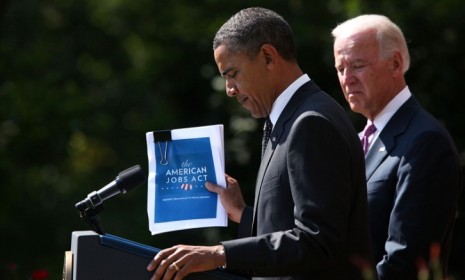

Paying for Obama's jobs bill: Tax hikes for the rich?

The president wants to fund his $447 billion jobs bill by scrapping tax breaks for hedge fund managers — and families making north of $250,000 a year

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Monday, Obama budget director Jack Lew explained how the president proposes to pay for his $447 billion American Jobs Act. The big takeaway: Tax increases for wealthier Americans. Obama's plan would limit itemized deductions for families earning more than $250,000 a year, make it harder for hedge fund managers to claim income at the lower capital-gains rate, and close loopholes for oil companies. Obama's proposals would bring in an estimated $467 billion over 10 years, starting in 2013. Do they have any chance of passing?

This plan will never pass: "These tax hikes will go nowhere in Congress, but that's probably by design," says Bryan Preston at Pajamas Media. If Obama really wanted to create jobs — not just save his own — he wouldn't have proposed huge "tax hikes that will force business to cut their spending." And it's not just Republicans who will object: Obama's attempts to soak the rich didn't pass when Democrats controlled Congress, either.

"Obama's jobs plan includes major tax hikes"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But this is just a strategic first move: The proposed tax hikes on the wealthy all have at least two things in common, says Ezra Klein at The Washington Post. "They've all been proposed by the Obama administration in the past, and none of them are likely to attract Republican support." If House GOP leaders don't come back with tax offsets acceptable to the White House, though, they now have to "try to explain why keeping taxes low on the rich is more important than helping the jobless."

"The White House's populist pay-fors"

Politics aside, the policy is right: If Congress wants to help the economy says David Dayen at Firedoglake, it should keep Obama's tax hikes for the wealthy, especially the capital gains proposal. When the ultra-rich can pay lower tax rates than the middle class, that doesn't create jobs, it just "distorts the economy and makes future growth nearly impossible."

"Capital gains tax cuts massively transfer wealth to the top"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com