more than $8 billion in private loans are in default, according to the CFPB. Private student loans are often more expensive than federal loans and lack borrower protections such as income-based repayment plans for cash-strapped borrowers. They also have fewer options for refinancing: “Unlike a mortgage, which is secured by a home, a student loan is not secured by specific collateral—so interest rates tend to be higher.” Rohit Chopra, the CFPB’s student loan ombudsman, said the agency has launched a “quest to make student loan repayment more flexible and easier for borrowers.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That’s a noble quest as far as it goes, said Daniel Luzer in Washington Monthly. But “private student loans are a very small part of the education debt problem,” making up only about 15 percent of total student debt. Going after that “is sort of like trying to fix climate change by focusing only on the carbon emissions of Europe.” It may make the new consumer protection agency feel like it’s pushing for reform, but it won’t do much to quell “the student debt domino effect on the economy.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

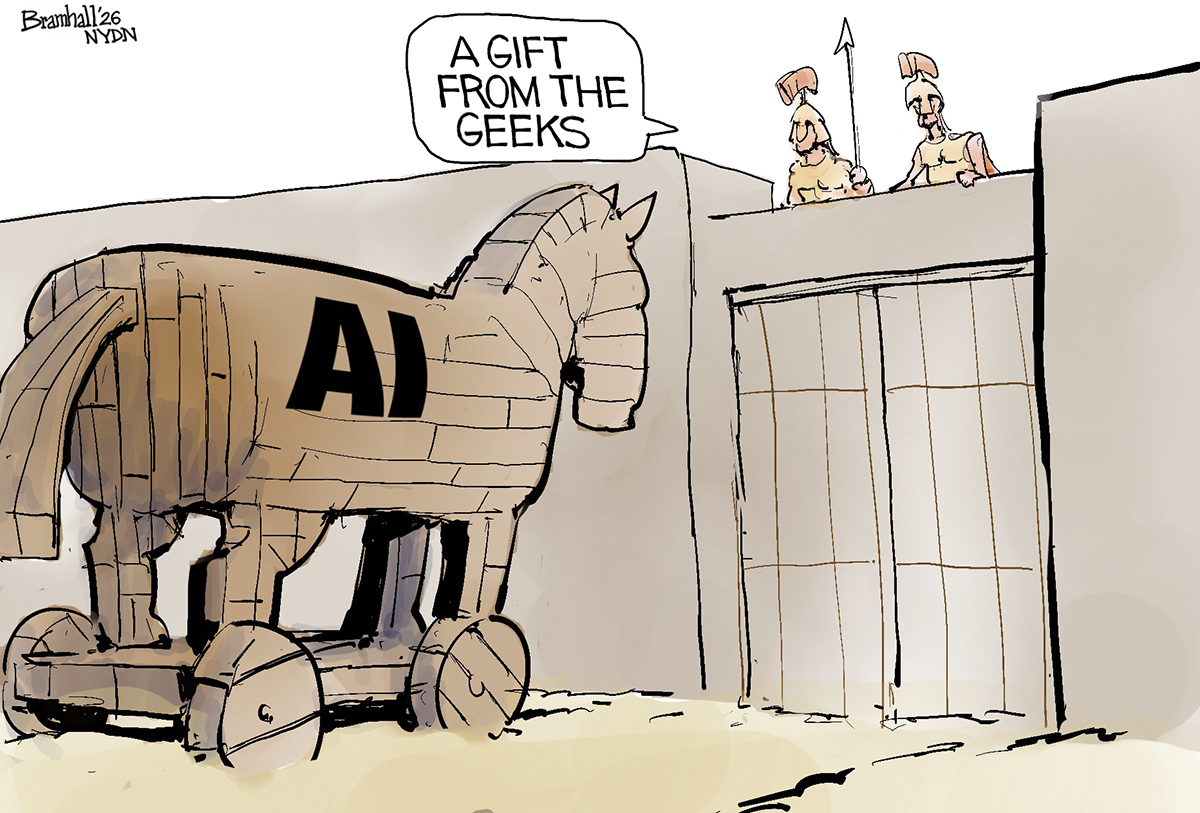

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’