Can the Fed lower the jobless rate?

By making public its desire to lower unemployment, the Fed hopes to inspire investors "to behave in ways that help bring that about"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

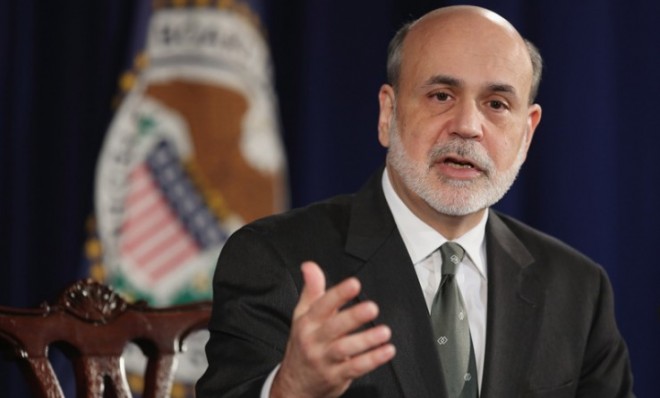

The Federal Reserve's announcement last week "would have stunned and dismayed earlier generations of central bankers," said Binyamin Appelbaum in The New York Times. Instead of the usual Delphic obfuscation, the Fed explicitly tied its future policy to concrete economic objectives, saying it would keep interest rates close to zero until unemployment falls to 6.5 percent, as long as inflation stays in check. It's not just the clarity that's a departure, said The Economist. It's been decades since the Fed emphasized that unemployment, and not just inflation, "carried weight in its decisions." Chairman Ben Bernanke downplayed the announcement as a mere "guidepost" for investors, "but it's actually much more than that." By making public its desire to lower unemployment, the Fed hopes to inspire investors "to behave in ways that help bring that about."

"The Fed tried this before and failed — with disastrous consequences," said Robert J. Samuelson in The Washington Post. In the 1970s, it pegged its interest rates to target both inflation and unemployment, and "the result was economic schizophrenia." When credit was eased to cut unemployment, inflation soared; that led in turn to tighter credit and more job losses, launching a vicious cycle of stagflation. "By 1980, inflation was 13 percent and unemployment 7 percent." The Fed has learned a lot since then, but I still doubt it can "predictably hit a given mix of unemployment and inflation." For all its heroic efforts to revive the economy, the Fed failed to predict or prevent the financial crisis and "has consistently overestimated the recovery's strength."

Let's give credit where it's due, said Daniel Gross at The Daily Beast. The Fed responded to the lagging economy in 2010 and 2011 "with innovative and controversial efforts to goose activity." Largely as a result, "the economy has actually been doing sort of okay this year." An explicit targeting of unemployment is a "very consequential announcement," but the markets greeted it with equanimity because Bernanke's policies have generally worked. Bailouts, including the rescue of AIG, have been successfully unwound, and we never had the massive inflation, high interest rates, and debased currency many feared. It's a pretty remarkable record, said Zachary Karabell at The Atlantic. Central bankers like Bernanke are "tending to the financial system with greater nimbleness, creativity, and maturity than their political counterparts or any other societal actor." Compared with our feckless lawmakers, they look like "giants among the pygmies."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com