MF Global: Where is the bankrupt firm's missing $700 million?

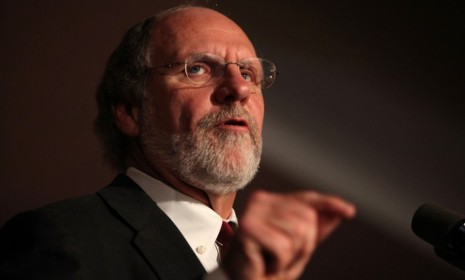

Jon Corzine's brokerage house files for bankruptcy — after the feds discover loads of cash missing from customers' accounts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

MF Global is broke. In "the biggest bankruptcy of 2011, by a mile," the brokerage firm headed by former New Jersey Gov. Jon Corzine (who also used to lead Goldman Sachs) filed for Chapter 11 protection on Monday. It's the "eighth-biggest" bankruptcy in U.S. history — and MF Global's failure is already being labeled a "baby Lehman." The bankruptcy filing followed MF Global's many risky bets on debt-ridden European countries, and a scuttled plan to sell itself to a rival brokerage firm to get out of the red. That deal was killed at the last minute, after federal regulators discovered that hundreds of million of dollars in client money was missing from MF Global's customer accounts. What happened to all the cash? Here, three theories:

1. Maybe customer cash was illegally mixed with company money

It seems "very likely" that the $700 million went missing because MF Global mixed clients' funds with company cash to stay afloat when its own trades went south, says "Tyler Durden" at Zero Hedge. If that happened, "someone has to go to jail." And that someone "should be none other than Jon Corzine himself." Well, the feds are continuing to look into the matter, and while the investigation "is in its earliest stages," it "may uncover something... intentional and troubling," says The New York Times. "One can't rule out misbehavior as a possibility," Darrell Duffie, a Stanford University Graduate School of Business professor, tells the Financial Post. (MF Global's lawyers aren't commenting.)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. Hold on. It could be an honest mistake

It is possible that this was just an "accounting error" or a "technical glitch," Duffie says. "Yeah," an anonymous source at MF Global tells New Jersey's Star-Ledger. The company was rushing to get its books in order for the sale, and customers were hurriedly pulling their money out of the troubled company. Those two factors could have combined to create a huge accounting error.

3. Other banks might share some blame

It's far too soon to know exactly what happened, says David Teich at Talking Points Memo. Maybe MF Global really was using customer money to cover its positions. Or maybe it was just sloppy. But it's also possible that other banks where MF Global had investments are "simply refusing to send the troubled firm its own money" amidst this week's chaos.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. The money may still show up

Remember, says The New York Times, we originally thought as much as $950 million was missing. But as MF Global gets its books in order, that number has since fallen to less than $700 million. "Additional funds are expected to trickle in over the coming days." Stay tuned.

Editor's note: Since this article was published, MF Global has admitted to federal regulators that it illegally diverted funds from customer accounts. Regulators are still unclear as to what the funds were used for and how common the practice was.