The stock market's frightening volatility: Is it 2008 all over again?

Turbulent markets, panicked investors, imperiled financial institutions... sound familiar?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

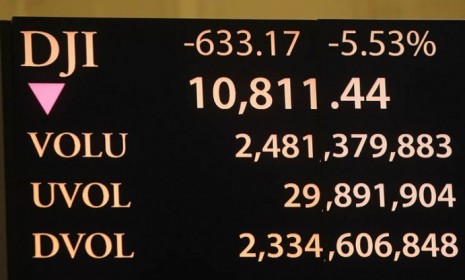

On Monday, the Dow Jones Industrial Average took a 635-point nosedive, capping a wave of frenzied selloffs fueled, at least in part, by S&P's downgrade of America's credit rating, and growing worries about the state of the economy. The Dow's sharp drop was the steepest one-day decline since the financial crisis nearly three years ago. And yet, by midday Tuesday, the Dow had climbed 200 points. Are we reliving the wild ups and downs of 2008?

No. The cause of this crisis is different: "Market turbulence alone isn't enough to prove that history repeats itself," says Francesco Guerrera in The Wall Street Journal. The 2008 crisis began with imprudent, overly confident home buyers and bubbled up through Wall Street, leading to the breakdown of the financial sector, and in turn, the recession. The crisis du jour is a "top-down affair"; governments around the world have mishandled their economies, causing financial institutions and businesses to lose faith. "Markets and banks, in this case, are victims, not perpetrators."

"Why this crisis differs from the 2008 version"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And this time, it's centered in Europe: Cratering stock markets might be jogging memories of 2008, "but it's not the same" today, says Andrew Ross Sorkin in The New York Times. If anything, it's the "intractable problems" facing the European Union that are most reminiscent of 2008. Greece, Spain, and Italy are nearing insolvency — just as our banks were in 2008 — while banks in France, Germany, and Britain are holding debt from those countries that may never be paid off in full. That's what's really causing market jitters around the world.

"Disaster movie gets a sequel, with subtitles"

But there are still similarities: Let's not assume "that 2011 and 2008 are totally divorced from one another," says Noreen Malone at New York. "The failure to fully recover from the 2008 crisis is a huge part of why we're being hit with this one now," and consumers will again panic and cut their spending, only making things worse. That's the problem with these easy comparisons: They "remind people of that panicky time" in 2008, and, by altering our behavior, can cause history to repeat itself.

"This isn't 2008 all over again, exactly"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention