Is the Kindle Fire too cheap?

Many analysts estimate that Amazon is hawking its new $199 tablet at a loss. Does that make good business sense?

Amazon surprised much of the tech world when it announced last week that its new Kindle Fire tablet, which boasts a 7-inch color touchscreen, would retail for just $199 — less than half of what the cheapest iPad ($499) goes for. Many analysts estimate that, given the Fire's likely manufacturing costs, Amazon is actually selling it at a loss. Why? Presumably to challenge the iPad's dominance and get customers to buy more Amazon e-books, which they can read on the Fire. Is this a good business strategy?

No. This is a dead end: Amazon is counting on Kindle Fire owners buying oodles of the e-tailer's digital entertainment content, says Horace Dediu at Asymco. But "the margins for Kindle content are thin" already. And that limited profitability may make it harder for Amazon to constantly develop and release newer gadgets. Amazon apparently sees its first tablet as "the end of its evolutionary path," whereas Apple sees the 18-month-old iPad "as only the beginning."

"The case against the Kindle as a low end tablet disruption"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But the Fire will boost sales of all Amazon goods: For Amazon, this is not about selling either hardware or digital content, says Andrew Rassweiler at IHS. It's about selling those highly profitable goods, from diapers to shoes, that are Amazon's real bread and butter. Amazon can use its tablet to entice customers to buy all kinds of things with just one click, which may make selling the Fire at a loss "well worth it in the end."

"Amazon sells Kindle Fire at low profit margin to promote online merchandize sales"

And this is a time-tested formula: "Amazon isn't being that creative," says Gene Marks at Forbes. "Back in the day, Gillette sold its razors at rock bottom prices for the sole purpose of [creating a market for] razor blades." Amazon is just applying that old-school formula to its digital domain. "It's a new world. But the lessons have been around for a while.""

"Amazon's new Kindle: It's just old school"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Bad Bunny, Lamar, K-pop make Grammy history

Bad Bunny, Lamar, K-pop make Grammy historySpeed Read The Puerto Rican artist will perform at the Super Bowl this weekend

-

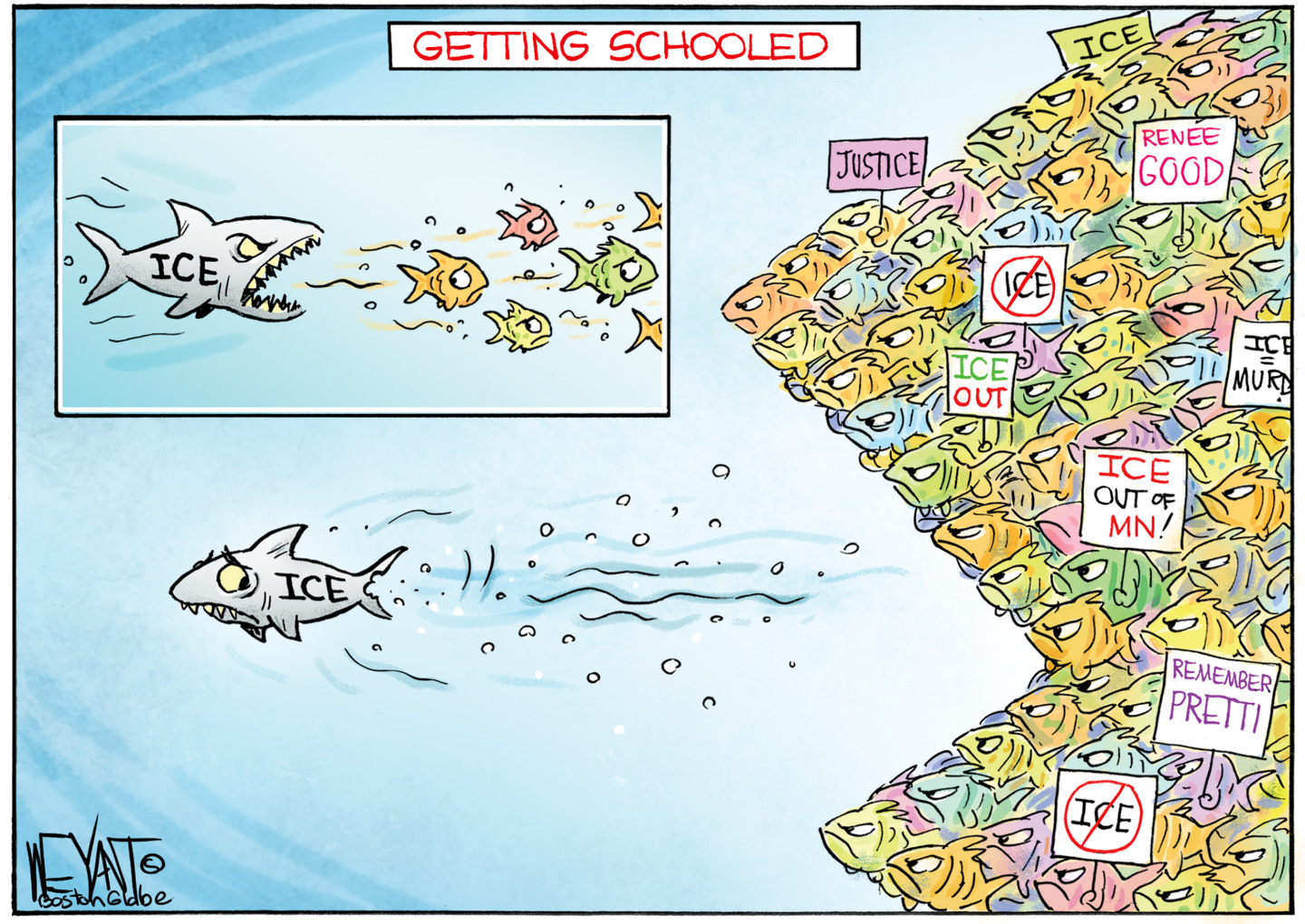

Political cartoons for February 2

Political cartoons for February 2Cartoons Monday’s political cartoons include ICE getting schooled, AI in control, and more

-

Democrats win House race, flip Texas Senate seat

Democrats win House race, flip Texas Senate seatSpeed Read Christian Menefee won the special election for an open House seat in the Houston area