Does avoiding taxes make Apple evil?

The tech innovator gets out of paying billions in corporate taxes every year by using perfectly legal — and perhaps questionable — loopholes

Apple is facing an angry backlash over the elaborate tactics it uses to sidestep taxes, such as setting up subsidiaries in low-tax states and foreign countries. Sen. Tom Coburn (R-Okla.) says he's "livid" about Apple's accounting tricks, which, according to a New York Times report, help the tech giant avoid paying billions of dollars in corporate taxes on the money it hauls in on iPhone and iPad sales every year. Apple says it "has conducted all of its business with the highest of ethical standards," and points out that its tax strategies are perfectly legal. Is Apple's accounting unscrupulous, or is it just good business?

Apple should be ashamed: Apple may be "one of America's most admired companies," says David Callahan at Policy Shop, but it's "also among its least ethical." Sure, it's not the only company called out for using Chinese factories that are tough on their workers, and many U.S. corporation "exploit tax loopholes," but "as the nation's top company, it has a greater responsibility for ethical leadership." And it certainly "can afford to behave better."

"iCheat: Apple's tax avoidance"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It's sketchy, but Apple does make lots of its money abroad: "Yes, it's frustrating, and yes, it's morally debatable," says Derek Thompson at The Atlantic. But the Googles and Apples of the world make a big chunk of their money overseas, and "they're going to use (legal) overseas loopholes to hide their money from our relatively high corporate tax rate" to maximize profits for their investors. Instead of worrying about it, we should "focus the tax revenue debate where it belongs": On what people earn at home.

"Are Apple's tax games bad for America?"

Apple isn't evil; our tax code is: Apple isn't doing anything wrong, says Christopher Bergin at The Huffington Post. It's merely "taking advantage of the tax rules as written." It's the tax code that's unfair, so "let's put the blame where it belongs." Instead of berating Apple, we should be putting pressure on our elected officials to fix our "unfair and broken tax system."

"Apple sidesteps taxes — what's wrong with that?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Magazine solutions - January 23, 2026

Magazine solutions - January 23, 2026Puzzle and Quizzes Magazine solutions - January 23, 2026

-

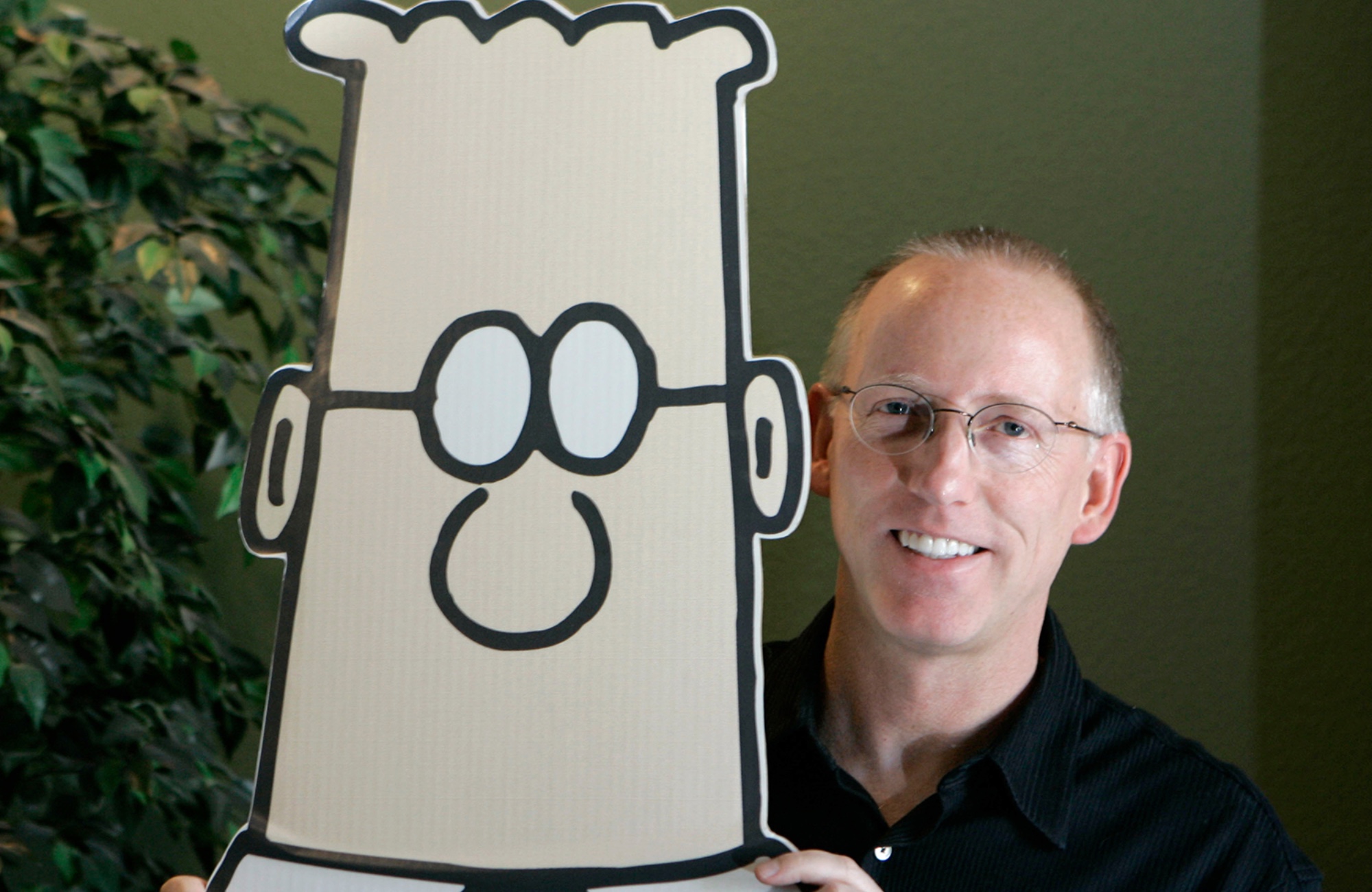

Scott Adams: The cartoonist who mocked corporate life

Scott Adams: The cartoonist who mocked corporate lifeFeature His popular comic strip ‘Dilbert’ was dropped following anti-Black remarks

-

The 8 best animated family movies of all time

The 8 best animated family movies of all timethe week recomends The best kids’ movies can make anything from the apocalypse to alien invasions seem like good, wholesome fun