MF Global's 'spectacular' collapse: Winners and losers

The brokerage firm files for Chapter 11 in one of the biggest bankruptcies in U.S. history. But not everyone is particularly upset

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

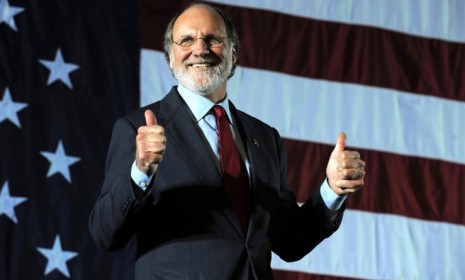

Brokerage firm MF Global's "spectacular" collapse — after placing massive bets on debt-ridden European countries and then failing to sell itself when hundreds of millions of dollars in customer funds went missing — left plenty of wreckage in its wake. When former New Jersey Gov. Jon Corzine (D) took over as CEO in March 2010, he aspired to turn MF Global into a "mini-Goldman," which investors found plausible since Corzine once headed up Goldman Sachs. Instead, MF Global's implosion has become more of a mini–Lehman Brothers, the last big Wall Street bankruptcy. Here are some winners, and some decided losers, from MF Global's failure:

WINNERS

Jon Corzine

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

His company is toast, and Corzine is out of a job, says C.J. Ciaramella at The Daily Caller. "But don't worry. He'll be just fine," thanks to an expected $12.1 million severance package — or, what "critics of Wall Street excess, like [President] Obama, often call 'golden parachutes.'" And even if his severance "is rescinded by the bankruptcy court," says Nin-Hai Tseng at Fortune, the multi-millionaire will hardly be hurting for cash.

Corzine is not only a former Democratic governor and senator, he's also a prolific fundraiser for Democrats and Obama. So "the Republican National Committee wasted no time trying to score political points" from his firm's collapse, say Herb Jackson and Juliet Fletcher in The Record of Hackensack, N.J. "Obama has had a lot to say about Occupy Wall Street but probably won't say anything about Jon Corzine," the RNC said. Tom Wilson, a lobbyist and New Jersey Republican official, added, "I'm sure the folks in the White House are sweating this a little bit."

Regulation

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"The failure of MF Global leaves egg on many faces," says Antony Currie at Reuters Breakingviews. But former Federal Reserve Chairman "Paul Volcker and Barack Obama are among those to escape the mess." When Obama added the complex, risk-limiting Volcker Rule to last year's financial overhaul, "it looked like overkill." But so far, MF Global's collapse seems unlikely to spread much beyond its own misery. That's a pretty big endorsement of "getting regulations like the Volcker Rule written and implemented correctly."

LOSERS

Jon Corzine

So much for Corzine's comeback after losing his re-election bid in 2009, says Megan McArdle at The Atlantic. His political and financial reputation is in tatters now, and he's "not a popular man with, well, pretty much anyone." In fact "the unholy glee in his fall has been surprisingly well distributed" across the political spectrum. And it gets worse: If MF Global dipped into its clients' funds for its spectacularly ill-placed gamble on European debt, as seems likely, that's "the regulatory equivalent of a felony offense." It's a safe bet "someone's going to jail. And they should be pretty senior."

MF Global's investors

Obviously, the "biggest losers" will be MF Global's various stakeholders, says Fortune's Tseng. The largest common shareholders — Guardian Life Insurance Co., Fine Capital Partners, Cadian Capital Management, and TIAA-CREF — stand to lose millions, and even top preferred stockholder J. Christopher Flowers, a private equity investor and Corzine friend from their days at Goldman, will reportedly lose $47.8 million. Some big banks face big losses, too: JP Morgan Chase and Deutsche Bank each have unsecured debt worth about $1 billion, and they're in line behind the secured lenders.

Goldman Sachs

When investors are asked why they weren't warier of Corzine's high-risk, highly leveraged trades, they reply: "He was from Goldman Sachs," says Andrew Ross Sorkin in The New York Times. "Being a former Goldmanite has long been considered the ultimate calling card," thanks to Goldman's mythical status atop Wall Street's power grid. But "a series of blunders by former senior Goldman executives raises questions about whether Goldman's secret sauce can actually be exported," or whether the "Goldman halo" is really so golden after all.

-

How to Get to Heaven from Belfast: a ‘highly entertaining ride’

How to Get to Heaven from Belfast: a ‘highly entertaining ride’The Week Recommends Mystery-comedy from the creator of Derry Girls should be ‘your new binge-watch’

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie