Is the era of free checking accounts over?

Facing new government regulations and a lackluster economy, the financial industry is forcing customers to pay more just to park their money at the bank

"If free checking accounts were animals, they'd be on the World Wildlife Fund's list of endangered species," says Catherine New at The Huffington Post. This week, industry trade group Bankrate reported that only 39 percent of checking accounts in America are free (meaning they require no minimum balance and don't charge a monthly fee). The free checking account used to be nearly ubiquitous — clocking in at a high of 76 percent in 2009 — but banks have been cutting back their largesse in a bid to squeeze more money out of customers. Here, a guide to the trend:

Why do banks need more revenue?

New government regulations and a struggling economy have eaten into bank profits. President Obama's 2010 overhaul of the financial system, which is meant to protect consumers from bad banking practices, curbed the ability of banks to charge customers overdraft fees. Major banks have tried to offset the losses in numerous ways, most prominently by trying to charge customers for using their debit cards, which was met with a severe public backlash.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How much does a checking account cost now?

Bankrate found that customers on average had to keep a minimum of $723 in their accounts to avoid a fee, which is up 23 percent from the previous year. The average monthly fee for a non-interest checking account is $5.48, up 25 percent from 2011. Bank of America, for example, is planning to charge certain customers between $9 and $25 to keep a checking account. Wells Fargo and JPMorgan Chase are considering similar measures.

How can customers avoid paying a fee?

Bankrate advises bank customers to set up direct deposit, which banks sometimes accept as a substitute for a fee or a minimum balance. However, that doesn't help people who work part time. In those cases, Bankrate recommends moving to a bank or credit union with free checking. Analysts note that 70 percent of large credit unions still offer free checking accounts.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Will customers switch banks?

Probably not. "Changing banks entails the hassle of rerouting direct-deposit payments and uprooting automated bill-paying arrangements," says Robin Sidel at The Wall Street Journal. "Many bankers are pushing ahead with the new, higher fees in a bet that customers won't switch.

Sources: Bankrate, Business Insider, The Huffington Post, The Los Angeles Times, NBC News, The Wall Street Journal

-

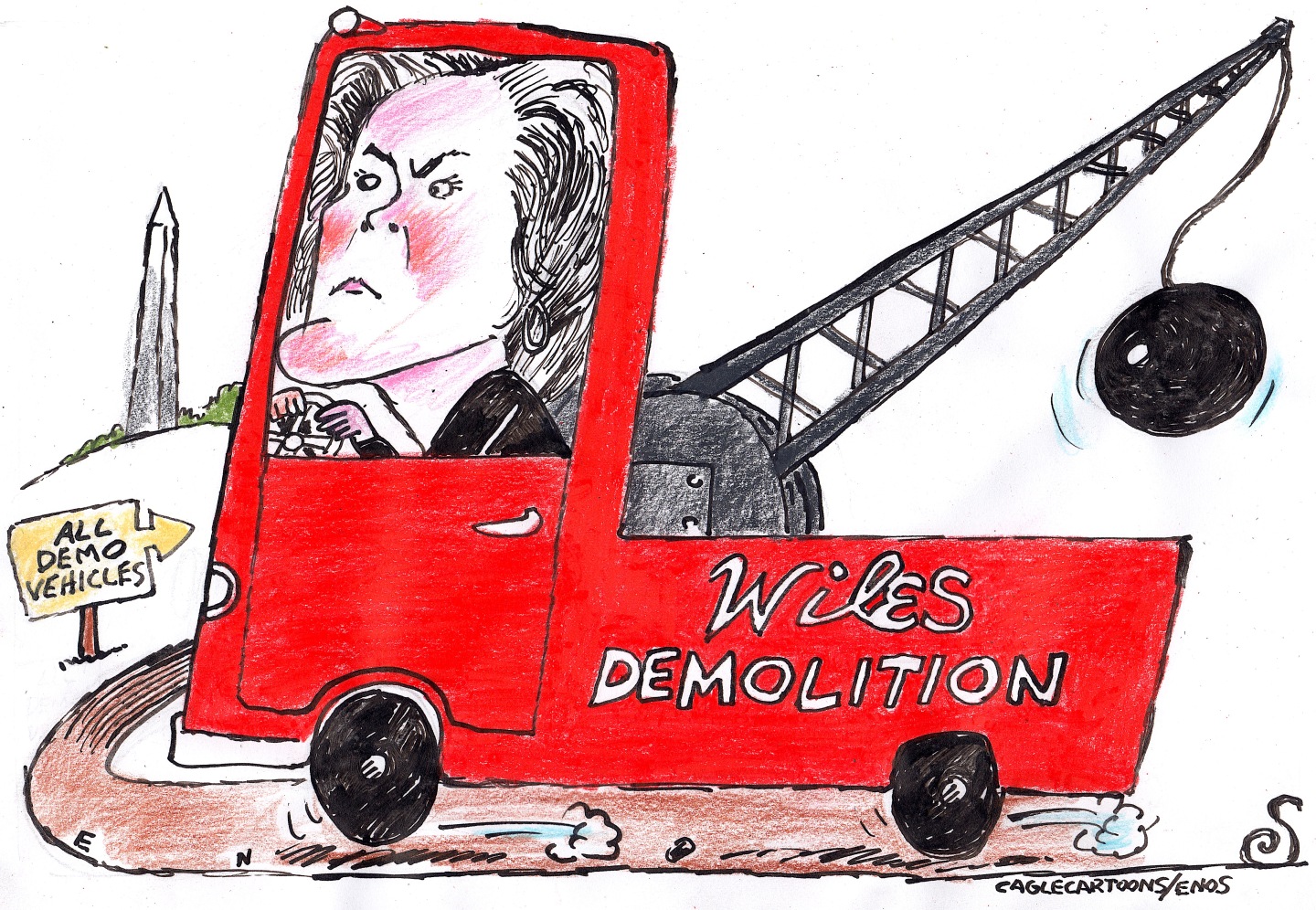

5 fairly vain cartoons about Vanity Fair’s interviews with Susie Wiles

5 fairly vain cartoons about Vanity Fair’s interviews with Susie WilesCartoon Artists take on demolition derby, alcoholic personality, and more

-

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s Wife

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s WifeIn the Spotlight Trollope found fame with intelligent novels about the dramas and dilemmas of modern women

-

Codeword: December 20, 2025

Codeword: December 20, 2025The daily codeword puzzle from The Week