Did JPMorgan CEO Jamie Dimon break the law?

The mega-bank's stock is plunging, its reputation has been battered, and now the Justice Department is investigating whether it committed a crime

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

JPMorgan Chase, the country's largest bank, continues to reel from its $2 billion trading loss last week, which critics are touting as evidence that Wall Street is still making the types of dangerous bets that caused the financial crisis in 2008. JPMorgan Chase's stock plunged by nearly 10 percent the day after CEO Jamie Dimon disclosed the loss, erasing $13 billion from the company's value. Dimon, one of the loudest voices against government regulation of Wall Street, has been pilloried in the press for what he has described as a "terrible, egregious mistake." And now the Justice Department is investigating whether the controversy involved more than mere blunders, raising the prospect that the bank or its executives could be charged with violating securities laws. Did Dimon do anything illegal?

Dimon might have misled shareholders: When news reports shed light on the bad bet a month ago, Dimon dismissed them, saying they were nothing more than a "tempest in a teapot," says Peter J. Henning at The New York Times. It's illegal for executives to make false or misleading statements about "material information" to shareholders, and Dimon's "reassuring statements may have given an increasingly false sense of security to investors about JPMorgan's risk management." Federal investigators will have to figure out what Dimon knew about the trade, and when he found out it had gone sour.

"JPMorgan's loss: Illegal, or just bad judgment?"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Dimon messed up, but he didn't commit a crime: "We appear to be on the verge of making it a crime for a business to lose money," says Jonathan Macey at The Wall Street Journal. JPMorgan's loss is no one's business but its "stockholders and a few top executives and traders who will lose their bonuses or their jobs." Instead of cracking down, the government should trust that a profit-seeking entity like JPMorgan will "learn from this experience and do a better job" next time. Instead, the government is exploiting the controversy to increase its "power and influence."

But this is hardly the bank's first offense: Dimon's JPMorgan has "systematically engaged" in legally dubious practices for years, says Richard Eskow at The Huffington Post. The company has "paid out billions to settle charges" that include bribery, corruption, perjury, forgery, investor fraud, and more. JPMorgan's "vast wealth" means lawsuits are nothing more than the cost of doing business in a "corrupt political system," which has failed to actually prosecute any executive connected to the financial crisis. What a shame.

"Jamie Dimon's JPMorgan Chase: Why it's the scandal of our time"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

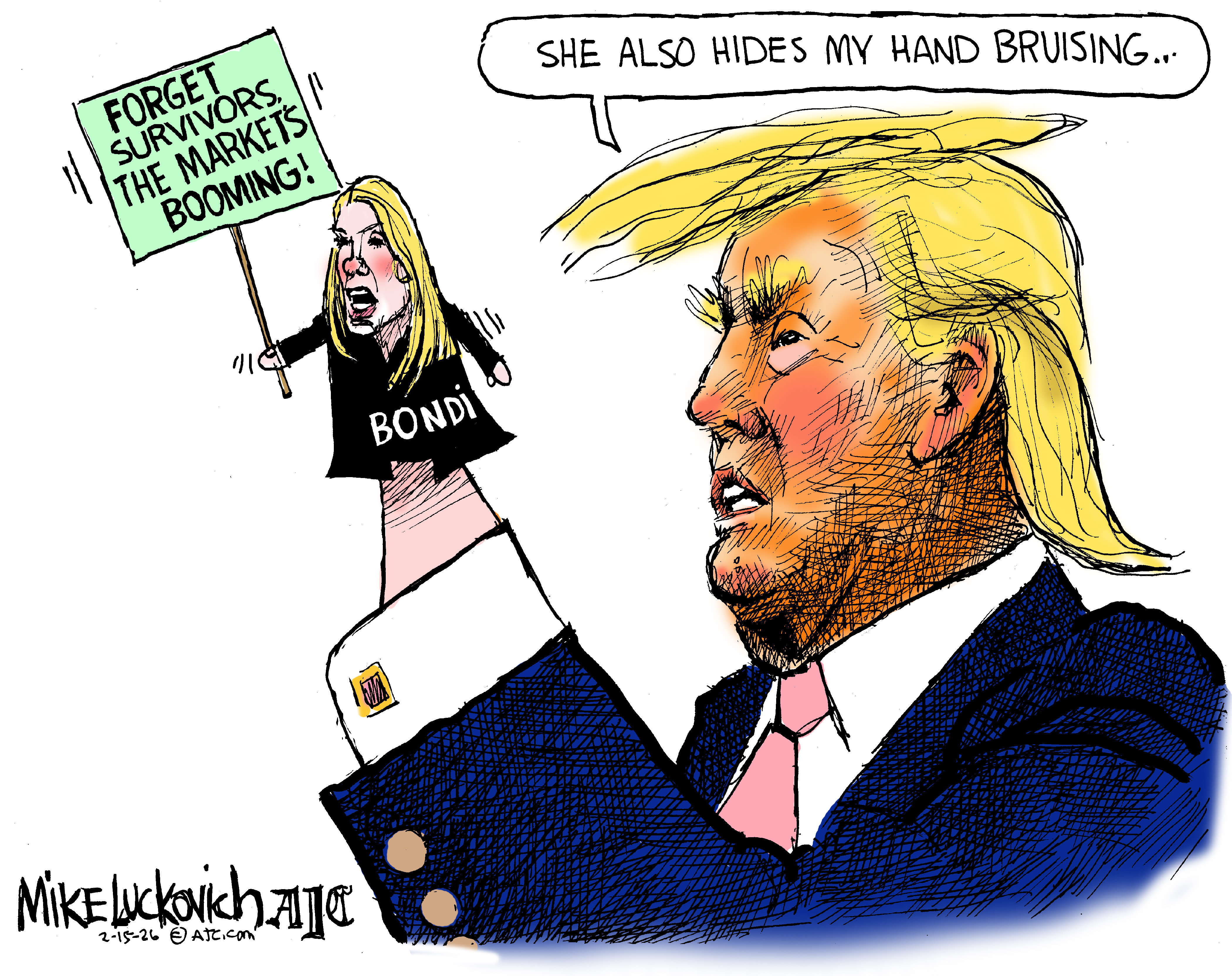

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’