The rise and fall of Kodak: By the numbers

After an incredible thirteen decades, the iconic American film and camera company is fighting for its survival

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

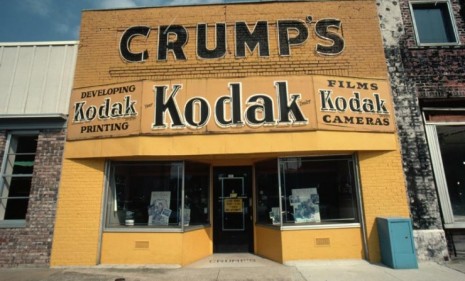

Eastman Kodak, the legendary American film and camera company that's struggled to adapt to the digital age, is teetering on the edge of bankruptcy. Though the company insists it has no intentions to file for bankruptcy protection, Kodak's share price plummeted to $0.78 on Friday amid fears of that very scenario. Here, a brief guide to Kodak's rise and fall, by the numbers:

131

Years Kodak Eastman Co. has been in existence. In 1880, George Eastman began commercially manufacturing dry photographic plates

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

$25

Price of the first Kodak camera sold in 1888. It came pre-loaded with enough film for 100 shots. After the film had been exposed, the user sent the whole camera to Rochester, N.Y., for the film to be developed, prints made, and new film inserted. That whole process cost another $10.

1896

The year the 100,000th Kodak camera was manufactured.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

50 million

Number of Kodak instamatic cameras produced from 1963 to 1970

$1 billion

U.S. sales for Kodak in 1962 — the first year the company reached that mark

$10 billion

Company sales in 1981

3

Number of straight years the company has been unprofitable. "Once synonymous with photography, Kodak has struggled with the move to digital cameras and failed to turn a profit since 2007," says Reuters.

More than $1.76 billion

Kodak's losses since 2008

$160 million

Amount the company disclosed it had borrowed against its credit line last week

As much as $3 billion

Estimated worth of Kodak's digital-imaging patents, which the cash-strapped company is reportedly looking to sell off

120,000

Number of people Kodak employed in 1973

86,000

Number of people Kodak employed in 1998

18,800

Number of people Kodak currently employees

$40

Value of Kodak shares in 2003, "when Eastman Kodak was one of the bluest of the blue chips." In September of that year, "the picture began to fade," says Franklin Paul at Reuters. "Film sales were dying, and Kodak slashed its dividend by 70 percent, hoping to gain flexibility as it beefed up spending on commercial and inkjet printers, medical imaging devices and other digital systems. It stopped investing in traditional consumer film."

$4.20

Amount Kodak shares were worth just one year ago

$.78

"Unbelievably low" price to which Kodak shares tumbled on Friday amid bankruptcy fears. "The decision is clear: either try to keep going or file for bankruptcy, which is no shame for an ordinary company, but quite a tragedy for the corporation that for years had huge success with its 'Kodak moment' ad campaign," says David Zielenziger in the International Business Times.

102 percent

Amount Kodak shares were up in Monday trading, following Friday's selloff

Sources: Bloomberg BusinessWeek (2), Democrat and Chronicle, Forbes, International Business Times, Kodak.com, Reuters, TheStreet, Wall Street Journal

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day