Will Groupon's IPO save it?

The daily deals giant is finally going public on November 4 — potentially giving the cash-strapped company the massive capital infusion it craves

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Many tech darlings are holding off on their initial public stock offerings, hoping they can wait until the turbulent market becomes a bit more receptive. Not Groupon. After months of speculation, the daily-deals giant is going public on Nov. 4, seeking to raise as much as $540 million by selling off just 4.7 percent of its shares. Once an extremely promising web property, Groupon has fallen from grace in recent months, as filings revealed that the company is highly unprofitable and bleeding hundreds of millions dollars. Will an IPO help Groupon resume its meteoric rise?

Groupon really needs the cash: This move may be more "necessity than choice," says Ari Levy at Bloomberg. Groupon is strapped for cash, with marketing costs having grown by 37 percent last quarter. As of the end of September, Groupon owed merchants nearly twice as much as it held in cash. In the first nine months of the year, Groupon lost $214.5 million. But perhaps going public now "may cushion Groupon against slowing sales growth and ballooning costs and give the company time to tweak its strategy."

"Groupon IPO a must as cash needs climb with investor tally: Tech"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It's better for Wall Street insiders than Groupon: The Groupon IPO "has little to do with building a strong company or focusing on buy-and-hold shareholders," says Tom Taulli at Forbes. It's "really just Wall Street's financial engineering at work." Share prices will likely surge at first and then take a tumble, giving short sellers a chance to get in and then make a tidy profit on the way down. "The bottom-line: Unless you are a quick-fire trader that can compete with hedge funds, you should stay away from the Groupon deal."

"Groupon: The shorts are sharpening their knives"

Groupon still has a rough road ahead: "The riskiest time for the company will be early next year in Q1," says Henry Blodget at Business Insider. It's likely that in the last quarter of 2011, analysts will give Groupon a bit of a pass, and lowball estimates to set the company up to "beat expectations," even if it's performing poorly. But by next year, Groupon will really have to prove its $12+ billion valuation and be "truly surprising on the upside." That's no easy task for the struggling company.

"And now another analyst says Groupon is worth less than the IPO Price..."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

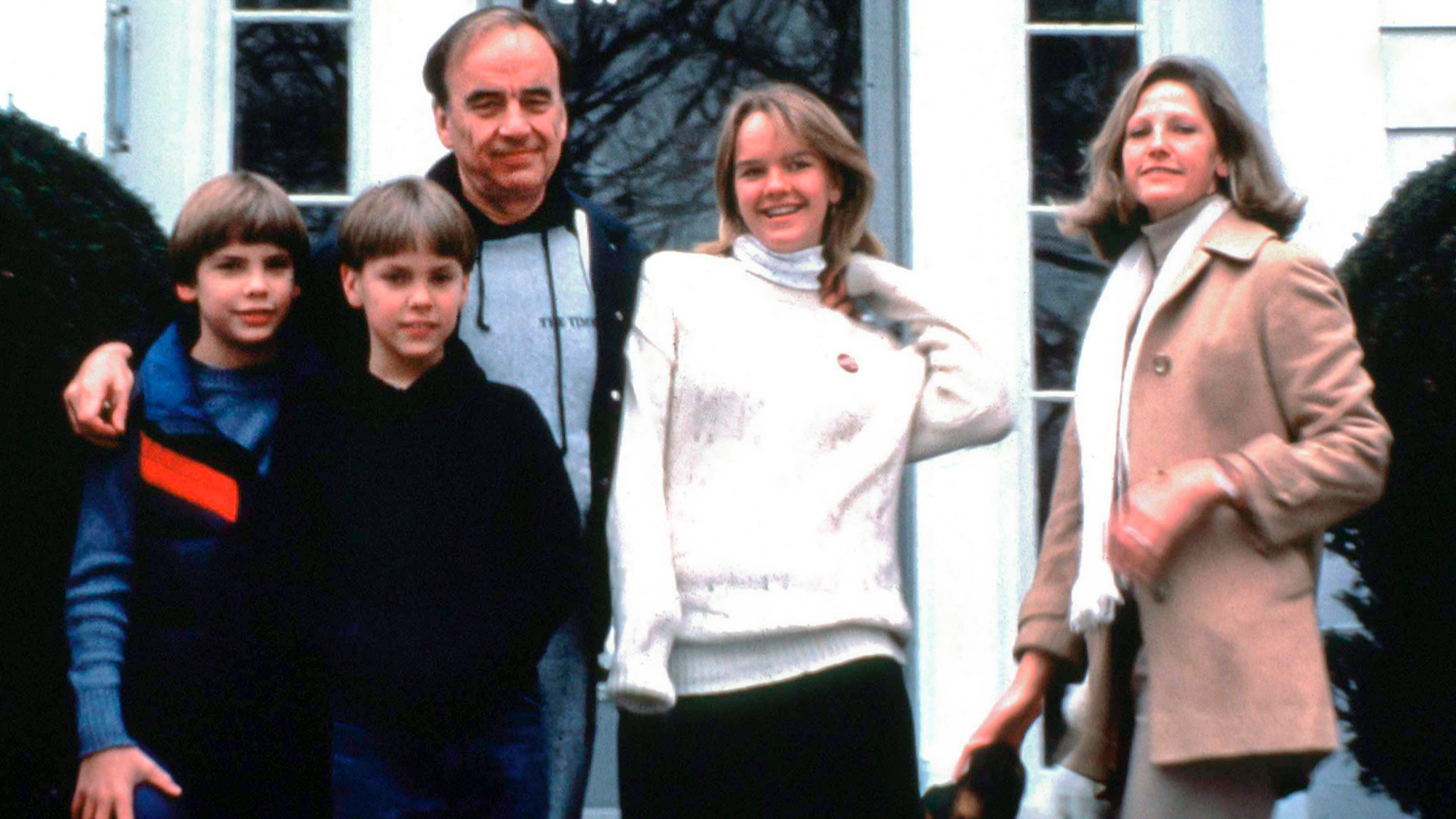

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

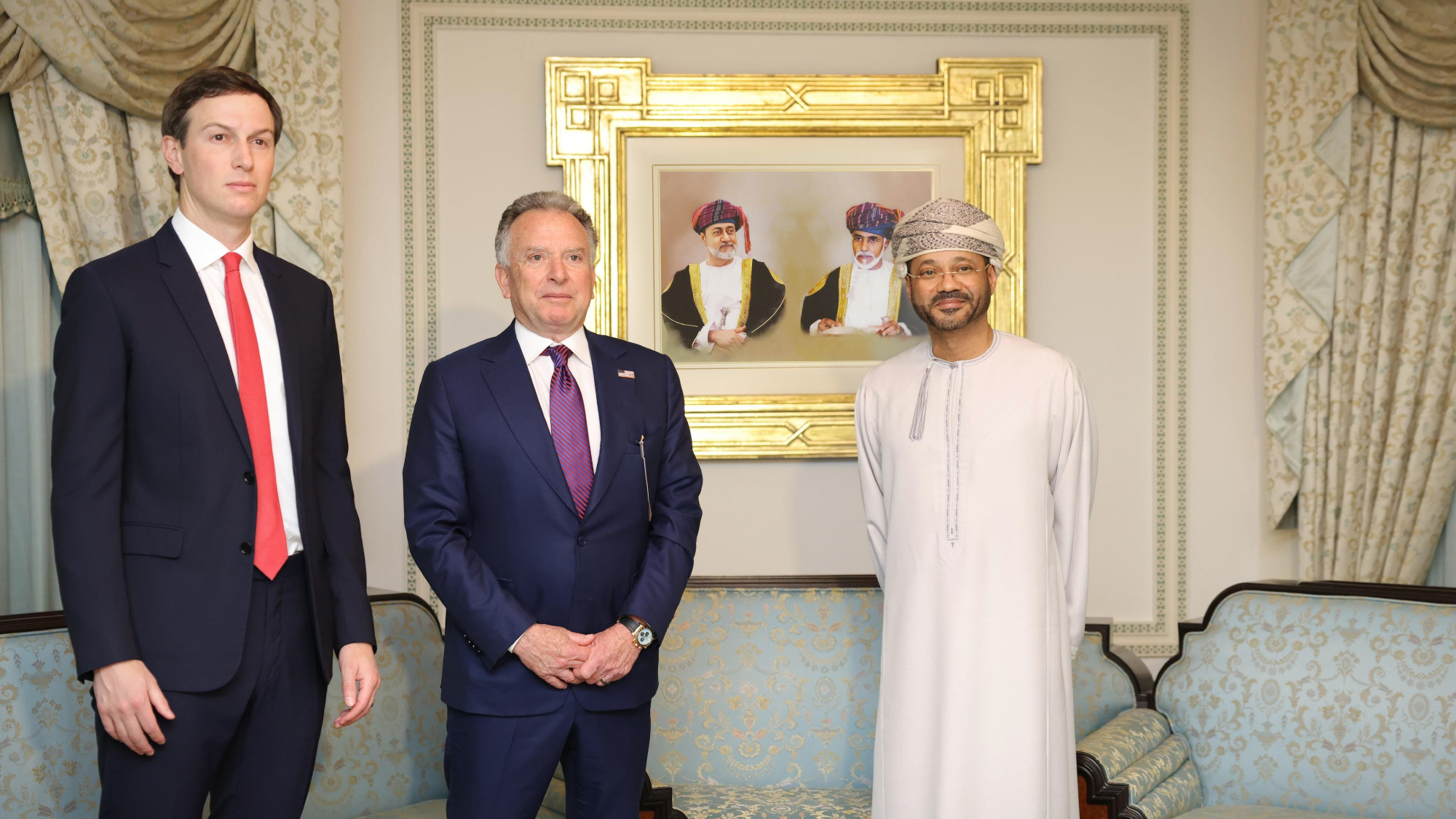

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine